Robinhood vs. Stash: Which is Best For You?

Robinhood and Stash have proven to be great investment tools for the everyday person over the years. Both apps have beginner-friendly platforms that allow anyone what they need to level the playing field and become the investor guru they’ve always wanted to be for little to nothing in cost. Both apps offer fractional shares, which allow you to invest in fragments of stock here and there and build up over a period of time. Both apps give you access to a variety of single stocks and Exchange Traded Funds (ETFs).

With both apps on a mission to do much of the same, have you wondered which one is better for your investment needs? Looking at the differences between the two might help you make a better determination.

What Robinhood Offers

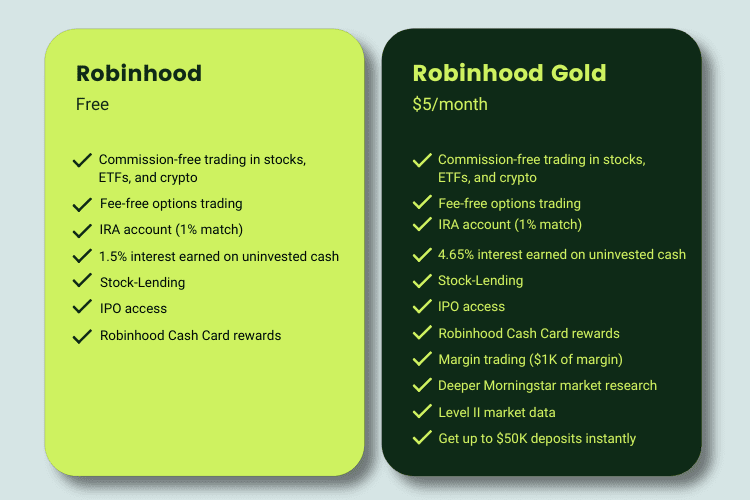

Robinhood’s commission-free trading lets you start investing with just $1 while opting for Robinhood Gold will cost you $5 monthly.

The platform professes that investing doesn’t have to be complicated — not with them. You can:

- Invest in your favorite companies — in stocks and fractional shares, investing as little as $1

- Get diversified stock bundles or ETFs

- Level up your investing strategies and buy or sell on a specific day at a specific price

- Earn 4.65% APY on uninvested cash

- Increase your buying power by borrowing from them

- Break into crypto for as little as $1 without the commission fees

- Get personalized portfolio recommendations for new investors

- Start an IRA

Robinhood Gold

Research and Market Analysis

With Robinhood’s premium membership plan, Robinhood Gold, you get access to pro research, market data from Nasdaq, and in-depth research by Morning Star analysts. All of this will give you the information you need to plan your next investment move.

More Growth Potential on Uninvested Cash

Robinhood Gold also earns you 4.65% interest on your uninvested cash and gets you larger deposits instantly. Deposits as large as $5,000 to $50,000 gets you a jump on investment opportunities. You can also borrow money to invest.

Other Robinhood Features

Robinhood Retirement

Anyone, anywhere, regardless of whether they have an employer matching 401(k) or IRA or not, can take advantage of the free money Robinhood is offering with their Robinhood IRA 1% match. It’s the only company allowing you to open an IRA while offering a match. That means you don’t have to work for Robinhood to open an IRA account to get the 1% match. Neither is it exclusive to only those who don’t have employer matching accounts.

Although the 1% match seems trivial compared to an employer matching plan, over time — say 40 years later — it could mean an additional $26,000 built into your retirement savings.

Robinhood Cash Card

You can turn purchases into stocks and crypto with the Robinhood Cash Card since it’s a debit card with weekly bonuses to help you invest as you spend. No monthly fees, in-network ATM fees, or overdraft fees, plus there’s no minimum balance required.

Who is Robinhood Best For?

If you’re looking for an inexpensive way to invest and don’t need a lot of support building or managing your portfolio, Robinhood is a good option for you. If you’re a novice investor looking to know the basics of investing and want to place trades quickly and easily, Robinhood is a good option for you, along with having the option to open an IRA account with a 1% match.

What Stash Offers

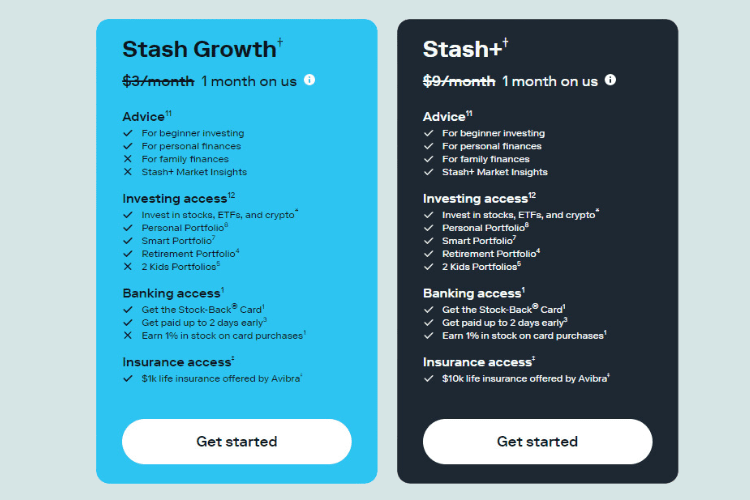

Stash lets you start investing at a minimum of $5 and upgrading to Growth and Stash+ plans will cost you $3 – $9 monthly.

Stash encourages you to invest your way by allowing you control through:

- Recurring investing by auto investing

- The Stock-Back® Card

- Dividend Reinvestment

- Stock Round-Ups

- Personalized guidance

Stash Growth and Stash+ Options

Smart Portfolio

Stash Growth Plans gives you access to the new Smart Portfolio feature. If you need a little hand-holding, this feature will allow Stash to research for you and pick ideal investments based on your risk level. This hands-off approach is done quarterly, so you’ll always be a step ahead on investing; it’s also stress-free. Stash also allows you the option to select your own investments. Get a $10 bonus after the initial $5 investment.

Other Stash Features

Stock Parties

You’ll also get the opportunity to attend virtual stock parties, where you’ll be offered stock rewards. The more people who attend the stock party, the bigger your share of the pot. Members have an hour after the party starts to claim the stock.

Stock Round-Ups

Stash will round up your purchases to the nearest dollar, and when it totals $5, it will send that money to your investment account. That equals more investment opportunities.

Stock-Back® Rewards

Earn stock even when you shop with Stash’s “Stock-Back®” rewards. Earn anywhere from 0.125% to 5% Stock-Back® on purchases at more than 11 million locations when you use Stash’s unique debit card. When you shop at any of these participating merchants, which include stores like Amazon, Walmart, Starbucks, and more, they’ll reward you with stock in their company. Using your Stock-Back® card at a retailer that doesn’t have a matching investment will still allow you the option of an investment of your choice from a predetermined list.

Stash Referral Program

Refer friends to Stash, and you both get a $20 bonus stock when your friend opens their Stash account and adds cash.

Who is Stash Best For?

If you want to learn as much as possible about the mechanics of investing and get personalized investment recommendations that will help you manage and grow your wealth over time, Stash is a good option for you. Also, if you don’t mind dishing out a little bit more in fees and monthly costs, as these costs will add up over time, then Stash may be a good option for you.

The Bottom Line

Both Robinhood and Stash are great investment options, but ultimately, the best one for you depends on your personal preferences. Whether you consider yourself a novice who wants to invest for the long term or someone who would prefer their hand is held every step of the way will determine the best platform for your investment needs.

Read More: