How to Use the 50/30/20 Budgeting Rule

Budgeting is a challenge, and figuring out where to start is a real struggle for some savers. Luckily, you don’t need to start building your budget from scratch. There are plenty of pre-made budgeting rules and plans that can help anyone find a way to save more money. One of our favorites is the 50/30/20 plan, a simple but effective budgeting strategy to help you conquer your money woes.

Here’s how the 50/30/20 budgeting rule works and why you should incorporate it.

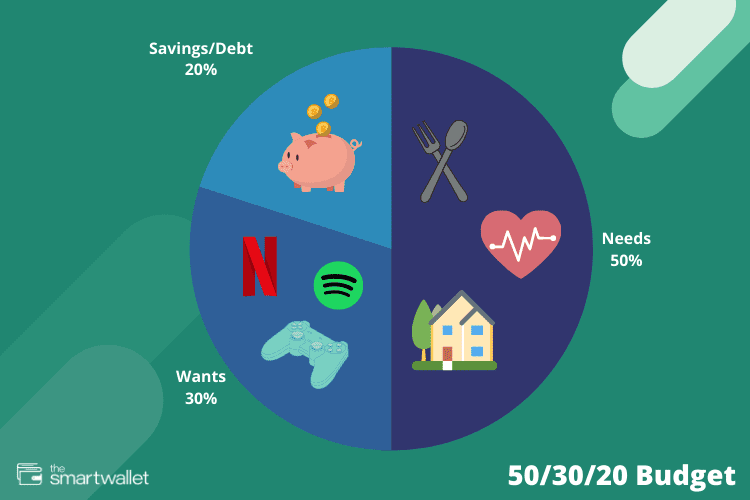

The 50/30/20 Rule

Before entering government, Sen. Elizabeth Warren (D-MA) was a professor at Harvard Law who, in 2005, published a book called “All Your Worth: The Ultimate Lifetime Money Plan.” In the book, Warren recommends budgeters split their money into three categories – needs, wants, and saving. Those categories, respectively, should get 50, 30, and 20 percent of your income.

Needs are pretty much everything you can’t live without or would be penalized for not paying – housing, groceries, utilities, etc. Naturally, these make up the bulk of your spending. Wants include any discretionary purchases – they may be nice to have, but you’d be fine without them. Think dining out, entertainment services, traveling, etc. The last 20 percent should go toward saving and/or paying off debt.

It’s an easy recipe for a useful budget. Applying the 50/30/20 rule forces you to stay on top of your spending, and take a closer look at where your money is going. First, by splitting your spending into needs and wants, you can immediately see if your budgeting priorities and spending habits are aligned. If they aren’t, the 50/30/20 rule provides a good baseline to shoot for when dividing your spending.

Following the 50/30/20 rule still allows you to pay yourself, too. Necessities are naturally prioritized, but even if you’re putting all your savings toward debt, you still have 30 percent to spend each month. Ideally, following this budget strategy will help you feel comfortable and stable in your finances, regardless of income level.

The budgeting strategy really is as simple as it seems. Let’s just say you make around $4,000 per month, so the 50/30/20 rule would set aside $2,000 for expenses, $1,200 for other spending, and $800 into savings.

Who Should Try This Budget?

Today, the average American saves less than 5 percent of their income. Adopting the 50/30/20 budget might force some serious changes in your habits, but these tweaks are designed to improve your overall financial health.

The 50/30/20 budget can be an effective tool for plenty of people, but particularly those who have never tried or succeeded at budgeting before. What makes the budget so successful is that it realigns your priorities to fit with your goals.

Assuming you’re picking up a budget because you want to spend less and save more, the 50/30/20 plan provides a handy framework to do exactly that. By forcing you to be more mindful of where you’re money is going – and what you’re doing with unspent funds – the budget can help you find financial comfort and stability.

It’s an easy budget to adapt over time, too. Even if your income level or total expenses change, you can easily tweak the budget to reflect the differences.

See Also: 7 Financial Advisors and Experts Share Their Best Money Tips

The Bottom Line on the 50/30/20 Budget

The single biggest drawback of the 50/30/20 rule is that for many, living off 50 percent of their income isn’t possible. A majority of people save little to nothing each year, largely because their expenses are too steep to set 20 percent of their money aside for savings reasonably.

However, it’s still a good baseline to shoot for to save more and spend less. Even if you’re currently living off an 80/10/10 budget, keeping the 50/30/20 as a goal can help you slowly build stability.