Earn $750 To Use Towards Investing in Google, Amazon, Netflix, and More

You don’t have to be rich to start investing, and it doesn’t have to be complicated either. There’s no need to wait until you have “enough money” as the earlier you start, the better!

Investing in well-known brands like Google, Amazon, Tesla, Netflix, and more is possible through micro-investing, and you can do it with Stash.

What is Stash?

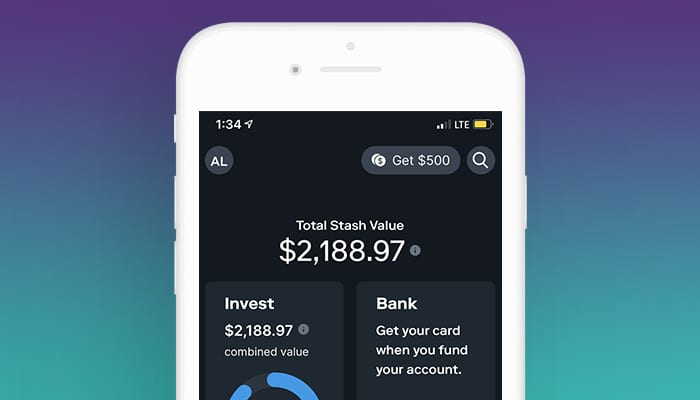

Stash is a micro-investing app that helps new investors build their portfolios and currently has over 5 million members.10 Unlike a typical robo-advisor, which directly invests money for you in a diversified portfolio, Stash aims to guide you in picking investments in ETFs and individual stocks.

You’ll also get an online bank account and a debit card1 which includes Stock-Back® rewards from merchants on qualifying purchases.2

Earn Stock While You Shop

Stash also has a debit card service1 that boasts “Stock-BackⓇ” rewards on purchases at more than 11 million locations11. Users in the program can earn 0.125% Stock-BackⓇ on all purchases and, at times, as much as 5% at certain merchants.2

When you shop at participating merchants with your Stash debit card, they’ll reward you with stock in that company. These include big brands like Walmart, Starbucks, Amazon, and 11 million more locations.

Stock Parties Give Bonus Stock

Members can claim bonus stock when attending a virtual Stock Party which is held at random times to allow more people to join in on the fun.

Some of the recent bonus stock they’ve given out include Nike, Southwest Airlines, Home Depot, and Peloton, just to name a few.

Another Bonus: Learn how you can make $750 to fund your Stash account.

Is Stash Worth It?

Stash can be great for investors who want more control over their portfolios than robo-advisors offer but need hands-on assistance.

Users can also invest in fractional shares of popular companies such as Amazon, Facebook, Tesla, and more without spending thousands of dollars.

You’ll also get a $10 welcome bonus after the initial deposit of at least $5 into your account.4

Once you’ve created your Stash account, then you can make $750 to fund it just by trying out some deals from Flash Rewards.

*Flash Rewards work by showing you “deals” they think you would like. This includes mobile apps and games, subscriptions, financial services, etc. Each type of deal you choose has its mini task to complete. After filling out basic info, you participate in a quick survey, see if offers interest you, and complete Level 5 to qualify/claim the reward!

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

*Investment advisory services offered by Stash Investments LLC, an SEC-registered investment adviser. This material has been distributed for informational and educational purposes only and is not intended as investment, legal, accounting, or tax advice. Investing involves risk.

1 Bank Account Services provided by and Stash Visa Debit Card (Stock-Back® Card) issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Investment products and services are offered by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed and May Lose Value. In order for a user to be eligible for a Stash debit account, they must also have opened a taxable brokerage account on Stash.

2 Program is subject to Terms and Conditions. Stash Stock-BackⓇ Rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any stock rewards earned through this program. In order to earn stock through this program, the Stash Debit card must be used to make a qualifying purchase (What doesn’t count: Cash withdrawals, money orders, prepaid cards, and P2P payments. See Terms and Conditions for more details). In order for a user to be eligible for a Stash debit account, they must also have opened a taxable brokerage account on Stash. Stock-Back Rewards that are issued into a participating customer’s personal brokerage account via the Stash Stock-Back Program, are not FDIC Insured, Not Bank Guaranteed and May Lose Value.

3 The Stash Monthly Wrap Fee starts at $1/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

4 Promotion is subject to Terms and Conditions. To be eligible to participate in this Promotion and receive the Bonus, you must complete the following steps: (i) successfully complete the designated registration process of opening an individual taxable brokerage account (“a Personal Portfolio”), (ii) link a funding account (e.g. an external bank account) to your Personal Portfolio, AND (iii) initiate and complete a minimum deposit of at least five dollars ($5.00) into your Personal Portfolio. In the event you only complete the designated registration process to receive the Financial Counseling Service (as defined in your Advisory Agreement), as applicable to you, or do not otherwise complete the account opening process for an individual taxable brokerage account (“Personal Portfolio”), you will not be eligible to receive the Bonus.

5 To note, SIPC coverage does not insure against the potential loss of market value.

8 For Securities priced over $1,000, the purchase of fractional shares starts at $0.05.

9 Stash offers two plans, starting at just $3/month. For more information on each plan, visit our pricing page.

10 This is not an endorsement or a statement of satisfaction by any Stash client and is defined by the number of clients who have e-signed.

11 The Nilson Report, 2019

13 This Program is subject to terms and conditions. In order to participate, a user must comply with all eligibility requirements and make a qualifying purchase with their Stock-Back® Card. All funds used for this Program will be taken from your Stash Banking account. This Program is not sponsored or endorsed by Green Dot Bank.

The sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here