12 Life Hacks to Easily Save & Make Money Now

Your bank account is getting thinner every day and that’s not even where you want to see the numbers go down. It’s time to really slam that fist on the table and internally scream “I’m going to finally take care of my money!”

Now you’re ready to be inspired but the truth of the matter is, saving and making money isn’t rocket science, but it does take repetition and reiteration. You’ve probably heard that it takes 21 days to form a new habit but it’s actually closer to 66 days. So if you’re ready to get serious on changing your financial picture, these life hacks we rounded up should help you on your way. And similar to weight loss, don’t expect results overnight but maintain for the long game.

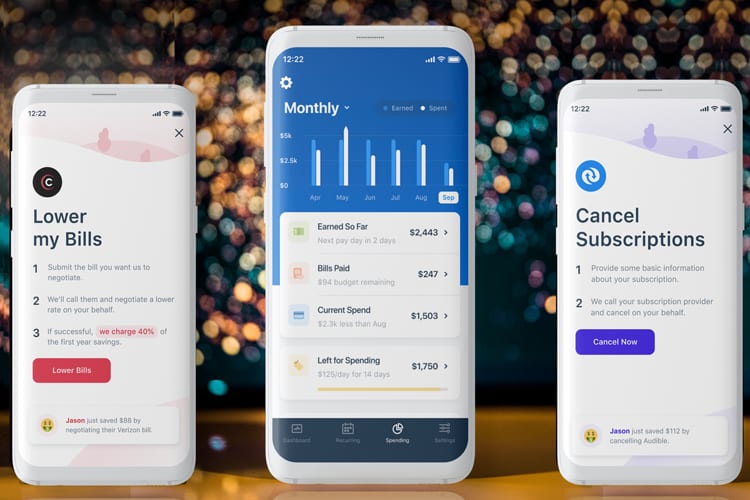

1. Use an App to Figure Out Where You’re Wasting Money

First things first, if you have trouble budgeting, you’re not alone as most people actually don’t know how to. When you understand how much money comes in and how much goes out, it’ll all start making sense.

Truebill easily helps you budget, even if you’re clueless. Their simple to follow budgeting pulls your historical spending, organizes it, and allows you to clearly see your spending so you can set a target budget with context. (Aka you can see where you’re wasting money on).

Truebill’s five-star reviews come from people formerly bad at budgeting. Nicole M. said Truebill “tracks spending and makes you accountable for every place your dollar is going. Shows you how a ‘few bucks’ here and there can really add up over time. Also gives you clues on how to save based on your spending. It’s like having a personal accountant tracking my money.”

Truebill will also alert you if you’re getting a little too spend-happy in your budgeted categories so you know when to curb it. Another user, Krystyna D. said, “This app is a lifesaver for budgeting. It lists your transactions in a minimalist and customizable way, has a spending graph that compares your current spending based on last month, and has a really great budgeting feature. I’ve been using the app for just about 7 months and they’ve done nothing but make a really great improvement to the service. I’ve tried some of the other services and they’re all cluttered and give you too much info without making what you want to see accessible.”

It’s simple but actionable budgeting that anyone can follow and it’s free to use! Join the many users today and control your spending with Truebill!

2. Eating Out Costs Up to $4,000 A Year So Learn to Cook

Did you know that it’s 325% more expensive to eat out versus eating at home*? Maybe it’s time to make more trips to the grocery store instead.

You’ll be aware of all the ingredients in your meal, in addition, you’ll get paid just for shopping!

It’s simple. All you have to do is take a picture of your grocery receipt and Ibotta will pay you cash.

Here’s how it works:

Before you go to the store, search for your shopping list items in the Ibotta app. After your store visit, take a photo of your receipt to get cash back.

Ibotta is free to download and you’ll also get up to $20 in Welcome Bonuses when you sign up! They’ve already given out $186 million dollars cash back to savers in 2019 alone.

Some offers we found:

- 25 cents back on any item

- $3 back on various shaving razors

- $2 back on KIND Protein Bars

- 25 cents – $4 back on ice cream

- $2 back on Herbal Essence Haircare

Popular stores are Walmart and Target, but Ibotta also works at restaurants, online shopping sites, and even at the bar. On average, active Ibotta users save up to $240 a year or more but the highest saver got $13,000 in cash back this year! What would you do with that extra money?

Welcome Bonus: Up to $20

Average savings a month: $20

What it could add up to in a year: $240

Additional Referral Earnings: $5 per referral

Don’t Toss That Receipt! Do This First for Free Money

Before you crumple up that receipt in your pocket or forever lose it in the abyss of your purse, scan it into the Fetch Rewards app, and earn points towards free money. I repeat, free money.

It’s ridiculously simple and actually fun to use.

Shop at any grocery store, convenience store, club store, neighborhood store, or big box store, take a picture with the app, and that’s it. (Favorites include Target, Kroger, and Walmart!)

Unlike other apps, you don’t have to go to specific stores, there’s nothing to pre-select prior to shopping, and there’s no minimum spend. Just scan in any receipt from a store that sells groceries (even when you didn’t actually buy any groceries) and boom, points for money.

You can start cashing out as soon as $3 (3,000 points) and you can grab a $2 welcome bonus on us (2,000 points) when you use promo code REWARD before scanning your first receipt!

Welcome bonus: $2

Average savings a month (depends on purchases): $25

What it could add up to in a year: $302

Additional referral earnings: $2 per referral

Save Up To 50% On Your Weekly Groceries With One Single App

People coupon to cut costs, but it can be time-consuming and frustrating with all the different places to look for them.

An app is here to change that though. It’s easy grocery planning and couponing with Flipp, an app that has all your weekly local store ads and coupons in one place.

Use the app to create a shopping list by tapping on the digital ads and clip coupons that match with the items you need. Long gone are the days of having a list in one hand and a stack of coupons in the other; all you need now is your phone.

You can search by category, retailer, or item and then ‘clip’ the coupon or load to your store loyalty card – it’s that easy! Flipp also allows you to see trending nearby deals, so you never miss out on a chance to save a little extra dough. Additionally, you can set reminders for expiring clips to ensure you use them in time.

With 1,000+ weekly ads from local retailers and 100+ coupons from brands you love, Flipp has no shortage of saving options!

3. It’s Not Just a Number – Your Credit Score Affects Your Entire Life

It’s smart to keep an eye on your credit score to make sure it doesn’t fall too much due to unpaid bills. Did you know that a low credit score could affect your ability to actually rent an apartment or even get a car? Yea, let’s try to prevent that from happening.

Credit Sesame is a free credit monitoring service that helps you improve and maintain your score.

You’ll get an easy-to-read view of your total debt plus everything that is contributing to your current score like credit usage, credit age, inquiries, and payment history. It also comes with personal recommendations to help increase your score.

Credit Sesame alerted me immediately when my score decreased because of a credit card and I was able to fix it right away. It’s free to use so this is definitely a must-have in everyone’s life.

Instantly Improve Your Credit Score for Free (Legit)

Regardless of what your score is currently at, everyone can use a boost to their 3 digit number, and Experian® wants to help.

A new feature called Experian Boost™ can help instantly improve your credit scores for free.

Experian does this by adding your positive payment history from utility and telecom bills to your Experian credit file. This is huge, because previously, your gas, water, electricity, TV, internet, and phone bills that you already pay for didn’t affect your credit. Now it does and to your benefit of potentially increasing your credit scores!

It’s simple to start, and all you need is a free Experian Boost membership and a few minutes to connect read-only permission to the online bank accounts you use to pay bills. Experian will check only utility and telecom payments and get you credit for the payments you’ve already been paying.

This process doesn’t hurt your credit at all and you can choose to remove the boost if you want.

Compared to expensive and drawn out credit repair services, this new alternative is the fastest and no-cost way to instantly improve your credit scores.

*Results may vary, see website for details.

4. Have Some Fun on Your Phone to Make Money

There are so many new games coming out on the daily that it’s hard to choose which to play.

My strategy? Only focus on the games that pay me for my time.

You can do it with AppStation, an app that pays you to try out new games.

When you earn coins from trying new games, you can redeem for:

- PayPal Cash

- Amazon gift card

- GameStop gift card

- PlayStation Store gift card

- Xbox Live gift card

- And too much more to list

Nab a 4,444 coin welcome bonus too, which is basically around 50 cents in value. And if you don’t like to wait, you can choose to payout as low as $1.

If your friends want to get it on the money action, introduce them to AppStation, where you’ll get bonus coins and 25% of all their earnings. To make it a supportive group, your friends will also earn 25% of your earnings too!

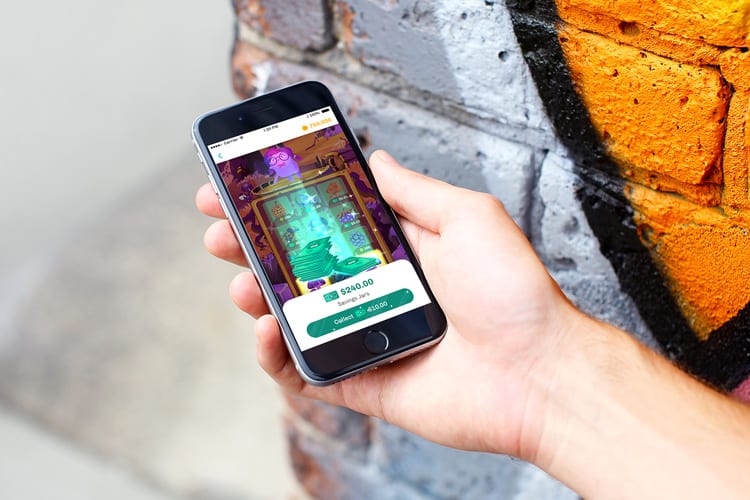

Get Paid to Try New Games. Every Gamer’s Dream.

Who would’ve thought you can play games to make some money?

All you need is Mistplay, a game platform where you can try new games to earn points redeemable for gift cards like Amazon, VISA, PlayStation Network, XBOX Live, and more.

In the app, all available free games are listed so just take your pick to try! The more time spent on each game, the more money you can earn.

You’ll only get paid for playing games if Mistplay is running so be sure to always install games from the Mistplay app!

BONUS: You’ll automatically get 200 welcome points upon sign up but use promo code Bonus_100 to get an additional 100 points for a total of 300 total points!

5. Give Your Opinions Freely and For Money

There are a lot of survey programs out there, but none as popular as Swagbucks, a free rewards program where you can earn cash for your time and opinion.

You get rewarded for doing surveys, searching the web, reading articles, and playing fun games but the one activity that earns you the most points is actually watching videos! These range from Entertainment, Health, Hobbies, Parenting, Tech, News, and more.

Points can then be redeemed for free gift cards, cash, and sweepstakes entries. All just by completing fun activities and giving your opinions.

New members can get a free $5 just for signing up, so join the other 10 million members already part of Swagbucks and start earning free rewards!

More Surveys, More Cash

When you have the downtime, there’s nothing easier than answering some questions in return for cash. If you want more surveys in your life, head over to MyPoints to sign up for free and similar to Swagbucks, you can participate in surveys, watch videos, and even read emails for points!

Points turn into gift cards from Amazon, Walmart, Starbucks, as well as PayPal Cash.

Get a $5 bonus when you complete your first 5 surveys!

6. Save $610 a Year by Checking Auto Insurance Quotes

You’re sharing the same roads with a lot of different people. Distracted people, oblivious people, road-rage people, etc. It’s best to cover yourself with insurance when everyone is operating a giant motor vehicle.

That’s why car insurance exists and is mandatory. You might be overpaying on your current insurance premium since it can be a hassle finding another provider.

However, you can search for quotes easily on EverQuote. They help match you among dozens of regional agencies and insurance carriers to filter the best matches to save on your car insurance.

It takes about 4 minutes to fill out the form and you’ll see a list of matches that show potential online quotes, email, and potential phone quotes.

EverQuote can save drivers $610 a year on average* compared to their current insurance premiums. Once you see your list of potential matches, choose the online ones you want or wait for more information via email or phone.

It’s a pretty simple process, so try it out to see how much you could be saving on the road!

7. Never Wait 2 Weeks for Your Paycheck Again – Here’s How

“People should have their money once they earn it. That’s how businesses work. When you buy something, you have to pay at once. But when you work, you wait two weeks for your own pay.”

If you agree with this statement, then you’re on the same page with Ram Palaniappan, the CEO, and Founder of Earnin, an app that’ll fast forward your paycheck to today.

In order words, if you worked today, you get paid today with Earnin.

Not everyone is eligible, but most are. If you have the following, you’re golden:

- Direct deposits from your employer into a checking account

- A regular pay schedule (like weekly, biweekly, semi-monthly etc)

- A fixed work location OR an online timekeeping system at work

That’s it. And after you connect your bank and employment info, you’ll get immediate access to your earnings.

You then choose what portion of your paycheck you want to Cash Out. Then, when your normal paycheck arrives via direct deposit, Earnin will just debit the amount you had previously cashed out. Simple!

It’s like having an advance payday loan but without the fees or interest. There is no charge to use Earnin as the app runs on tips by the community. Pay what you wish!

Even if you have a side gig of on-demand jobs, like Uber, Grubhub, Instacart etc, Earnin will work!

8. Get Paid in Gift Cards if You’re Fine with Lock Screen Ads

The average person unlocks their phone 110 times per day – that’s a lot of time spent looking at a screen for free.

With S’more you get paid every day you unlock your phone. It’s even easier than it sounds, and since you can cash out with as little as $1 there’s no waiting around for your rewards!

They partner up with brands looking for more impressions (aka your eyeballs) and you don’t need to click on anything to get paid either.

S’mores pays in gift cards so you can redeem for:

- Amazon.com

- AMC Theaters

- Best Buy

- CVS

- Target

- Domino’s Pizza

- Starbucks and more!

Just use your phone normally, and your earnings will apply daily. Pretty much the easiest thing to do.

9. Play Games, Save Money, Win Cash. Saving is Actually Fun Now.

Look, we know saving money is boring, but it’s just one of those non-negotiables in life. 63% of Americans don’t even have enough to cover a $500 emergency. Yikes.

That’s why Long Game Savings is actually making saving fun by just playing free games on their app. Games are light and easy-to-play (think lotteries, scratchers, slots, and more) and you can win daily cash prizes up to $1M (yes, million) and crypto!

When you set up a savings account, you access the games. The more money you save, the more you can play and now, their new debit card lets you earn more rewards just by spending normally. It has a RoundUp feature that lets your purchases be rounded up to the nearest dollar with the change going towards your savings. So every time you’re buying a meal, getting stuff at Target, etc, you’re contributing to your savings and earning interest!

Long Game Savings is completely free-to-use as banks pay them, not you. There’s no way to lose money, but plenty of ways to earn and win! Plus you can withdraw your money at any time.

10. Don’t Get Gouged at 29% APR on Your Credit Card. You Could Get a Low 3.84% APR Instead

If you don’t want to go into your next decade of life with debt looming over you, consider a debt consolidation. In the long run, you’ll save money from not having to continuously pay high-interest.

Debt consolidation just means you’re borrowing money at a low-interest rate and using that money to pay off the outstanding balances from your high-interest credit cards.

If it sounds foreign to you, don’t stress. You can keep your research simple with Fiona, the fastest, easiest, most comprehensive way to search for loans from the top providers.

It’s free to use and the application takes less than 60 seconds to complete. Fiona will search all the top online lenders to get you the best personal loan anywhere between $1,000 and $100,0000. You’ll find rates as low as 3.84% APR and loan terms from 24-84 months depending on the lender.

Not only will they help with debt consolidation, but they can also help with any big moment in your life that you may need a personal loan for like Home Improvement, Wedding, Medical bills and more.

11. Get Cash Back for All the Uber and Lyft Rides You’re Already Taking

Everyone uses ride-sharing services nowadays, primarily Uber and Lyft. It’s made going out for dinner and drinks so much easier now that you can rely on a phone app to get you home safely after a night out.

But here’s another phone app you’ll want because it can recoup some of your social life money, which we all know, can get pretty expensive. It also gives you points (redeemable for cash) on every ride you take anywhere!

Use Freebird to request your next Uber or Lyft to the bar, restaurant, movies, shopping, airport, (basically anywhere!) and get cash back and points for your ride.

Here’s how it works:

- Download Freebird

- Connect your Uber or Lyft account

- Connect the card(s) you want to get cash back on

- Ride anywhere to participating locations to get cashback

- Ride anywhere else to get points that turn into cash rewards

To earn cash rewards, just visit a participating location that has a cash offer and make a purchase there with your connected card. Once the transaction clears, you’ll see the cash reward in your Freebird account!

You’ll also earn points just for taking an Uber or Lyft anywhere which can be redeemed for cash rewards. However, to get the cash back and points rewards you have to request your Uber or Lyft through the Freebird app. You still earn Uber rewards through the Freebird app though, so there are no losses!

BONUS: For our readers only, use promo code SMARTWALLET to get $5 off the first 3 rides ($15 value!)

12. Buy Now, Pay Later to Make it Easier On Your Wallet

Layaway plans are back and better than ever, this time – they’re more high tech.

Say you want to buy that fancy blender for $200 but can’t fork it over all at once. Rather than charging your high-interest credit card, use QuadPay instead.

The QuadPay app lets you split any purchase anywhere (online & in-store) into 4 interest-free payments over 6 weeks. In this case, you’d be making 4 separate $50 payments for the blender which is much more manageable.

How does it work?

- Download and sign up for Quadpay. (No long forms, get instant approval, and no hard credit checks!)

- Browse the store directory or search for your favorite stores online.

- Choose “Pay with Quadpay” on the checkout page

- Enter the total purchase amount (inclusive of shipping and taxes)

- Complete your transaction and enjoy your purchase right away

Quadpay will automatically split your payments into 4 installments using your linked card. If you need to return an item, you’ll be refunded like normal.

Again – interest-free! If you’re late on a payment, it’s a $7 up-charge, and $14 if you’re still late after a week. How to avoid it? Just don’t be late.

*325% more expensive eating out vs home source: Investment Zen

*EverQuote’s individual savings, if any, and premiums will vary by customer. Savings amount based on countrywide survey of users from Nov 2018 to Apr 2019 who reported old and new premiums.