How This 27-Year-Old Earned Over $145K in Robinhood To Buy a Tesla and More

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

**Everyone’s financials are different, and what worked for Nick may not work for you. Investing always involves risk.**

“It changed my life.”

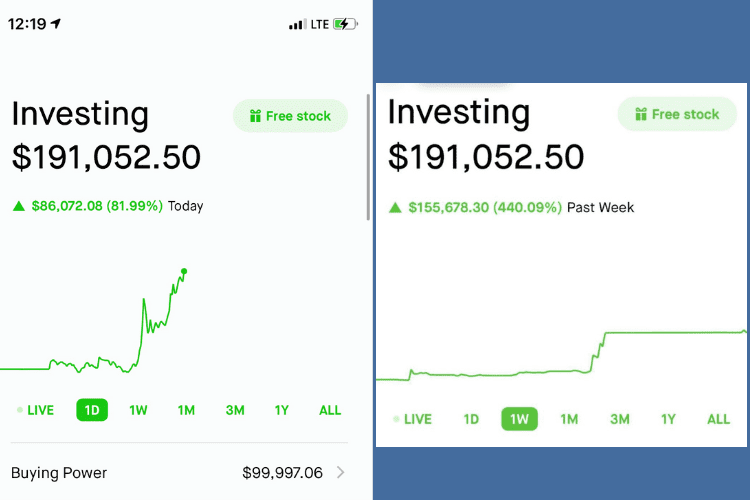

Nick Gilmore from OH was stunned when he opened up his Robinhood app and realized his stock had taken off. After just a year and a half of investing, he couldn’t believe his stocks shot up 82% in one day. His overall portfolio was up 440%, making his investment total sit at $196,000 at one point.

This computer engineer, adjunct professor, and Ph.D. student took the time with us to explain how it all happened, how he spent the money, his future plans, and to give other investors some your mileage-may-vary tips and inspiration. And yes, he doesn’t get much sleep.

How it Started in 2020

It took a COVID-19 lockdown for Nick to start investing. Since he had so much free time at home back then before his new jobs and schooling, he decided that he’d learn a skill that would benefit him for the future.

So he dived into research and watched YouTube videos to learn about investing, to which he gives a shoutout to channels ZipTrader and deadnsyde, who provides technical analysis and reasoning why they like the stock with significant detail instead of just telling you what to do.

Nick initially used the Stockpile app but quickly switched over to Robinhood (a free trading app that lets new investors get started with just $1) because he appreciated its simplicity and ease of use. He currently holds investments in WeBull and Fidelity as well, but a majority of his money is still in Robinhood.

“Robinhood gets flack for some things, one of them being so easy that a kid could get their hands on it and lose a lot of money, but it’s still appropriate for beginners. For someone like myself, who wasn’t a kid and was trying to learn, it was, for me, the right platform to use.”

The Stock That Sent His Portfolio to the Moon 🚀

It wasn’t GameStop (GME), AMC, or any hype stock.

It was Ocugen (OCGN).

A press release caught Nick’s eye when Ocugen had signed a contract with a biotech company to work on a COVID vaccine that was different from Pfizer’s and Moderna’s mRNA vaccine.

“I personally thought there was a market there since it could potentially solve the world’s pandemic and explode someday.” So he waited for the slight dip and placed a starter position of $5,000 in late December 2020 and kept dollar-cost averaging down over some time. The surge happened in early February 2021.

“Pre-Ocugen, my portfolio was $26,000 of my own money and worked it up to $58,000. When I started with Ocugen, I placed $5,000, and over time ended up with $27,000 alone in that one penny stock.”

It takes a very aggressive mindset to be able to hold that much money into a penny stock since they’re extremely high-risk. Nick was fine with volatility but started to get worried when his overall portfolio decreased to $14,000.

But then Ocugen took off and shot to the moon. This was a snapshot of his portfolio around that time:

“It was a moment I’ll never forget. People talk about how much money can change your life, and they say $5 million or so, but after what I experienced, this absolutely changed my life.”

It took a year and a half for his life to change.

How Nick Spent His Earnings

The first thing Nick did was hire a financial advisor because he didn’t want to mess it up.

He knew he wanted to spend on one thing he really wanted and be responsible with the rest.

Again, everyone’s financials are different, and what worked for Nick may not work for you. Investing always involves risk. Below is what his advisor suggested for Nick’s specific case. You will need your own advisor when the situation arises for yourself.

With his financial advisor’s guidance, Nick left $120,000 in his portfolio for continued investment and took out $85,000 to spend on the following:

| Amount | Item |

|---|---|

| $40,000 | Set aside for taxes |

| $30,000 | Tesla Model 3 down payment |

| $9,000 | Paid down some student loans |

| $6,000 | Maxed out Roth IRA 2021 contribution |

“The money left over gave me opportunities to open positions on long-term stocks.”

You Don’t Have to Be Rich to Invest

Nick was by no means rich, but he remarked that “not everyone has it well as I did and do currently” because he doesn’t worry about rent (lives with family) and has two great jobs.

Your financial situation will be different, but you don’t have to wait until you have enough money to start. That’s why Robinhood makes it easy for new investors to get started with just $1 on stocks, ETFs, and options, along with cryptocurrency, commission-free.

They also give free stock worth $2.50 up to $225 for new members, with chances to get a high-value stock in Facebook, Microsoft, etc.

Nick’s YMMV Tips for Beginner Investors

YMMV = your mileage may vary (everyone’s experience will be different)

Nick wouldn’t have made the money he did if he wasn’t an aggressive investor, and he says, “you can have aggressive tendencies with some of your portfolio but not all. Some of the dudes on Reddit, they’ll do wild YOLOs, but I won’t ever do that.”

Here are his two major tips:

1. Do your own due diligence – “Don’t just look at Reddit, don’t just look at Motley Fool, don’t just Google search. Understand what the company does, and its fundamentals, and don’t buy into the hype because you don’t want to chase a stock that has already surged. This is a risky move that could work, but it WILL fail at some point. If you decide to attempt buying a surge, have extremely strict stop losses.

“Also, before investing in a company, treat it as if you’re writing a paper and influencing someone else to invest in that company. Basically, I’ll do so much research that that person reading my research should be like, wow, I’m in.”

2. Start positions slowly – “If you have $1,000 total to invest, I would suggest not to throw it all into one stock. Start with $100, and over some time, build up your investment in various stocks. Don’t expect stocks to jump the next day because you’re investing in the fundamentals of the company.”

“As long as you believe in the company, then it’ll be OK to have volatility. If you can’t handle the ups and downs, then it’s pretty hard to invest.”

And this is still currently Nick’s method of investing. If he saw a company in a sector he really liked, and their financials at the time may not be great, but he believed in their values and foundation, he’ll invest. He’s not investing in stocks to make a quick flip.

What Now?

For Nick, a sports lover and former powerlifter competitor, stocks have made their way as one of his top hobbies and continues to use Robinhood as his primary investing platform. His focus now is on finishing up his Ph.D. in information systems security and eventually working on his future investment company.

We thank Nick for taking the time to share his story with us with such candor and wish him luck on his dissertation!

Read More: How to Invest in Stocks With the Best Investment Apps

*The Smart Wallet is a paid affiliate partner of Robinhood.