How to Make Extra Money from Home Before You (Hopefully) Go Back to Campus

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

As students around the nation start ending their school year from home, it’s a bittersweet time to not be able to share the excitement with friends and family. But know that you’re part of the unique class to be able to weather this storm and be proud of your accomplishments thus far!

Since there’s so much uncertainty in daily life now, one thing is for sure, making extra money however you can, even when you’re safer at home can be vital to you and your family.

All you need is reliable internet and a smartphone or laptop. We go over our favorite ways for students to make money, even while at home.

1. Get Free Money Back on All Your Shopping Hauls

Check your pockets; check your purse. And keep receipts for your iPhone.

Just grab all your recent receipts from your coffee runs, grocery trips, restaurants, and gas station fill-ups, scan them into Fetch Rewards on iOS, and earn points for free money! Connect your email account, as well, to count DIGITAL receipts from Amazon, Instacart, and more.

Basically, snap a pic of your receipt from anywhere, and that’s it; you’ve got points for money. There’s no minimum spend, no need to select items manually, scan in any receipt from any store or gas station, and it’ll automatically reward you.

It’s free and easy to use and is a must-have iOS app for anyone who buys stuff!

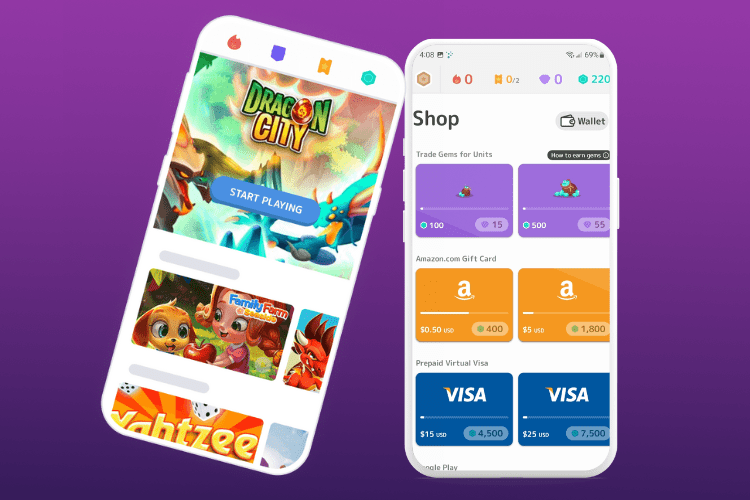

2. Play New Games and Earn Branded Gift Cards

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!

3.

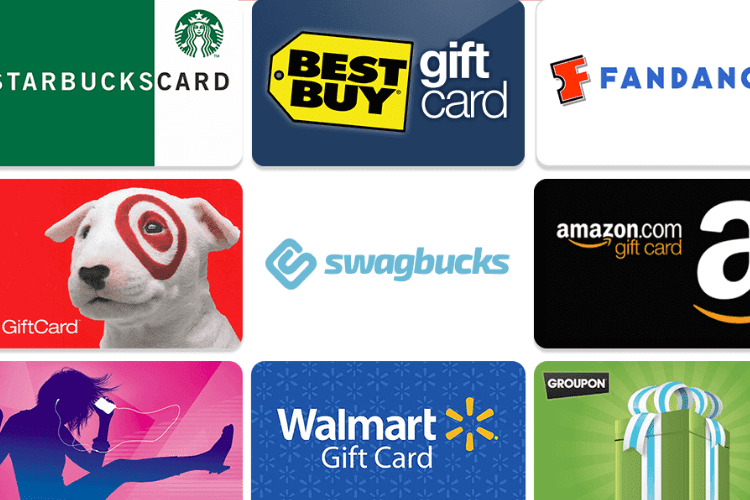

4. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

5. Get Paid Up to $225/Month While Watching Viral Videos and Taking Fun Surveys

Founded in 2000, Inbox Dollars has been paying customers for their opinions for over 24 years and counting! They are one of the most trusted survey sites with fun, multiple ways to earn extra cash that set them apart.

“Fast and easy. Love that I can cash out to my PayPal and easily transfer money to my bank account.” – Tefanie P

Take surveys, watch videos, play games, and even read emails for extra cash. Who wouldn’t want to watch viral videos for money and get paid up to $225/month?

Inbox Dollars is a great platform to make a little side money. It’s free to sign up, so give it a try today!

6. Work From Home: Earn $20 Per Hour to Start Teaching English To Kids Online

The past few months have been rough on Americans and their livelihoods. If you’ve been considering a side gig to supplement your primary income or need a job working from home, teach English online to kids ages 5-13!

EF Online (Education First) is a teaching platform helping to connect students in China and native English speakers for 20+ years with their global network of 600+ schools. You’ll experience a flexible schedule where you can work from home, earn up to $20/hr to start, with all lesson materials are provided. While teaching experience is preferred, it’s not required. Earn extra rewards the more you teach!

Here are the requirements:

- Must be a native English speaker living in the U.S.A with a Bachelor’s degree in any field

- By the start of your teacher’s contract term, you must earn and submit documentation of a 40 Hour TEFL (Teaching English as a Foreign Language) certification (or higher)

- Agree to an online background check (no cost to you)

- Be available to work during a set range of hours

- Have a solid wifi connection and headset

- And lastly, be passionate!

Classes are 25 minutes each and since EF Online encourages repeat classes, you might be teaching the same students regularly. In addition, parents can book you up to 6 months in advance leading to a more stable income.

If you enjoy interacting with kids, this is definitely a rewarding and flexible gig from home!

Note: The following U.S. states are excluded from this gig – CA, IN, MA, NH, NJ, NY, and IL.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.