18 Dope Ways to Make Money For A Home Glow Up

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Maybe you want all the plants.

Or a new at-home gym. An upgraded kitchen countertop. Or the dining table desperately needs to be resurfaced. Whatever it is, there has to be something in your home that can benefit from a makeover.

And since we’re used to spending time at home by now, it’d be nice to spruce up the place. You can do it by earning a little something extra on the side. Check out below for some fun and practical options to help you out.

1. Get Up to $2,500 in Credit to Shop

If you have anything leftover from the recent stimulus check, stretch the funds even further when you shop at Zebit instead.

They offer over 90,000 items in their marketplace featuring brands like Apple, Beats, LG, Cuisinart, eGift cards, and more with no membership fees, no hidden fees, and no penalties.

Once approved, you’ll get up to $2,500 of credit to shop their marketplace and the ability to spread payments out over time. It’s great for large purchases like TVs, appliances, and new phones.

Signing up for Zebit is free and doesn’t affect your FICO score. To prevent fraud and identity theft, they ask for the last 4 digits of your SSN and annual income, which they verify using certain credit reporting agencies, so not all applicants are approved, but there is no FICO score pulled! And don’t worry, Zebit uses bank-grade encryption and they don’t sell your info.

2. Earn a $10 Amazon Gift Card by Trying New Games

When you’re ready to add even more games to your lineup, then download Cash Giraffe, an Android app that pays you to try out new games for, yes, you guessed it, cash. All are free to download!

Just earn coins from trying new games, and then you can redeem them for:

- PayPal Cash

- Amazon gift card

- GameStop gift card

- PlayStation Store gift card

- Xbox Live gift card

- And more good stuff

“Payouts are faster than most apps. PayPal rewards are small, but hey, it’s free money 💰 🤑“- Cassandra McGuire

A 3,599 coin welcome bonus is yours immediately too, when you sign in! Plus, get 200 coins for every friend you refer and 25% of their earnings.

3. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

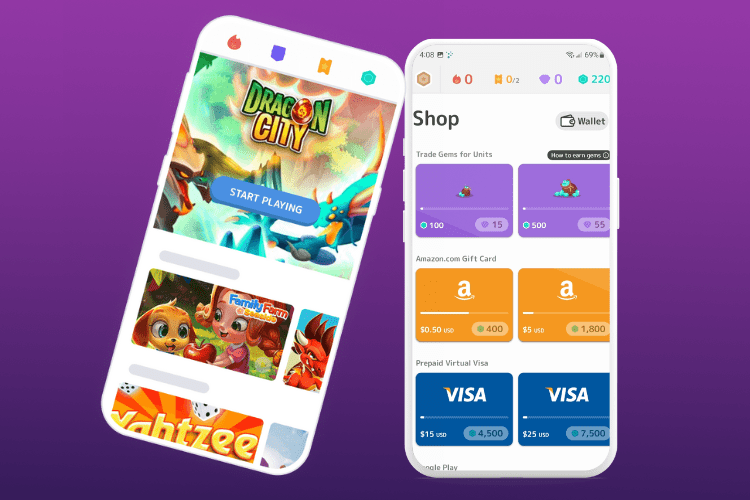

4. Play New Games and Earn Branded Gift Cards

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.