15 Ways to Save Money This Month Even on Minimum Wage

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

It may seem a little hopeless to save when you’re barely squeezing by on minimum wage income.

Since the federal minimum wage is $7.25 per hour, that’s only $15,080 annually before taxes (!) but at least 22 states have raised their minimum wage rules earlier this year.

It’ll definitely take time to save, but it’s not hopeless. You can do it, and we can help.

Here are some ways to get you started:

1.

2.

3.

4.

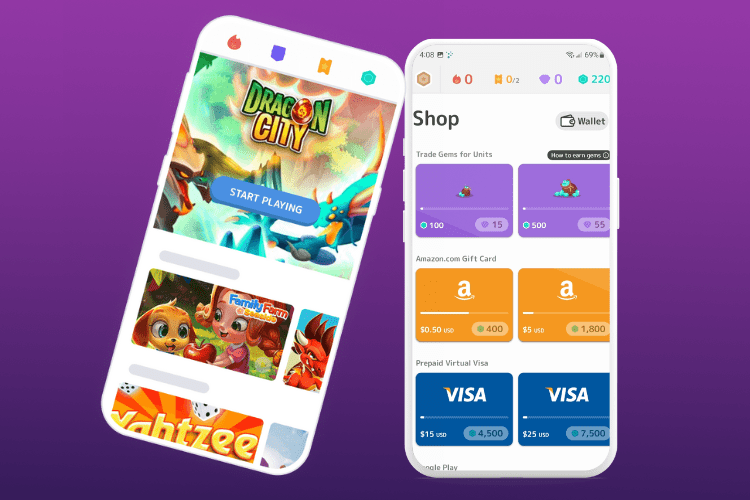

5. Play New Games and Earn Branded Gift Cards

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!