Why Millennials Love This Budgeting App That Saves People Over $720/Yr

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Finances. We know we should stay on top of them, but too often we push them aside — or we just don’t know where to start.

That’s why we’re going to talk about Truebill.

This personal finance app has opened our eyes to where we were wasting money without even realizing it. Our team members benefited immediately from using Truebill, and we’re sure it’ll help you out too like it has for the app’s 2 million+ members.

What is Truebill & How it Works

Truebill is a money management app that gives you complete control over your money. It does the following really well:

- Groups all your bank accounts and spending into one simple dashboard

- Helps you create a budget you’ll actually use

- Cancels useless subscriptions you forgot about (like we did!)

- Can lower bills by 20% through negotiating on your behalf

It’s really simple to start. All you have to do is:

- Download Truebill

- Connect your bank account(s) and credit card(s) so it can pull all transactions to analyze and categorize spending (Yes, you’ll need to know your logins)

- You’ll see everything that’s going on with your accounts in one place, including all transactions and recurring subscriptions (some you may want to cancel, and others you may want to keep!)

- With your permission, the app will also check to see if there are any bills they can lower for you

Note on security: Truebill is partnered with Plaid, which means your banking credentials are encrypted and NEVER stored. The app only has read-only access to your accounts!

Once you get your account up and running, you’ll see everything all in one place to really understand where your money is going.

Increase Your Savings Immediately (We Saved $753)

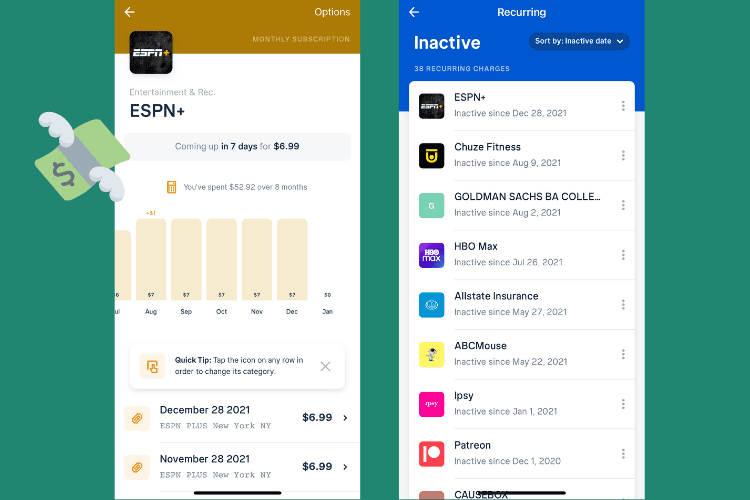

No matter how on top I thought I was on my finances, Truebill still managed to find a subscription I’d missed. It was an ESPN+ trial that I had forgotten to cancel…7 months ago.

I wasted almost $53 on the unused streaming service and would’ve lost out on even more without Truebill’s help. I canceled ESPN+ on my own, but the Truebill team can also cancel subscriptions for you if you prefer.

My teammate, Caleb K., saw even more savings. He has his own personal Google spreadsheet for budgeting but downloaded Truebill to automate the process. Since Truebill categorizes spending, he was able to see how he spent thousands on food delivery last year (thanks, COVID), along with seeing transactions he didn’t recognize at all.

Through the app, he realized he spent over $700 on four Amazon Prime channels that he never even watched!

“This was frustrating to discover but I immediately saved myself over $700 this year thanks to Truebill.”

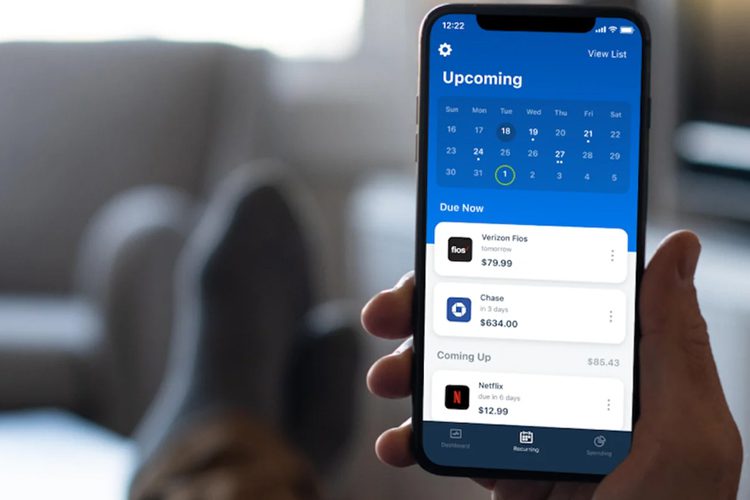

Since the app neatly organizes all your bills and recurring subscriptions in an interactive calendar, you won’t ever be blindsided by a forgotten subscription again. Your newly categorized spending will also help you set a budget to meet your financial goals!

Avoid Bill Creep & Lower Bills by 20%

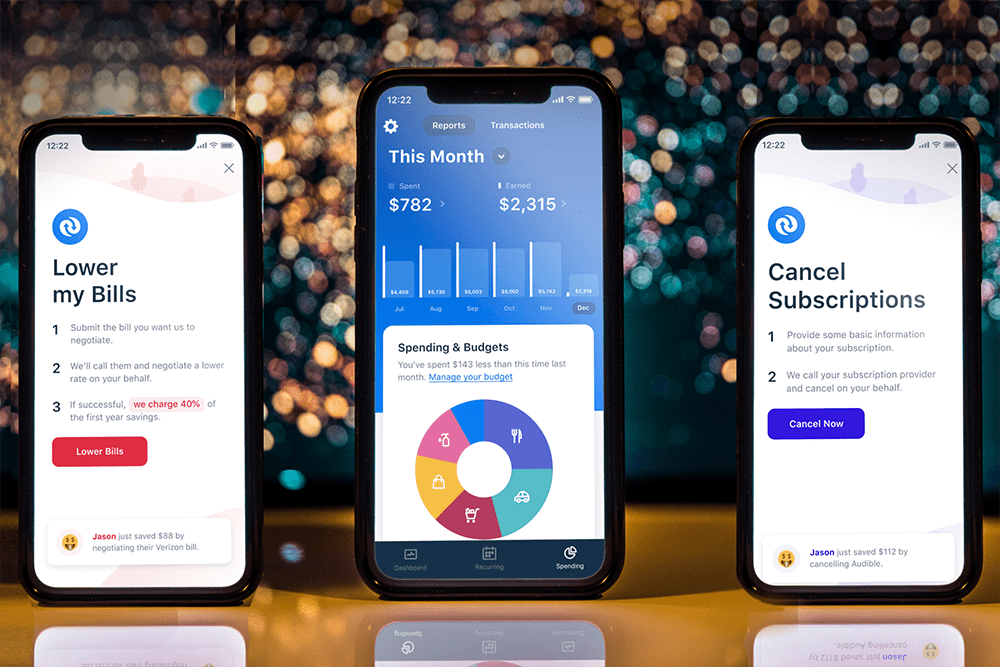

In addition to providing you with an easy-to-understand dashboard of your financials, Truebill also has a team of people to help lower your bills by up to 20%.

This is a huge help with monthly bills, especially since bill creep is real. Introductory offers will expire, automated payments get overlooked, and companies will profit over their customers being too “lazy” to check or shop around.

If you never ask for a better and lower rate, your service provider will never offer it. That’s why the Truebill team is here to help you negotiate your bills, sparing you from long, frustrating phone conversations and saving you money.

If Truebill successfully lowers your rates, they’ll take a cut between 30-60% of the first-year savings (you get to choose what you pay). But if they’re not able to lower your bill(s) and you already have the lowest rate, there’s no charge at all.

For example, let’s say Truebill saved you $20 per month on your internet bill.

$20 over 12 months is $240 in total savings, so 40% of that will be $96 (with payment plans available to break it down even further). You’ll still be saving $144 in the end, and you didn’t have to do any extra work!

Truebill will even monitor internet and cable outages and actually request credit back to your account too. It makes outages less infuriating for sure.

Track and Understand Your Credit Score

The Truebill app gives free access to your credit score. Your credit score is important to keep track of since it determines your creditworthiness and can affect future loans, jobs, insurance, apartments, and other financial services.

Truebill Premium members have access to their full credit report on a monthly basis.

This was vital for my teammate Cayla G., who discovered she had a $100 bill sent to collections that she wasn’t aware of.

Due to her address not updating correctly, she never received the bill — and she would’ve never found out if it wasn’t for Truebill.

When she quickly paid the bill, she saw there was ANOTHER issue: there was a 22-year-old credit card under her name that she hadn’t opened. Thanks to the app, she’s now in the process of getting the fraudulent card removed.

Alright, How Much Does Truebill Cost?

Truebill is a free app with optional paid services (bill negotiation) and premium plans.

Over the past 7 years, Truebill has saved over $100,000,000+ for its users!

The Truebill Premium plan allows you to choose your own price — between $3 and $12/month. If you choose $3 or $4, the cost is billed annually after a 7-day free trial.

We suggest you check out the app and see if Truebill is right for you!

Truebill makes it easier to understand where your money is being wasted and how you can save better. You might be surprised at what you’ll find out. We saw immediate savings when we used the app ourselves, and we think it’ll change the way you look at your own finances as well. Let’s start plugging those money leaks.