21 Ways to Rack Up $1,500 Before Halloween

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Let’s creep it real and make sure we’ve got some extra money on the side for the important stuff.

Once you save enough for the essentials taken care of, then set aside some leftovers for the fun things, like…Halloween! Check out some options below to help make some money here and there. The best part? They’re things you do on a daily basis anyway, like shopping, doing errands, and scrolling on your phone.

1.

2. Earn a $10 Amazon Gift Card by Trying New Games

When you’re ready to add even more games to your lineup, then download Cash Giraffe, an Android app that pays you to try out new games for, yes, you guessed it, cash. All are free to download!

Just earn coins from trying new games, and then you can redeem them for:

- PayPal Cash

- Amazon gift card

- GameStop gift card

- PlayStation Store gift card

- Xbox Live gift card

- And more good stuff

“Payouts are faster than most apps. PayPal rewards are small, but hey, it’s free money 💰 🤑“- Cassandra McGuire

A 3,599 coin welcome bonus is yours immediately too, when you sign in! Plus, get 200 coins for every friend you refer and 25% of their earnings.

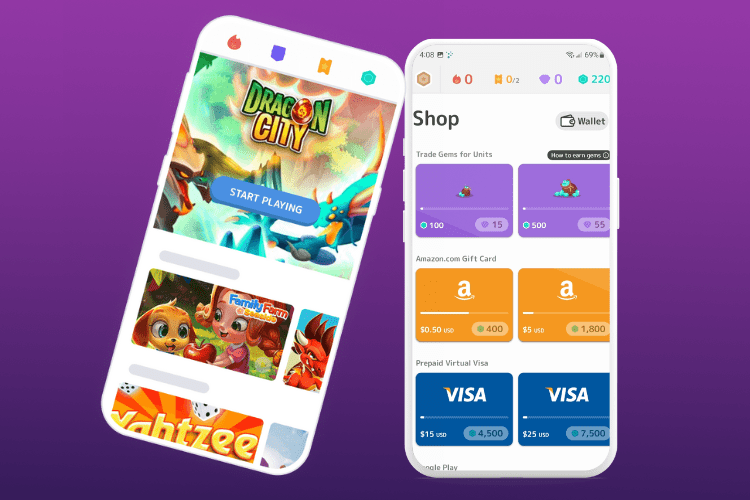

3. Play New Games and Earn Branded Gift Cards

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.