Truebill Review: The Big Picture Finance Tracker

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

If you find yourself wondering where your money goes, it’s probably time to start tracking it.

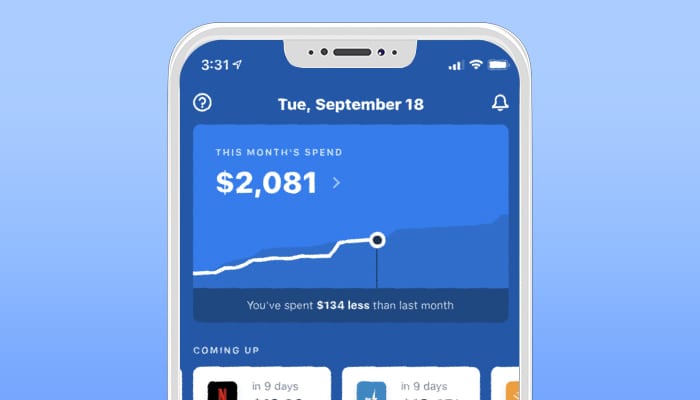

Truebill is an app that helps users manage their finances by managing subscriptions, lowering bills, and optimizing spending. By creating a snapshot of your financial life, the app makes it easy to see what’s coming in, what’s going out, and why. It positions itself as the most convenient and big-picture personal finance tracker, budget planner, and bill reminder app.

- Comprehensive bill savings strategies

- Robust expense tracking and insights

- Basic tools are free to use

- Works on behalf of users to save money

- Premium services cost money

- Some users report technical difficulties on app

It’s great for people who want to gain a better understanding of their unnecessary expenses and cut spending by identifying waste.

How Does Truebill Work?

Truebill helps users save money a few different ways:

- Tracks and lowers bills

- Subscription monitoring

- Categorizes spending to track the largest and most frequent expenses

Tracks and Lowers Bills

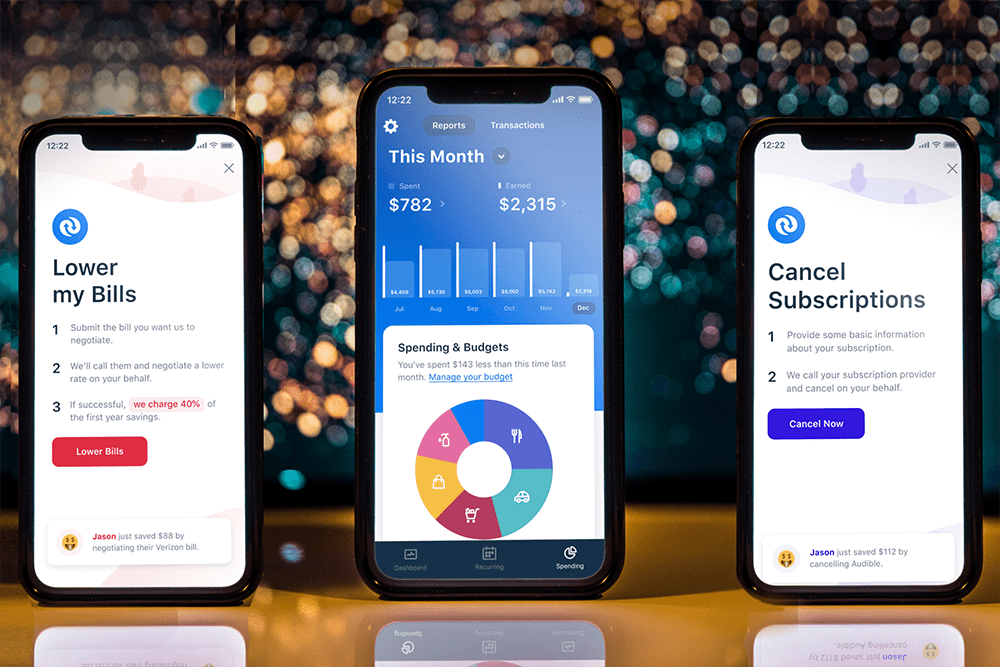

Truebill’s “Lower My Bills” feature negotiates directly with more than 20 cable, internet, and cell service providers to help users claim the lowest rates possible. To take advantage of this feature, simply upload a copy of your most recent bill or connect directly by logging into your online account. Truebill uses that information to get you onto a promotional plan, slash unfair fees, and lower the rate.

Most Truebill users see savings of 20% through this Truebill service, but it’s not free. Truebill charges 40% of the total annual savings and requires upfront payment.

Subscription Monitoring

This is Truebill’s most popular feature. It connects through your checking account and/or credit card account using the financial encryption service Plaid. Truebill takes a few minutes to scan through all transactions to flag recurring bills, changing to bills, and other alerts.

Truebill reports all of this information so that app users can use the information to cancel subscriptions, change spending behavior, or question rate changes. The basic subscription monitoring service is free, while Truebill Premium costs $4.99 per month or $35.99 annually. Truebill Premium offers additional features, such as automatic subscription cancellation, overdraft and late fee refund requests, and more.

Personal finance tracker, budget planner, & bill reminder app

Easily budget, even if you don’t know how to

They negotiate with over 20 cable, internet, and cell service providers to help you claim the lowest rates possible

Popular: Keep track of all recurring bills and subscriptions so you can cancel, change spending behavior or question rate changes

Similar Products

Truebill is the only app of its kind. No other app currently offers the range of services and premium add-ons found on Truebill but there are a few alternatives that offer similar services.

Billshark focuses only on helping customers lower their bills. Just like Truebill, Billshark charges 40% of total savings. Billshark can negotiate for lower cable, internet, cell phone, and home security services.

Trim helps customers cancel subscriptions and lower bills by charging 33% of total savings. Though the total cost of Trim is lower, it works with a smaller number of service providers and can’t request bank fee refunds.

Does Truebill Cost Money?

Truebill is free to download and use at the basic level.

Customers must pay to take advantage of its premier services. “Lower My Bills” charges 40% of the total annual savings it achieves, and Truebill Premium costs between $3 to $12 a month.

Features & Pro Tips

According to Truebill, there’s an 85% chance that the app’s services can lower your bills. If you save $100 a year, Truebill takes $40, leaving you with $60 in savings that you didn’t have before. This service is extremely valuable for people who may not pay close attention to their cell phone and internet bills. Truebill can cut through the bogus fees, find new promotions, and use other tricks to downsize painful monthly bills.

Users who don’t want to pay the full annual subscription cost for Truebill Premium can pay as they go on a monthly basis. Maximize the premium services to find unwanted subscriptions, request bank fee refunds, and other benefits during the first few months, then revert to the free version of Truebill.

Is Truebill Right For You?

This app is a great choice for people who want to become more in-tune with their spending habits and don’t mind paying a few fees to achieve that goal. If you can’t account for all of your monthly expenses, or if you’re concerned that you’re paying for monthly subscriptions or utility services that you never use, Truebill can help you stop the financial bleeding. Even careful spenders may find Truebill valuable for its unique spending insights and utility bill negotiations.