You Need A Budget Review – Budgeting Made Easy

If you struggle with budgeting, there have never been more tools available to help you get on track. One of the most popular is You Need A Budget, available for anyone to try because of its 34-day free trial.

We tested the platform for a few weeks to see how it worked, what it offered, and how effective it is at saving you money. If you’re looking for a hand with saving money, maybe You Need A Budget!

How Does YNAB Work?

The entire platform is super simple to use, and you’ll get an in-depth tutorial when you first log in. YNAB has a Quick Start guide that will walk you through all the basic features and perks of the service in a few minutes. What really sets YNAB apart is its view on budgeting. As opposed to other services that break down your past spending and show you areas to improve, YNAB focuses on the present and future.

As with any budget service, the first step is linking your bank account. Once you’re connected, YNAB will have you set a goal from the existing spending categories, or you can create your own. Your goal can be saving a set amount for vacation, paying off some level of debt, or simply building your savings. Whatever it is, YNAB is designed to get you thinking about priorities and problem-solving. What is it you want to accomplish with your budget, and how do you get there?

Now that you’ve picked a goal, you’ll get into the heart of YNAB. The platform prompts you to budget all of your available money for one thing or another. Start by tallying your immediate expenses – housing, food, water, electricity, etc. Then divvy up the money for other bills and payments, and whatever’s left can go toward goals, savings, or fun.

After each month, YNAB rolls over any unspent money into next month’s budget, showing you in real-time how you’re progressing. One downside of You Need A Budget is that it doesn’t automatically sort transactions. While all my spending is uploaded to the platform, I have to manually assign most purchases to spending categories.

How Much Can You Save?

According to the company, the average user saves $600 in their first two months with YNAB. Personally, I found that YNAB helped keep me aware and on top of my budget. Between having to review and categorize each transaction within the platform, and the emails YNAB sent me a few times per week, I felt more plugged into my spending than usual.

While I haven’t seen any significant savings in my first few weeks of testing (thanks, Christmas shopping), I certainly think I have a better grasp on my own habits. YNAB does also offer useful and simple-to-read reports on your spending, net worth, and income vs expenses that can really help you take control. The platform really gives you a comprehensive, holistic look at your finances without overwhelming or confusing you. That alone is extremely valuable when trying to save money.

Savings vary from user to user, and nobody can guarantee that you’ll save money, but YNAB puts the tools to succeed in your hands.

Is YNAB Worth Using?

Overall, the budgeting platform is very easy to use. My favorite feature is how easily I can move money from a category where I over-budgeted to one where I didn’t budget enough. The process helps me evaluate my spending in each area, while also adjusting my future expectations and tightening my overall budget.

YNAB consolidates all my spending and budgeting info in one spot and helps break down my categories in a way that allows me to prioritize goals. Even the layout of the platform makes you think about your spending decisions – on the budget page, my major expenses like credit card bills and rent at the top, while things like dining out and vacationing are toward the bottom.

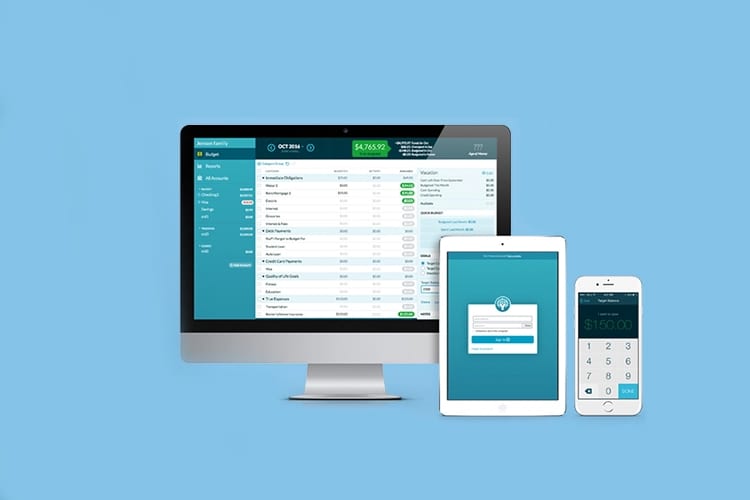

YNAB is also available on tons of devices. While I only used my laptop and phone, you can connect your Apple Watch, iPad, or Alexa to YNAB and have your budget at your fingertips at all times if needed.

After the 34-day trial, YNAB comes out to be $6.99 per month if you pick the yearly plan. If you go with the monthly plan, it’s $11.99 a month. While there are free alternatives, I’d recommend anyone to try the free trial and see if YNAB works for them. Their average user saves $6,000 in the first year, according to the webpage, so a small monthly fee isn’t much if you’re gaining valuable budgeting skills.

The Bottom Line

You Need A Budget is a great platform for anyone looking for help getting on top of their finances. While setting and maintaining a budget is still on you, YNAB can really help you visualize and prioritize your spending and saving.

While the platform may not have some of the bells and whistles of other budget apps, one of YNAB’s greatest strengths is its simplicity. It’s accessible to everyone and makes the mountain of budgeting feel a bit easier to climb.

Read More: People Love This Budgeting App That Figures Out Where You’re Wasting Money