15 Ways Moms Can Save Money This Year

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

You’re the pillar of the family.

You take care of the kid(s), the house, your significant other, and hopefully manage to squeeze in some you-time.

But there are always additional ways to save that can stretch that precious dollar out. Whether your household has two incomes or not, extra money is always appreciated and necessary. Here are some ways that your family can incorporate to help save more money this year!

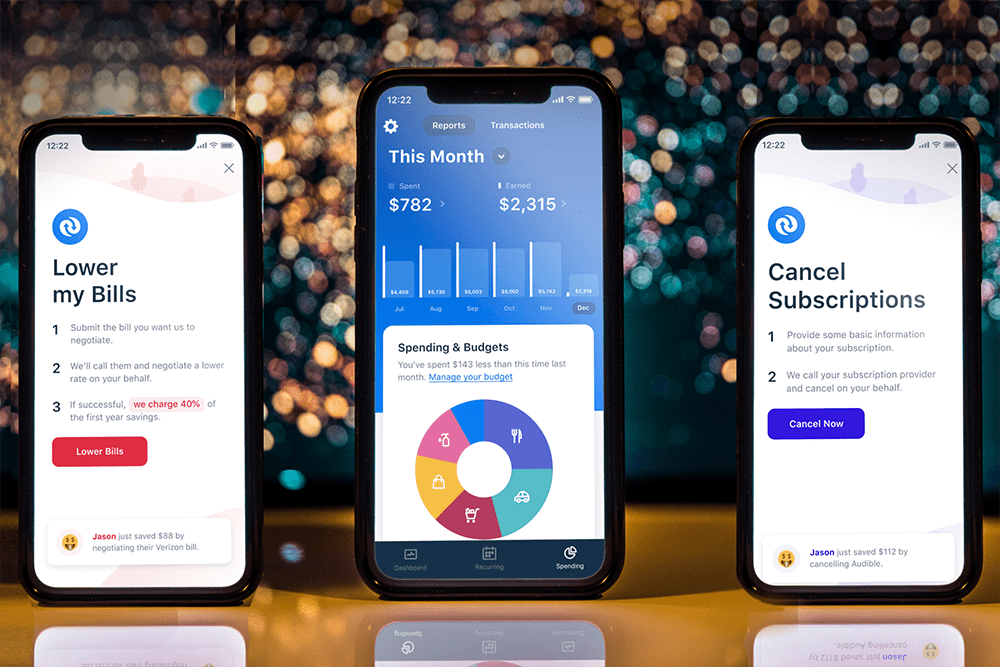

1. Budgeting Made Easy With This App, Even if You Don’t Know How

First things first, if you have trouble budgeting, you’re not alone as most people actually don’t know how to. When you understand how much money comes in and how much goes out, it’ll all start making sense.

Truebill easily helps you budget, even if you’re clueless. Their simple to follow budgeting pulls your historical spending, organizes it, and allows you to clearly see your spending so you can set a target budget with context. (Aka you can see where you’re wasting money on).

Truebill’s five-star reviews come from people formerly bad at budgeting. Nicole M. said Truebill “tracks spending and makes you accountable for every place your dollar is going. Shows you how a ‘few bucks’ here and there can really add up over time. Also gives you clues on how to save based on your spending. It’s like having a personal accountant tracking my money.”

Truebill will also alert you if you’re getting a little too spend-happy in your budgeted categories so you know when to curb it. Another user, Krystyna D. said, “This app is a lifesaver for budgeting. It lists your transactions in a minimalist and customizable way, has a spending graph that compares your current spending based on last month, and has a really great budgeting feature. I’ve been using the app for just about 7 months and they’ve done nothing but make a really great improvement to the service. I’ve tried some of the other services and they’re all cluttered and give you too much info without making what you want to see accessible.”

It’s simple but actionable budgeting that anyone can follow and it’s free to use! Join the many users today and control your spending with Truebill!

2. Family Essentials – Get Up to $240 Cash Back in Grocery & Household Savings

Diapers, formula, snacks, picky teenager food, etc. No matter what your kid’s ages are (including your spouse), their needs and wants are going to put a strain on the wallet.

Solution? Get cash back on all your household essentials.

It’s simple. All you have to do is take a picture of your grocery receipt and Ibotta will pay you cash.

Here’s how it works:

Before you go to the store, search for your shopping list items in the Ibotta app. After your store visit, take a photo of your receipt to get cash back.

Ibotta is free to download and you’ll also get up to $20 in Welcome Bonuses when you sign up! They’ve already given out $186 million dollars cash back to savers in 2019 alone.

Some offers we found:

- 25 cents back on any item

- $3 – $5 back on various wine

- $2 back on KIND Protein Bars

- 25 cents – $4 back on ice cream

- $2 back on Herbal Essence Haircare

Popular stores are Walmart and Target, but Ibotta also works at restaurants, online shopping sites, and even at the bar. On average, active Ibotta users save up to $240 a year or more but the highest saver got $13,000 in cash back this year!

Welcome Bonus: Up to $20

Average savings a month: $20

What it could add up to in a year: $240

Additional Referral Earnings: $5 per referral

3. Affordable Car Insurance Exists – Here’s How You Could Save $610 This Year

You’re sharing the same roads with a lot of different people. Distracted people, oblivious people, road-rage people, etc. It’s best to cover yourself with insurance when everyone is operating a giant motor vehicle.

That’s why car insurance exists and is mandatory. You might be overpaying on your current insurance premium since it can be a hassle finding another provider.

However, you can search for quotes easily on EverQuote. They help match you among dozens of regional agencies and insurance carriers to filter the best matches to save on your car insurance.

It takes about 4 minutes to fill out the form and you’ll see a list of matches that show potential online quotes, email, and potential phone quotes.

EverQuote can save drivers $610 a year on average* compared to their current insurance premiums. Once you see your list of potential matches, choose the online ones you want or wait for more information via email or phone.

It’s a pretty simple process, so try it out to see how much you could be saving on the road!

4. Get Cash Back Up to $396 a Year On Everyday Purchases

Saving money and getting cash back on purchases always sounds like a great idea – until you completely forget to take the steps to get the savings. There are SO many ways to save money while shopping, who can remember if it’s not automatic?

Rakuten (previously called Ebates) can help you get cash back on everyday shopping as well as apparel, beauty, restaurants, and more, automatically. With Rakuten, you don’t even have to upload your receipts after your purchases. They’ll send you simple push notifications when your favorite stores increase their cash back deals or have a good sale.

Offering simple one-tap savings with no points or fees helps ensure that you get the most out of your purchases. So, before buying anything, hop into the app to see if you can get up to 40% cash back at over 2,500 stores.

They also have an amazing referral program where you can earn $25 for each eligible friend. New members get a $10 bonus too!

5. Don’t Toss That Receipt! Do This First for Free Money

Before you crumple up that receipt in your pocket or forever lose it in the abyss of your purse, scan it into the Fetch Rewards app, and earn points towards free money. I repeat, free money.

It’s ridiculously simple and actually fun to use.

Shop at any grocery store, convenience store, club store, neighborhood store, or big box store, take a picture with the app, and that’s it. (Favorites include Target, Kroger, and Walmart!)

Unlike other apps, you don’t have to go to specific stores, there’s nothing to pre-select prior to shopping, and there’s no minimum spend. Just scan in any receipt from a store that sells groceries (even when you didn’t actually buy any groceries) and boom, points for money.

You can start cashing out as soon as $3 (3,000 points) and you can grab a $2 welcome bonus on us (2,000 points) when you use promo code REWARD before scanning your first receipt!

Welcome bonus: $2

Average savings a month (depends on purchases): $25

What it could add up to in a year: $302

Additional referral earnings: $2 per referral

6. Never Pay Overdraft or Hidden Fees Again*

Common bank fees.

You’re aware of them, you try to avoid them, but you still get hit from time to time.

The worst are overdraft fees (especially when they come in bunches at around $33 per bounce).

Good news is that it can be completely avoidable by setting up No-Fee Overdraft with Varo.

There are no monthly account service fees, no foreign transaction fees, and fee-free withdrawals at 55,000+ Allpoint® ATMs worldwide. Also, Varo lets you overdraft up to $50 without charging any overdraft fees! You can conveniently use the Varo Visa® debit card anywhere Visa debit cards are accepted — and the Zero Liability‡ guarantees you won’t be responsible for any unauthorized charges made.

When you open your Varo bank account, you can open a high yield savings account too. Start earning 1.61% Annual Percentage Yield (APY)* on your savings and then move up to 2.80% APY* based on qualifying activity. To put this in perspective, the national average APY is only 0.09%!***

In addition, get your paycheck up to 2 days earlier with direct deposit.^

This is the new way to bank and it takes less than 5 minutes to learn more and apply for free.

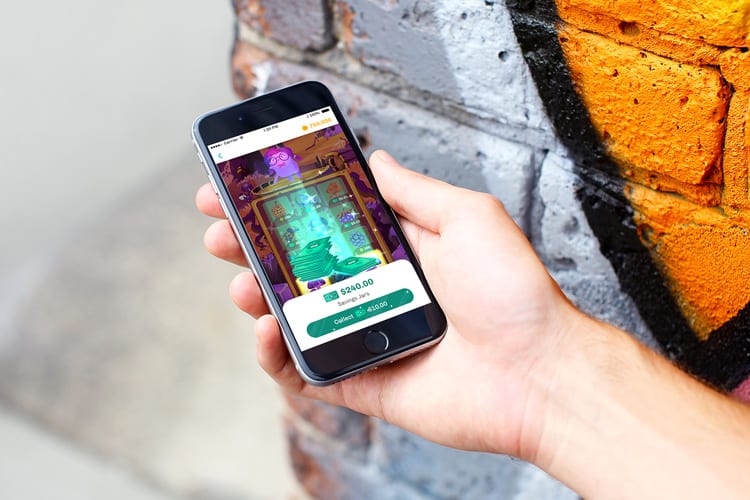

7. Play Games, Save Money, Win Cash. Saving is Actually Fun Now.

We know saving money is difficult, but it’s just one of those non-negotiables in life. 63% of Americans don’t even have enough to cover a $500 emergency. Yikes.

That’s why Long Game Savings is actually making saving fun by just playing free games on their app. Games are light and easy-to-play (think lotteries, scratchers, slots, and more) and you can win daily cash prizes up to $1M (yes, million) and crypto!

When you set up a savings account, you access the games. The more money you save, the more you can play and now, their new debit card lets you earn more rewards just by spending normally. It has a RoundUp feature that lets your purchases be rounded up to the nearest dollar with the change going towards your savings. So every time you’re buying a meal, getting stuff at Target, etc, you’re contributing to your savings and earning interest!

Long Game Savings is completely free-to-use as banks pay them, not you. There’s no way to lose money, but plenty of ways to earn and win! Plus you can withdraw your money at any time.

8. Buy Stuff Normally = Get Gift Cards You Actually Want

If you have room for 1 more app on your phone, then it needs to be this.

Actually, delete another app to make room for this one. It’s that good.

It’s called Drop, a free app that gives you gift cards on stuff you already buy from your favorite stores and brands.

Your everyday purchases from Amazon, Target, Trader Joe’s, and Walmart? You’ll get points for that. Points translate to gift cards so the more you collect, the more you can redeem!

The only thing you need to do is link any credit or debit card you usually use for buying stuff and that’s it! Drop will automatically recognize when you buy from your activated offers to reward.

There’s literally no downside to using this free app to get more gift cards. Use it on top of your loyalty points and credit card points for even more rewards!

LIMITED TIME OFFER: Use promo code SMARTWALLET to unlock 5,000 points ($5) automatically when you link your first card on Drop!

9. Always on the Go Means More Gift Cards for Your Wallet

You feel like you’re always on the go and that’s ok. Do errands, play with the kids, walk the pet, etc. Wherever you are, you’ll easily get compensated for just living your normal busy life.

Panel App is a loyalty incentive app that will give you points just by leaving the app running in the background. This is passive income at it’s best.

Because it gives you points on location, go ahead and enable location services. Then just turn the app on before you go about your day.

After testing it we think it’s a great (lazy) app that rewards you for doing almost nothing. If you’re still skeptical, know this:

- You don’t have to complete offers

- You don’t have to watch ads

- You don’t have to buy anything

- You don’t have to do anything but leave the app running

We snagged a $5 Amazon gift card via email after leaving the app on and forgetting about it. You can also choose VISA gift cards, MasterCard gift cards or sweepstakes entries.

Overall, a solid choice for earning a bit of money for literally just leaving the app running on your phone!

TIP: When you’re a new member, it’ll ask you if you want to keep the app running in the background. Just tap “Yes” to continue getting paid!

10. Skip Expensive Advisers and Start Investing With Just $1

If you feel a little clueless whenever there’s talk about investment portfolios, you’re not alone. It can sound overly complicated.

However, there’s an app that’s like an easy gateway to investing.

It’s called Stash, an investment app that only takes $1 to start and you’ll also get a $5 bonus after funding your first investment!

They offer thousands of investments which include stocks and Exchange Traded Funds. You’ll get to choose where to put your money based on things like your personal beliefs, interests, and goals. Their newest feature, Stock-Back™ rewards* lets you invest in brands you spend on with the Stash debit card.* Purchased something at Amazon? Earn Amazon stock rewards. It’s like cash back but with stock!

Finally, investing is no longer for the elite 1% with Stash helping to make it so easy for the rest of us.

11. Improve Your Credit Scores Instantly – And it’s Free

Having a low credit score can impact a lot in your life, like the ability to rent an apartment, get a car, and even a cellphone plan.

That’s why it’s important to maintain positive credit card payment history and to keep credit utilization ratio in check (not using more than 30% of your credit line on any credit card).

Regardless of what your score is currently at though, everyone can use a boost to their 3 digit number, and Experian® wants to help.

A new feature called Experian Boost™ can help instantly improve your credit scores for free.

Experian does this by adding your positive payment history from utility and telecom bills to your Experian credit file. This is huge, because previously, your gas, water, electricity, TV, internet, and phone bills that you already pay for didn’t affect your credit. Now it does and to your benefit of potentially increasing your credit scores!

It’s simple to start, and all you need is a free Experian Boost membership and a few minutes to connect read-only permission to the online bank accounts you use to pay bills. Experian will check only utility and telecom payments and get you credit for the payments you’ve already been paying.

This process doesn’t hurt your credit at all and you can choose to remove the boost if you want.

Compared to expensive and drawn out credit repair services, this new alternative is the fastest and no-cost way to instantly improve your credit scores.

*Results may vary, see website for details.

12. Buy Now, Pay Later to Make it Easier On Your Wallet

Layaway plans are back and better than ever, this time – they’re more high tech.

Say you want to buy that fancy blender for $200 but can’t fork it over all at once. Rather than charging your high-interest credit card, use QuadPay instead.

The QuadPay app lets you split any purchase anywhere (online & in-store) into 4 interest-free payments over 6 weeks. In this case, you’d be making 4 separate $50 payments for the blender which is much more manageable.

How does it work?

- Download and sign up for Quadpay. (No long forms, get instant approval, and no hard credit checks!)

- Browse the store directory or search for your favorite stores online.

- Choose “Pay with Quadpay” on the checkout page

- Enter the total purchase amount (inclusive of shipping and taxes)

- Complete your transaction and enjoy your purchase right away

Quadpay will automatically split your payments into 4 installments using your linked card. If you need to return an item, you’ll be refunded like normal.

Again – interest-free! If you’re late on a payment, it’s a $7 up-charge, and $14 if you’re still late after a week. How to avoid it? Just don’t be late.

13. Save Up To 50% On Your Weekly Groceries With One Single App

People coupon to cut costs, but it can be time-consuming and frustrating with all the different places to look for them.

An app is here to change that though. It’s easy grocery planning and couponing with Flipp, an app that has all your weekly local store ads and coupons in one place.

Use the app to create a shopping list by tapping on the digital ads and clip coupons that match with the items you need. Long gone are the days of having a list in one hand and a stack of coupons in the other; all you need now is your phone.

You can search by category, retailer, or item and then ‘clip’ the coupon or load to your store loyalty card – it’s that easy! Flipp also allows you to see trending nearby deals, so you never miss out on a chance to save a little extra dough. Additionally, you can set reminders for expiring clips to ensure you use them in time.

With 1,000+ weekly ads from local retailers and 100+ coupons from brands you love, Flipp has no shortage of saving options!

14. Cashing Out on The Everyday Things You Do Online

The average American spends 24 hours online a week(*), but for me, I know I definitely surpass that. If it’s the same for you, capitalize on all that online time by earning points you can redeem towards gift cards, and even better, cash.

You can do it with Swagbucks, a free rewards program for the everyday things you do online.

Earn points by:

- Watching entertaining videos

- Shopping at your favorite retailers

- Searching the web

- Participating in surveys

- Playing fun trivia games

Then you can redeem for a large variety of gift cards (Amazon, Target, Walmart, Starbucks are popular) or my favorite, Paypal Cash and Visa Gift Cards. Cash out in as little as $3!

You’ll even get a $5 bonus when you earn 2,500 SB points within your first 60 days. While you obviously won’t get rich doing this, you can nab an extra $10-$20 a month on them.

Keeping your profile updated and doing the Daily To-Do List will also earn you extra SB. There are a lot of opportunities so you can cash out early and often!

More Surveys, More Cash

When you have the downtime, there’s nothing easier than answering some questions in return for cash. If you want more surveys in your life, head over to MyPoints to sign up for free and similar to Swagbucks, you can participate in surveys, watch videos, and even read emails for points!

Points turn into gift cards from Amazon, Walmart, Starbucks, as well as PayPal Cash.

Get a $5 bonus when you complete your first 5 surveys!

15. Your Next New Favorite Beauty Subscription is Only $12 A Month

If you periodically feel like a mess, maybe it’s time to treat yourself with a beauty subscription that’ll make you feel pampered. Something to look forward to each month. And something that’s only for you.

So instead of spending money on full-size beauty products that you might not even like, check out IPSY.

IPSY is a monthly subscription service that includes 5 beauty items in a trendy makeup bag delivered directly to your door. Best part? It’s only $12 a month AND there’s free shipping.

On average, the items are valued at $45 or more. Additionally, it includes all the brands that beauty addicts know and love (MAC, Smashbox, Kiehl’s, Too Faced, and more) so you know you’re getting the products you’d probably buy anyway.

The products are also customized for you! During sign up, IPSY asks some beauty questions in a quick two-minute quiz that they use to personalize your beauty bag so you get the items you REALLY want.

Bonus: Get $1 Million in Life Insurance for as Little as $8/Month

When you hear “life insurance” the first 2 things that might come to mind are death and finances. Ultimately it’s “I love you” money to your family after you’ve passed away.

So for most people, life insurance is logical but the long process could be deterring. Some life insurance companies can take up to 2.5 months for the approval process to complete, including lots of paperwork and a comprehensive medical exam which may be inconvenient.

But one company is trying to change all that. Bestow’s mission is to offer affordable term life insurance in under 5 minutes without you having to talk to anyone. No exam needed either.

You can get up to $1 million in coverage and they offer 2 years, 10 years and 20 years term options.

All of Bestow’s policies are underwritten by North American Company for Life and Health Insurance®, who’s been around for over 100 years and holds an A+ (Superior) rating with A.M. Best, a global credit rating agency for insurance companies.

In plain English terms, it means your policy is provided by dependable insurance giants who have been serving customers for many years.

So if you’re between the ages of 21-54, here’s what they’ll ask:

- Your basic information (Name, Email, Address, SSN etc)

- Some Life questions (medical history, hobbies, lifestyle)

- Beneficiaries (who would receive the money after insured’s death)

- Policy and payment details (If approved, you choose the monthly payment and enter credit card info)

Each policy has a “free look” period (usually 30 days) which means you can cancel if it’s not right for you and get a full refund.

And you can easily change your policy at any time based on life events like marriage, job loss, divorce etc.

Life insurance talk isn’t fun but Bestow is attempting to make it as easy as possible for people to get covered quickly. Go ahead and see what your rates are in just under 5 minutes. It’s the biggest “I love you” you can give to your loved ones.

*Bestow is currently not available in New York

*Varo Annual Percentage Yield (APY) is accurate as of March 31, 2020. This rate is variable and may change. No minimum balance required to open account. Balance in Savings must be at least $0.01 to earn interest.

**Average ATM fee source: Bankrate

***0.09% national average APY: FDIC for the week of Feb 11, 2019 https://www.fdic.gov/regulations/resources/rates/#one

^Early access to direct deposit funds depends on timing of payer’s submission of deposits. We generally post such deposits on the day they are received which may be up to 2 days earlier than the payer’s scheduled payment date.

*Investment advisory services offered by Stash Investments LLC, an SEC-registered investment adviser. This material has been distributed for informational and educational purposes only and is not intended as investment, legal, accounting, or tax advice. Investing involves risk.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.