19 Ways to Make Money for the New iPhones

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

You’ve been waiting for it. Something to look forward to in this pandemic year.

News about the next iPhone 12 (+Pro + Max) has officially been released and you’re wondering if you should be joining in on the pre-orders.

As always, each iPhone drop costs a significant chunk of change so maybe you need a little help in making those monthly payments go down a bit easier. We got you.

It’s always fun (and smart) to make extra cash wherever you can, particularly when you’re just doing what you normally do. So we’ve listed out some ways below to help you make some money towards your next new iPhone!

1. Get Free Money Back on All Your Shopping Hauls

Check your pockets; check your purse. And keep receipts for your iPhone.

Just grab all your recent receipts from your coffee runs, grocery trips, restaurants, and gas station fill-ups, scan them into Fetch Rewards on iOS, and earn points for free money! Connect your email account, as well, to count DIGITAL receipts from Amazon, Instacart, and more.

Basically, snap a pic of your receipt from anywhere, and that’s it; you’ve got points for money. There’s no minimum spend, no need to select items manually, scan in any receipt from any store or gas station, and it’ll automatically reward you.

It’s free and easy to use and is a must-have iOS app for anyone who buys stuff!

2. Get Up to $55 Per Win Popping Bubbles

Make consistent extra money playing Bubble Cash, where you match 3 bubbles of the same color until you clear the board. It’s popular, too, since the game is frequently ranked within the Top 10 in the App Store with a 4.6/5 star rating with over 120K+ reviews!

Win free cash when you collect enough gems to enter practice tournaments, and then win MORE when you enter the higher stakes tournaments (there’s a small entry fee for the bigger tournaments).

“Finally, a game that isn’t a scam! I won $71 yesterday on Sunday, and today on Monday, it was already in my Paypal” – Mzmari

Play for free now, and then switch to cash games to increase your winnings whenever you want. Obviously, this won’t make you rich, but 100% worth it compared to other games that don’t pay.

3. Take Surveys & Play New Games to Earn Extra Cash

There are a lot of survey programs out there, but none are as popular as Swagbucks, a free rewards program where you can earn cash for your time and opinion. Members can earn an average of $50 a month!

You get rewarded for doing surveys, searching the web, reading articles, and playing fun games but the one activity that earns you the most points is completing surveys. (Don’t skip out on those!)

Points can then be redeemed for free gift cards, cash, and sweepstakes entries. All just by completing fun activities and giving your opinions.

New members can get a free $5 just for signing up, so join the other 15 million members already part of Swagbucks and start earning free rewards!

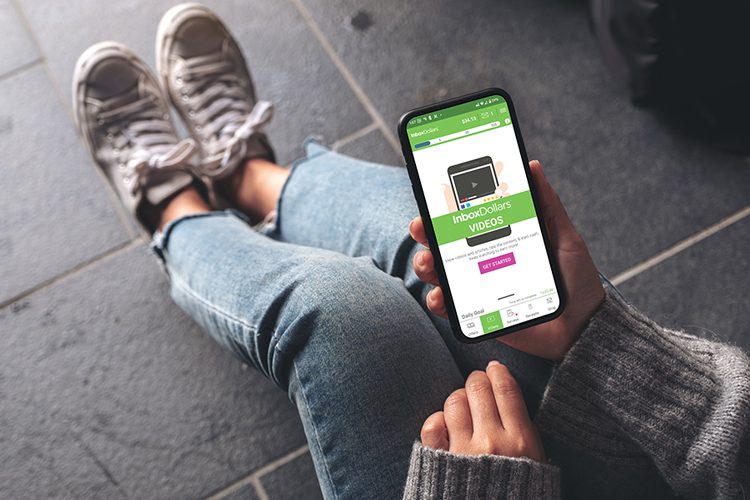

4. Get Paid Up to $225/Month While Watching Viral Videos and Taking Fun Surveys

Founded in 2000, Inbox Dollars has been paying customers for their opinions for over 24 years and counting! They are one of the most trusted survey sites with fun, multiple ways to earn extra cash that set them apart.

“Fast and easy. Love that I can cash out to my PayPal and easily transfer money to my bank account.” – Tefanie P

Take surveys, watch videos, play games, and even read emails for extra cash. Who wouldn’t want to watch viral videos for money and get paid up to $225/month?

Inbox Dollars is a great platform to make a little side money. It’s free to sign up, so give it a try today!

5.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.

Image: Apple iPhone 12 Pro & iPhone 12 Pro Max