5 Ways Anyone Can Save on Monthly Bills with Little Effort

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Bills, bills, bills. The cycle of life.

Since most of our paychecks go straight to bills, it’s a huge deal if any savings can be found.

With recurring bills, it can be hard to notice the “bill creep” as well. This means your bill each year can “creep up” in price without you noticing due to automatic payments.

For instance, your internet connection could increase by $3 a month. Your cable TV? Another $4 a month. You might not even notice, and that’s exactly what companies are hoping for.

But you can prevent that from happening.

That’s why we’ve rounded up 7 ways that anyone can apply immediately to start saving on their monthly bills.

1. Free Gift Cards Just for Going Shopping? Yes, please.

Go on your normal grocery shopping trips. Scan your receipt afterward. Get points towards gift cards.

No extra fuss. No digital coupons to pre-select or specific stores to go to. It’s perfect for the lazy but smart saver.

Fetch Rewards on iOS or Android, an app where you can scan ANY grocery receipt to get rewards.

Scan receipts from supermarkets, neighborhood corner shops, wholesale clubs, drugstores, convenience stores, and liquor stores. Unlike other apps, you’re not restricted to specific stores.

You can start redeeming points for rewards with as little as 3,000 points ($3).

2. Affordable Car Insurance Exists – Here’s How You Could Save $610

You’re sharing the same roads with a lot of different people. Distracted people, oblivious people, road-rage people, etc. It’s best to cover yourself with insurance when everyone is operating a giant motor vehicle.

That’s why car insurance exists and is mandatory. However, you might be overpaying your current premium because finding another provider can be a hassle.

However, you can easily search for quotes on EverQuote. They help match you among dozens of regional agencies and insurance carriers to filter the best matches to save on your car insurance.

It takes about 4 minutes to fill out the form, and you’ll see a list of matches showing potential online, email, and phone quotes.

EverQuote can save drivers $610 a year on average* compared to their current insurance premiums. Once you see your list of potential matches, choose the online ones you want or wait for more information via email or phone.

It’s a simple process, so try it out to see how much you could save on the road!

3. Get Help Getting Out of Debt

Debt happens from credit cards, medical bills, collections, and more, but don’t let it overwhelm you by not addressing it immediately. Ease that stress and resolve it with National Debt Relief.

They’re rated #1 for debt settlement on top consumer review sites and A+ with the BBB, so if you have over $10,000 in debt, you can get a free, no-obligation debt relief consultation.

There are no fees until your debt is resolved, which can take as soon as 24-48 months. Check now since it only takes minutes to see if you qualify!

4. Figure Out Where You’re Wasting Money and Stop With This App

Realistic budgets are hard to make, especially if you’re lazy, to begin with. (No judgment; I can be, too).

You know you should start, but it just gets put off.

Here’s an easy solution, though: Rocket Money.

Their simple-to-follow budgeting pulls your historical spending, organizes it, and allows you to see it to set a target budget with context (aka, see where you’re wasting money).

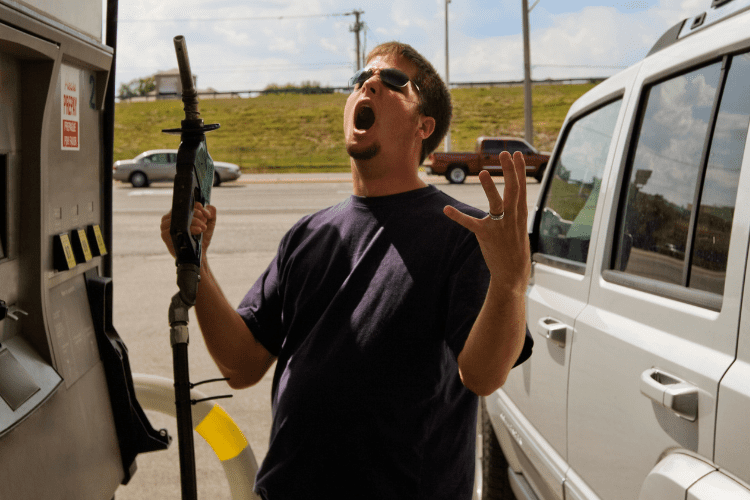

5. Save on Gas Bills With This App

With more employees heading back into the office or hybrid roles being more popular, you’re most likely driving more than years before.

Here’s a chance to save on gas with every trip to the station by using Upside, a free cash back app that partners with 100,000+ businesses to bring you great offers you can’t get anywhere else.

You can get up to 25¢ per gallon, up to 30% back on groceries, and up to 45% back at restaurants. On average, frequent users earn an extra $340 a year for just getting things they already buy!

New members can use a welcome code: TSW25 to get an additional 25¢ a gallon on their first gas purchase!

Bonus: Round Up Your Purchases to Automatically Save & Invest

Having savings alone won’t be enough to retire from, but you might think you don’t have enough money to start investing.

Utilize Acorns instead, which has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

The app automatically saves and invests your spare change from every purchase with the Round-Ups® feature. You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

There are no hidden fees, and Acorns makes it easy to invest in your future with your spare change.

Read more: