Splitwise: Ditch Mental Math And Use The Best Bill Split Calculator

Have you ever struggled to use your mental math skills to plan activities with friends? Do you spend time using your smartphone calculator at a restaurant, while the waiter impatiently judges your group?

If you’re tired of inaccurate computation and multiple Venmo requests, you’re in need of a bill split calculator and Splitwise may be the solution for you.

How Does Splitwise Work?

Splitwise uses Fintech software which offers technology to help enhance and automate financial transactions. The bill-splitting app industry continues to grow and thrive with competitors such as Settle Up, Tab, and Splid also offering users similar services and opportunities.

From splitting grocery bills, night outs, and dinner parties to planning group trips and travels, Splitwise offers users the ability to track expenses and balances with housemates, friends, trips, groups, co-workers, and family, among others. As individuals, we are highly social, eager, and enjoy creating memories. Yet it’s also important to be accountable to each other, financially that is.

The Best Features on Splitwise

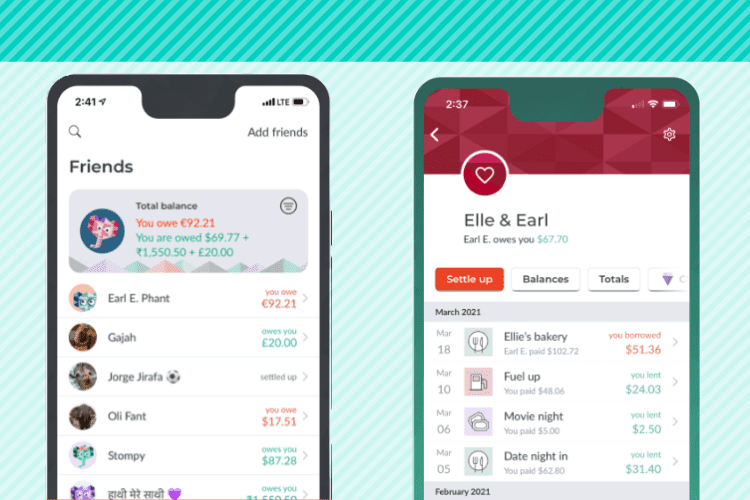

Organization and Convenience

The Splitwise app is truly the best bill split calculator because it allows you to make organized groups, and add expenses easily. You can pay back friends and record any cash or online payment. The app also provides you with the ability to track and keep a log of monthly expenses for your household or friend group. You can even connect the app with PayPal and Venmo!

Debt Simplification

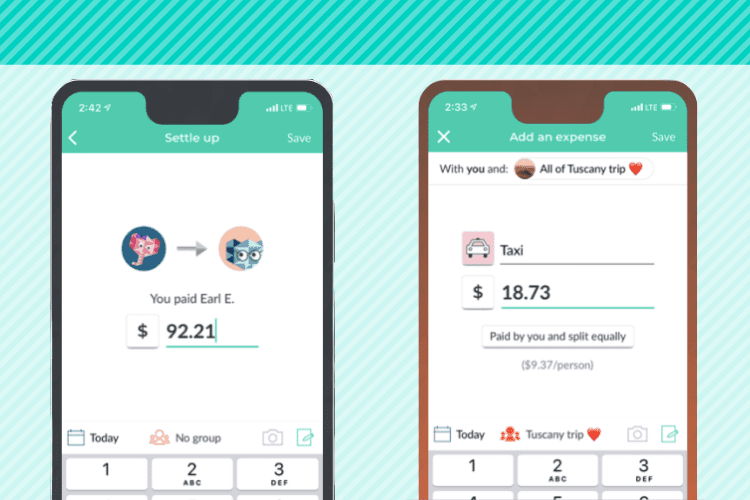

What’s more? The other core features of the app also allow you to split by percentage or shares so that the splits are fair and equal. You can even calculate total balances, suggest repayments, and even simplify debts by creating “debt triangles” which minimize the number of transactions. Splitwise ensures that anyone who pays is accurately reimbursed.

I remember using Splitwise on a few nights out with friends. The process was easy, and hassle-free and we ended up only having to pay one person back for each of our expenses!

Splitwise Pro: Enjoy Extra Features

While many of us are always on a tight budget, exerting control over your money is essential. Splitwise offers a trial of its pro version, free of charge for a week. After the trial ends, the pro version currently costs $2.99 per month or $29.99 per year.

It includes access to unique features such as receipt scanning, taking high-resolution photos of receipts, factoring tax and tip, default splits, itemization, currency conversions with a selection from over 100 countries, expense search, and a complete breakdown of group spending represented through graphs and charts.

The pro version also offers individuals an ad-free experience and the ability to save default splits and get first grabs on new features.

How Do I Send and Receive Money on Splitwise?

Easy! Just click the “settle up” button to pay a friend, where you should see several options for how to pay back the person, including cash, PayPal, and Venmo.

You’ll need to “record a payment,” split the cost, and pick how you’d like to receive your money. Similarly, you can receive money by either cash, Venmo, PayPal, or other third-party payment providers which you’ll be able to connect to your bank account.

Be sure you have the necessary apps and accounts installed on your phone. This way, you have access to both send and receive money to your bank account.

The Bottom Line

In this overheated economy with the highest inflation in 40 years and supply shocks, the little things can truly make the difference (especially when it comes to fairly splitting expenses!) As a bill split calculator, Splitwise offers multiple options for splitting and organizing expenses as a group. The app also has an attractive and user-friendly interface, making it efficient and easy to use. This bill-splitting app is certainly my pick!

So go ahead and download the app for free on either iOS, Android, or even on your web browser.

Read More: Why Millennials Love This Budgeting App That Saves People Over $720/Yr