Waiver Review: Time to Wave Overdraft Fees Goodbye

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Silent but costly.

That annoying overdraft fee seems to occur just one day before a deposit rolls in. Or you get dinged $35 for something as little as $2.50. Make it make sense, right?

Every year, banks make over $30 billion in overdraft fees. These fees seem to kick us when we’re down (1 in 5 people experience it). And they add up. So it’s time to wave overdraft fees goodbye and keep that money in your rightful pocket.

Let’s take a closer look at Waiver which will help keep your money from getting sucked out.

What is Waiver?

Waiver is a new service that blocks your bank from being able to charge you those annoying $35 overdraft fees. You won’t even need to switch banks or open any new accounts. Continue using your own bank!

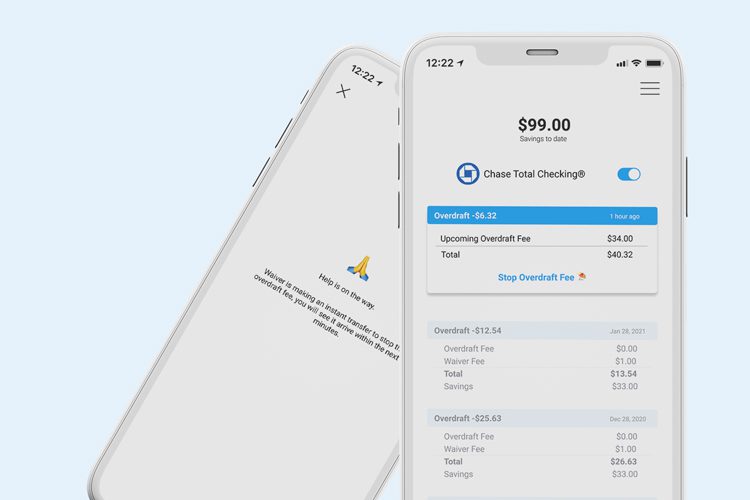

If your balance ever gets into the negative, Waiver will alert you immediately and make an instant transfer to bring it back to $0.00 and avoid the overdraft fee. When your balance returns to positive, Waiver reverses the funds.

Their process: Monitor > Alert > Block > Save

It’s like a bouncer for your bank account since Waiver is always on standby to block any

incoming fees.

What does Waiver Cost?

There is currently no charge to use Waiver with promo code: TSW (so be sure to use it!)

Waiver is free to sign up for, and there are no monthly fees or optional tips either.

Is Waiver Worth Your Time?

Short answer: Absolutely.

Longer answer: We think it’s an invaluable service, particularly when Waiver is free to sign up for using promo code: TSW

You’ll also be supporting a women-owned and Hispanic/Latinx business that believes that banking needs to work the same for everyone. Why should banks pocket billions in overdraft fees when it hurts the people that need that money the most?

That’s how Waiver’s mission was born and how you can take part in keeping your money in your own pocket. Time to block those pesky fees!