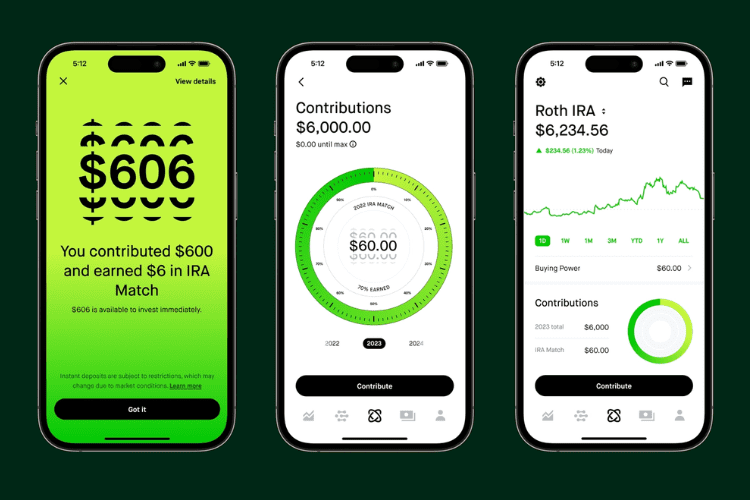

Robinhood Now Offers the Only IRA With a 1% Match

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Can you say, “Free money for retirement?” Retirement doesn’t come cheap. The money you save for retirement can make the difference between comfortably enjoying retirement on your own terms or being forced back into the workforce just to make ends meet. So, when Robinhood offers an opportunity to earn free money for retirement, you have to give it consideration.

Many Americans are offered some form of retirement plan through their employer 401(k) plan that may allow the employer to match what the employee puts in. But there are just as many Americans who don’t have that option. As many companies have opted out of pension plans, employees are left responsible for saving on their own. Furthermore, if you don’t have an employer that offers a 401(k) or is self-employed or freelance, the last thing you’d expect is for someone to match what you put in your Individual Retirement Account (IRA). Robinhood is the first company to offer an IRA with a match, where no employer is necessary.

What Are IRAs?

An IRA is an investment account that allows individuals to save for retirement. IRAs have tax-deferred or tax-free growth potential, offering tax advantages for the individual. IRAs are more effective the earlier they’re started.

Robinhood offers two types of IRAs:

Traditional IRA

Traditional IRAs allow individuals to grow their money tax-deferred, meaning they make their contributions before taxes are taken out. Taxes are withheld until they’re withdrawn in retirement. Eligible contributions may be tax deductible, which allows individuals to save by reducing their taxable income.

Roth IRA

Roth IRAs allow individuals to pay taxes on their contributions now so that when they retire, they can withdraw funds without having to pay taxes on them. You must qualify to meet the terms of the Roth IRA.

Who Is the Robinhood IRA 1% Match Available To?

The Robinhood IRA 1% match is available to anyone. Many employers offer their employees 401(k) options, providing a 3% to 5% match. But many people have decided to live outside of that box and are starting their own businesses to be their own bosses. Sure, you can open an IRA account on your own without an employer, but Robinhood is the only company allowing you to open an IRA while offering a match. That means you don’t have to work for Robinhood to open an IRA account to get the 1% match. Neither is it exclusive to only those who don’t have employer matching accounts.

Anyone, anywhere, regardless of whether they have an employer matching account or not, can take advantage of the free money Robinhood is offering.

How Do You Earn the Match?

Anyone who has chosen one of the two available IRAs Robinhood offers through its app and funds the account using an external bank account can receive the 1% match. You can select how you want to build your investment portfolio — either through a mix of stocks and ETFs — or select through the recommendations the app will provide to you.

Should You Put Your Money in a Robinhood IRA?

A recent 2022 survey found that over half of Americans (55%) are not where they want to be with their retirement savings. On top of that, 35% say that they are significantly behind the curve regarding their retirement savings. In addition, Pew Charitable Trust found that many Americans who do not have employer matching plans would be more willing to participate in a defined contribution savings plan if they could.

Given that, if you’re among the nontraditional workforce that does not have an employer-matching plan, this could be just what you’ve been waiting for. Also, while job security is not promised to anyone, having a plan outside your employer-matching plan could be beneficial down the road. Robinhood will even allow you to roll over your current retirement savings.

Although the 1% match seems trivial compared to an employer matching plan, over time — say 40 years later — it could mean an additional $26,000 built into your retirement savings.

Could that additional money come in handy during retirement? I’ll let you be the judge.

The Bottom Line

The time to start saving for retirement was yesterday. If you haven’t started, today is the day to start. Regardless of how or where you save, remember to get started and increase your contributions as your earnings increase. Never leave free money on the table. Whether through Robinhood or your employer, aim to contribute the maximum (there are limits to contributions) to receive 100% of the free match you’re offered.

Read More: