Stash Review: You Don’t Have to Be Rich to Start Investing and Build That Wealth (+ Get $10 Bonus)

It’s never too early or late to start investing as long as you start. You don’t have to wait for the “right time” or be rich to get your share of brand-name companies.

At this point, stocks are “king” for both the Millennial and Gen Z generations to build that wealth, and you can use Stash to help you get there.

What is Stash?

Stash is an investing app that lets you start investing with just $5. This beginner-friendly platform gives access to thousands of single stocks and ETFs (Exchange Traded Funds).

You can search for specific company names for stocks you’re interested in (e.g., Netflix, Apple, Tesla, etc.) and choose from ETFs, which Stash conveniently renames into easy-to-understand themes sorted by risk tolerance, goals, interests, and values.

For example, Stash presents “Amplify Transformational Data Sharing ETF” as “BLOK,” which includes companies actively involved in blockchain technologies. Much easier to remember and understand, right?

Stash makes it as simple as possible for anyone to start investing. Previous Stash members can appreciate the new features as well!

| New Stash Features |

|---|

| Stock-BackⓇ Rewards1: The Stash debit card lets you earn stock while you shop |

| Round-Ups: Utilizes spare change from purchases to invest |

| Smart Portfolio: Growth and Stash+ Members get access to hands-off stress-free investing |

| Stock Parties: Claim bonus stock at regularly scheduled virtual stock parties |

| Crypto: It's now even easier to get exposure to crypto with Smart Portfolio |

How to Get Started On Stash & Get a $10 Bonus

Since Stash is a financial services company, they’ll ask for some personal information when you sign up, including your legal name, birth date (must be at least 18+), and Social Security number to verify U.S. citizenship.

- Download Stash

- Answer some questions about yourself, risk tolerance, net worth, and goals

- Choose a monthly plan ($3 for Growth, $9 for Stash+ Plans)

- Deposit at least $5 start investing (Get $10 bonus)

After account creation and deposit, you can choose where to put your money, and Stash will provide guidance and tools to help you invest. There’s no need for thousands of dollars to get your share of well-known companies.

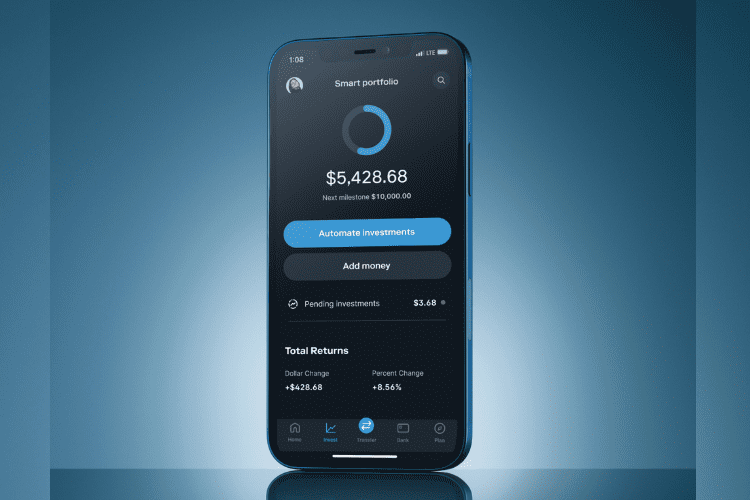

💡 DIY or Go Stress-Free with Smart Portfolios

You can be free to cherry-pick your own stocks and ETFs with advice from Stash, or you can get hands-off, stress-free investing with the Smart Portfolio feature.

All you need to do is add cash to your Smart Portfolio, and Stash will utilize its financial research to pick ideal investments for you based on your risk level and rebalance the mix every quarter.

This type of automation makes investing even easier if you prefer a hands-off approach!

Interested in cryptocurrency? Currently, Smart Portfolio users will get exposure to investing in crypto, to help diversify your portfolio even further.

- No Investing Minimum2

- Fractional investing lets you buy pieces of expensive stocks

- Smart Portfolios offers hands-off stress-free investing

- Attend virtual Stock Parties to get a piece of offered stock(s) reward

- $10 welcome bonus after the initial deposit of $5 in Invest Account

- The fees can add up, especially for small accounts

- ETF expense ratios eat into returns

- Primarily for ETF and stock investing

🛍️ It’s Easy to Earn Stock While You Shop

If you want additional ways to earn stock, Stash has a unique debit card service that gives “Stock-BackⓇ” rewards1 on purchases at more than 11 million locations. This is offered for every plan!

Earn 0.125% Stock-BackⓇ on all purchases and, at times, as much as 5% at specific merchants with bonuses!

Basically, when you shop at participating merchants with your Stock-BackⓇ card, they’ll reward you with stock in that company. These include big brands like Walmart, Starbucks, Amazon, and more.

If you use your Stock-BackⓇ card at places that don’t have a matching investment, like your local hair salon, they’ll reward you with an investment of your choice from a predetermined list instead.

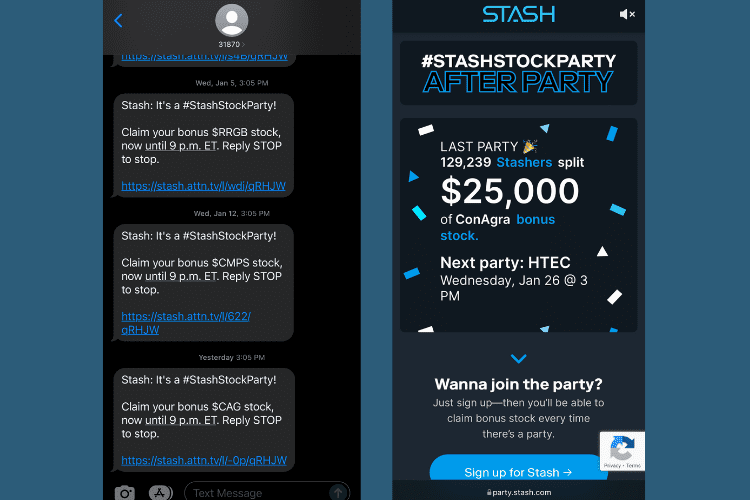

🎉 Attend Stock Parties To Get Bonus Stock

Another way to earn bonus stock is by attending randomly held virtual stock parties. This is also open to every Stash member, and we’re subscribed to the stock party text messages, so we never miss a bonus stock opportunity.

Typically, you’ll have an hour from the start time to claim the stock, and the more people that attend the party, the bigger your share of the total pot can be!

Some of the recent bonus stocks they’ve given out include Nike, Southwest Airlines, Home Depot, and Spotify, to name a few.

How Much Does Stash Cost?

The Stash Growth Plan starts at $3.00 and includes an Investment account, a no-hidden-fees bank account3, and access to Smart Portfolio, which provides hands-off investing. The Stash+ Plan is $9 a month, which includes everything the Growth Plan does, but has a 1% back in stock on all purchases up to $1,000 each month.

You’ll also get a $10 welcome bonus after the initial deposit of $5 in your personal portfolio!

Is Stash Legit & Safe?

Short answer: Yes.

Stash has been around since 2015 with 6 million+ clients, along with being a registered investment adviser with the SEC, and offers FDIC-insured bank accounts through Green Dot Bank. They also use the same type of 256-bit encryption that most banks use.

You’ll also set up a pin code (required each time you open the app) or set up thumbprint or facial recognition.

It’s Better With Friends

Refer friends to Stash, and you’ll BOTH get $20 bonus stock when they add cash to their Stash portfolio. Win-win.

Stash is great for new investors and investors who want a stress-free, non-intimidating approach. Start investing as little as just $5 and build your wealth!

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.

1All rewards earned through use of the Stash Visa Debit card (Stock-Back® Card) will be fulfilled by Stash Investments LLC. Rewards will go to your Stash personal investment account, which is not FDIC insured. You will bear the standard fees and expenses reflected in the pricing of the investments that you earn, plus fees for various ancillary services charged by Stash. Stash Stock-Back® Rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates.

2 What doesn’t count: Cash withdrawals, money orders, prepaid cards, and P2P payment. If stock of the merchant is not available for a qualifying purchase, the security will be in shares of a predetermined ETF or from a list of predetermined publicly-traded companies available on the Stash Platform. See full terms and conditions

3The Stash Monthly Wrap Fee starts at $1/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

4Other fees apply to the bank account. Please see the Deposit Account Agreement for details. If applicable, your Stash banking account is a funding account for purposes of the Advisory Agreement. Your Stash subscription fee may be deducted from your Stash banking account balance. Promotion is subject to Terms and Conditions. To be eligible to participate in this Promotion and receive the Bonus, you must complete the following steps: (i) successfully complete the designated registration process of opening an individual taxable brokerage account (“a Personal Portfolio”), (ii) link a funding account (e.g. an external bank account) to your Personal Portfolio, AND (iii) initiate and complete a minimum deposit of at least five dollar ($5.00) into your Personal Portfolio. In the event you only complete the designated registration process to receive the Financial Counseling Service (as defined in your Advisory Agreement), as applicable to you, or do not otherwise complete the account opening process for an individual taxable brokerage account (“Personal Portfolio”), you will not be eligible to receive the Bonus.

5Early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period.

Crypto is relatively new and can be volatile. Investments are Delaware Statutory Trusts and offer indirect exposure to Crypto.

Fractional shares start at $0.05 for investments that cost $1,000+ per share.

This Program is subject to terms and conditions. In order to participate, a user must comply with all eligibility requirements and make a qualifying purchase with their Stock-Back® Card. All funds used for this Program will be taken from your Stash Banking account. This Program is not sponsored or endorsed by Green Dot Bank.

Stash Growth Plan starts at $3/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

Stash offers two plans, starting at just $3/month. For more information on each plan, visit our pricing page.

Smart Portfolio is only available in the Growth ($3) and/or Premium ($9) Tier. This is a Discretionary Managed Account whereby Stash has full authority to manage according to a specific investment mandate. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Stash does not guarantee any level of performance or that any client will avoid losses in the client’s account.

A “Personal Portfolio:” You can choose your own investments only in a “Personal Portfolio” which is a Non-Discretionary Managed account.

Bank Account Services provided by Green Dot Bank, Member FDIC.

Please review the Referral T&Cs. To participate and receive cash bonuses or stock rewards, you must: (i) open a taxable brokerage account (“Personal Portfolio”) that’s in good standing. (ii) send a referral invitation to a friend and (iii) your friend must complete the account opening process for a Qualifying New Account. Your referee friend must (i) complete the process of opening an account by using the special designated referral link from your invitation (ii) link a funding account (e.g. an external bank account), and (iii) initiate a minimum deposit of at least one cent ($0.01) into their Account. This Program is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A. Inc., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any funds earned through this program.

Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value. All product and company names are trademarks ™ or registered ® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

While such registration does not imply a certain level of skill, it does require us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client.

To note, SIPC coverage does not insure against the potential loss of market value.