Varo Review: No-Fee Mobile Banking, High-Interest Savings

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

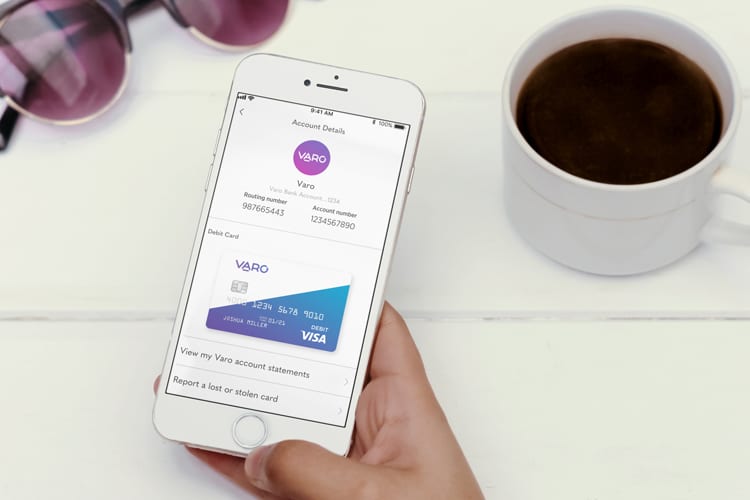

Varo is one of the top personal finance apps on the market, part of a wave of mobile-only challenger bank apps that are giving traditional banks a run for their money. (Which is great, since more competition boosts innovation which ultimately benefits the rest of us!)

Aimed squarely at millennials, Varo targets customers with steady paychecks who want to qualify for high-interest savings accounts (starting at 1.21% Annual Percentage Yield* and going up to 2.80% APY*) and who don’t need a physical branch location or old-school amenities like physical checkbooks.

How Varo Works

In Varo’s mobile banking app, you can open no-fee bank and savings accounts, make payments and transfers, deposit checks, and use various financial planning and budgeting tools – all on your smartphone!

To withdraw cash, you can make no-fee withdrawals at 55,000+ Allpoint ® ATMs worldwide, including 42,000 in the U.S. Allpoint ATMs are located in places like Costco, Walgreens, and Safeway — so it’s never far to find a free ATM.

But since there are no physical branches, you can make cash deposits only at participating Green Dot® locations nationwide, like Walmart, CVS, Rite Aid, Walgreens, 7-11, Dollar General, Family Dollar, Albertsons, Safeway, Kmart, and Kroger. Cash deposits incur a fee of $4.95 at checkout or $5.95 if you purchase a MoneyPak.

Since we tend to be a cashless society, we don’t foresee members having to use cash deposit often.

Why Varo is Worth Your Time Compared to Others

Varo shines with its high-interest savings rate and free automated savings tools, like Save Your Change. This free-to-use feature rounds-up every transaction to the nearest dollar so you can save a little every time you use your account.

Members can earn up to 2.80% APY*, as long as they direct deposit at least $1,000 per month, use their Varo debit card five times per month, and have a balance of $50,000 or less.

Those who don’t meet these requirements can still get 1.21% APY*.

By comparison, mobile banking apps Simple and Chime offer only 0.01% APY; Marcus By Goldman Sachs, offers 2.25% APY; and AMEX Personal Savings offers 2.10% APY.

Bonus perk: If you set up direct deposit with Varo, you can receive your paycheck up to 2 days early!^

How to Get Started with Varo

To get started, head to Varo and apply to open an account.

You just have to be 18+ years old, have a valid, government-issued ID, a valid Social Security number, and provide basic personal information to verify your identity. You also have to be a U.S. Citizen (or permanent resident status) in the United States.

Varo doesn’t require a minimum deposit to open a bank account and if you’re switching over from another bank, it’ll guide you through.

There are many ways to fund the account. You can:

- Set up direct deposit or Instant Pay from Uber and Express Pay from Lyft;

- Transfer from an external bank account via the Varo app or your bank’s online tools (can take 1-4 business days);

- Transfer from digital wallets like Cash App, Venmo and PayPal

- Deposit checks by taking two photos in the Varo app; or lastly

- Deposit cash at thousands of Green Dot locations nationwide

Is Varo Free? How Does Varo Make Money?

Varo doesn’t charge any fees for its banking products and there are no fees for transfers or debit card replacements. With the average American spending up to $329 year on bank fees,** this is valuable savings for the customer.

They make their money on interchange fees that merchants pay (doesn’t affect customers) and by charging some interest on personal loans.

Is Varo Legit?

Varo Bank Accounts are provided by The Bancorp Bank, and deposits are FDIC-insured up to $250,000 through The Bancorp Bank; Member FDIC.

It’s considered one of the top personal finance apps by Bankrate and NerdWallet as well.

The company’s co-founder and CEO Colin Walsh led Europe’s largest consumer credit and charge card business at American Express and, at the time of writing, Varo has a 4.7/5 star rating on the iTunes app store, with 16,000 reviews.

Final Thoughts on Varo

If you’re a millennial with no need for a traditional bank, interested in getting paid up to 2 days earlier^, want to get the best rate on your savings, and a desire for a “hands-off” tool to start saving money, then Varo would be worth trying!

**$329 a year bank fees source – Motley Fool