New Year, New You: 11 Money Moves To Make Before 2022

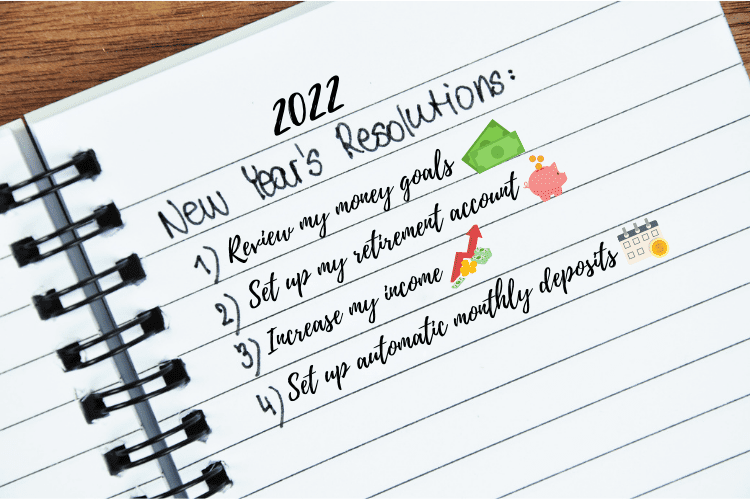

The new year is upon us, and you know what that means: 2022= the new you! Time for resolutions and changes that you follow through with! Don’t be that person who has no New Year’s resolution or who makes them and then doesn’t stick to them. 2022 is a new beginning, and it’s time to take control of your financial future: we’re here to help you!

One of the most critical aspects is your finances. There are big-money moves you can make now to ensure your finances are in the best shape possible. Let’s review the best money moves to make before you ring in the new year:

1. Review Your Money Goals

The first place you’ll want to start is to ask yourself, “what are my money goals?” Writing your goals down can help you visualize them and set your plans in action. Whether it’s saving for a down payment on your first home or a new car, paying off credit card debt, refinancing your student loans for a lower interest rate, or to start micro-investing, putting these goals down on paper will help you get started.

2. Set Up Your Retirement Account

Are you contributing to an employer-sponsored 401(k) plan? Do you have a Roth IRA set up with automatic monthly contributions? If you answered yes to both of these questions, then kudos to you! If not, don’t worry: it’s never too late to start planning your financial future.

First things first, inquire to find out if your job offers a 401(k) plan with employer matching. Some companies provide matching contributions between 3-7% per pay period; that match can grow exponentially through your career and can mean a lot of money in your retirement account.

It’s essential to speak with a financial advisor to determine the best financial investment products for your portfolio. You can also start a personal Roth IRA account, which is a retirement savings account that you can start on your own. My personal favorite is Fidelity’s Roth IRA account; with some of the lowest fees in the industry, you’ll be sure your money is in good hands, and that your money will grow, tax-free, until retirement age. Check out IRA vs. 401(k): Everything You Need To Know to better understand the difference between the two types of accounts.

3. Increase Your Income

This goal is one we all aspire to achieve. I mean, who doesn’t want a bump in pay?! So let’s talk about how to increase your income in 2022.

First off, why not ask for a raise? 2021 is the year of the Great Resignation: more Americans have quit their jobs or changed jobs in the past year than ever before. Employers are eager to retain good talent and many will go to great lengths to do so.

If you’re a hard worker and an invaluable asset to your team, have a conversation with your manager about bumping up your salary. Additionally, because the job market is so hot at the moment, it shouldn’t be challenging to find a new and higher-paying gig pretty quickly if you’re looking for more money or you just want a change of pace.

4. Save Money with Automatic Monthly Deposits

It’s no surprise that saving a portion of your monthly income is necessary for a bright financial future. Most banks have a feature that allows you to set up automatic monthly deposits from your checking account to a savings account. You can even set the monthly deposit date on the same day as each month’s payday. This way, it’s like you never even saw the money, and it gets instantly squirreled away for a rainy day. You’ll be thankful you made this vital money move!

5. Start Budgeting

Budgeting is key when it comes to managing your finances responsibly. Luckily, there’s a simple 50/30/20 budgeting rule you can follow in 2022 to keep your finances in order.

- 50% “needs:” your monthly rent or mortgage, groceries, gas, medical expenses.

- 30% “wants:” entertainment, dining out, traveling.

- 20% “savings and debt:” monthly contributions to your savings account, your student loan payment, or your investments.

If you’re someone who typically has trouble with budgeting, this is an easy method to ensure that your money is allocated wisely each month. In addition to this method, use a free personal finance app like Rocket Money that figures out where you’re wasting money (it really works!) to save over $720 a year.

6. Start or Boost your Emergency Fund

According to USA Today, 37% of Americans worry their emergency funds aren’t big enough. We all know that surprises can happen in life. When the car breaks down again, or you have to pay a surprise medical bill unexpectedly, it’s always important to have some reserves on hand.

The last thing you’ll want to do is rack up significant, high-interest credit card debt because you simply don’t have any extra funds on hand for an unexpected expense. The sooner you start contributing to your emergency fund, the more peace of mind and financial security you’ll have!

7. Check Your Credit Score

This may seem like a given, but many people aren’t sure about their current credit score. Your credit score updates periodically and is affected when you open or close new lines of credit, when you make timely payments (this is good!) or miss payments (this isn’t so good) on a loan or a credit card, or when your credit access line increases, for example.

It’s helpful to be aware of your current credit score when you want to apply for a new credit card or take advantage of a lower interest rate on your mortgage. Check your credit score in 90 seconds for free here.

8. Buy Life Insurance

Is your family’s financial future protected? When is the right time to buy life insurance? The answer is now: without a solid life insurance policy, your family could be in a difficult financial situation if anything happens to you.

Many employers offer a life insurance plan equivalent to your annual salary. You’ll be able to designate one or more beneficiaries on your policy, so each person you love is protected financially. If you’re not enrolled already, be sure to reach out to your company’s HR department today!

9. Start a Side Hustle

The onset of the COVID-19 pandemic has led many Americans to take up a new side hustle and harness the power of gig work to earn extra money. Grocery delivery apps like Instacart or Shipt allow you to earn cash on your time as a 1099 independent contractor. You can actually get paid to shop for other people’s groceries and deliver them right to their doorstep: find out how I was able to earn more than $700 per week part-time as an Instacart Shopper.

A great resource to help you find gig work opportunities is the free Steady app; with over 3 million users, there’s no question you’ll have success finding work too. Steady members, on average, also make an extra $5,500 a year!

Taking on a gig economy job will surely help you boost your income in 2022 and help you meet all of your financial goals.

10. Pay More Towards Loan Principal to Reduce Interest Payments

We all have a list of monthly bills and expenses that we’re obligated to pay. For example, you might have another six years of $200 monthly student loan payments before you’re debt-free. If you can afford to add an extra $50 per month to that monthly payment, you can potentially shave YEARS off your repayment plan and be debt-free much sooner. So why are you waiting?! Start that side hustle and pay down that debt more quickly than you planned!

11. Make Sure To Put Yourself First

Making sure you’re on the right track financially can seem like a daunting task. It’s of utmost importance to take care of yourself in the process and not get too stressed out about money! Whether it’s exercise, meditation, or healthy eating habits, your mental and physical wellbeing come first. And yes, it’s still possible to save money while making healthy life choices.

The Bottom Line

It’s about to be a new year, which means new beginnings. Take this opportunity to manifest your dreams by taking complete control of your financial future with these eleven helpful tips. After all, planning is critical if you want to get ahead in life, and your finances are not an aspect to be overlooked. Cheers to a new year, a new you, and making money moves for a successful 2022!