The Best Investing Apps for “Dummies” in 2022

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Money can get overwhelming but it really just comes down to the following: owing money, growing money, using money, or giving money away.

Let’s focus on the growing money part.

You should know by now that just saving money isn’t enough anymore. What you save today will lose value over time due to inflation. That’s why it’s so important to invest in addition to saving, and the earlier the better. You know you should start, but where to begin? What if you don’t have enough money?

To help we picked the best investment apps to start with, and you definitely don’t have to be rich to start. Both beginners and those looking to diversify their portfolios will benefit as it only takes $5 and under to invest. Also, people typically have multiple brokerage portfolios, so if you can’t decide on one, try out a few!

1. Forget Reddit Bros, Follow Real Investors Instead (+ Get Free Stock Worth Up to $300)

Reddit forums have a lot of stock hype and users going all in (and risking their money big-time).

Don’t listen to the hype and use Public instead, a social-investing app where you can own stocks for as little as $1, all commission-free.

You don’t have to have thousands of dollars to get a share of big companies like Apple, Peloton, Target, Uber, Tesla, etc.

What makes Public unique from other platforms is that you can follow real investors on the app (financial experts, entrepreneurs, celebrities, athletes, etc.) to get a first-hand look at what they’re investing in instead of going at it alone.

Public makes it easy for everyone to invest in the companies they believe in with no minimums, $0 commissions, and a robust community to gain knowledge from. Plus, get a free slice of stock worth $3 – 300 when you deposit funds!

2. Get $10 to Invest in the Legal Cannabis1 Industry. No Experience Necessary

Stash also lets you start investing with as little as $5. You can choose where to put your money, and they’ll provide guidance and tools to help. You can also invest in companies you regularly use to make a custom Personal Portfolio.

You can even invest in the legal cannabis industry which is big business as retail sales are projected to hit $70 BILLION by the end of 2028.*

Plus, with Stash Growth and Stash+, you can also choose the Smart Portfolio option which offers hands-off stress-free investing based on your risk tolerance.

It takes less than 2 minutes to get started and they’ll even give you $10 to start investing when you sign up and deposit $5 or more into your Personal Portfolio.

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

3. Get Free Stock Worth Up to $225

By now, you’ve probably heard of Robinhood, as it’s considered one of the easiest to use free trading apps that lets you trade stocks, ETFs, and options, along with cryptocurrency, commission-free! Like the others, you can just get started with $1.

Pictured above is Nick Gilmore from OH, who actually earned enough on the Robinhood app to purchase the car he’s always wanted. Living the dream!

When you sign up for Robinhood, you’ll get free stock worth $2.50 up to $225 for new members, with chances to get a high-value stock in Facebook, Microsoft, etc. You’ll even get access to 24/7 customer support!

4. Investing for People Who Don’t Have Time To Invest (+ Get Up to $85 Bonus!)

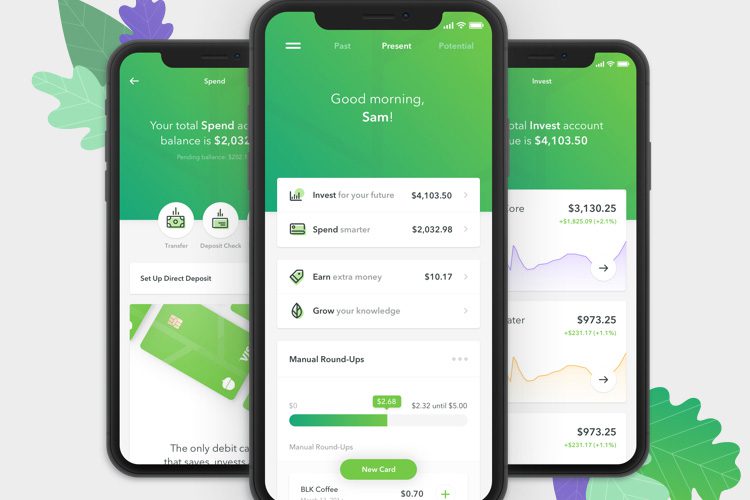

A regular checking account is basically like a waiting room for your money to enter or exit. But with Acorns Banking, you’ll get an account that does more, like automatically saving and investing for you! It’s perfect for those that don’t want to overthink (nor have the time).

You’ll get a metal tungsten debit card with your custom signature engraved and every time you make a purchase, the spare change gets invested into an expert-designed, diversified portfolio of stocks and bonds. When you make your first investment, you’ll get a $10 bonus!

AND get an additional $75 bonus when you set up a direct deposit to take a portion of each paycheck and automatically set it aside into your checking, investing, and retirement accounts.

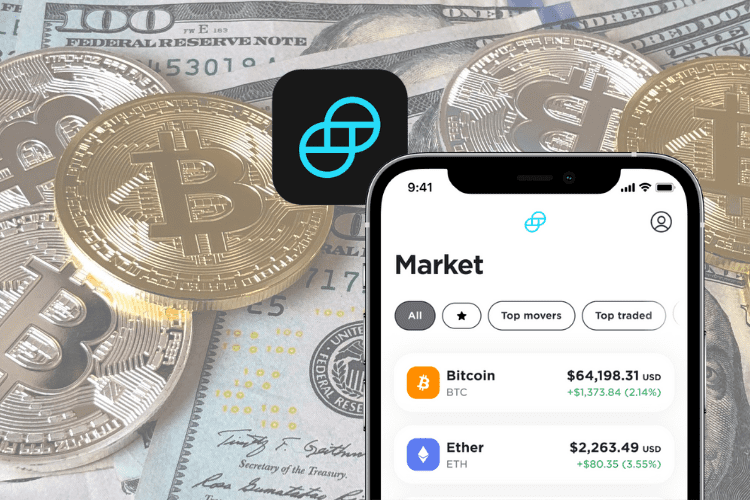

5. Easily Get Started with Crypto and Earn Up to 8.05% APY*

Crypto is all everyone’s talking about and it’s now even easier to get started with Gemini, a cryptocurrency exchange that lets you buy/store/sell bitcoin and crypto instantly.

They’re also the only exchange that lets you earn interest on your crypto (including stablecoins) by offering up to 8.05% APY on GUSD (Gemini Dollar). Put your crypto to work and select the ones you want to earn interest!

Start investing in crypto with as little as $5 and it only takes three minutes. Their own NFT gateway allows you to buy/sell NFTs to diversify your portfolio too. In addition, Gemini is the world’s first exchange to complete SOC 1 Type 2 and SOC 2 Type 2 exams which shows they’re extremely serious about security and compliance!

When You Need More Money:

All the investment apps we chose are easy and affordable to get into, but consistent depositing is key. When you find companies you believe in to invest, then regularly add to your portfolio on a monthly basis.

Here are some ways to make some extra money so you can invest!

Steady: Over 3 million people are already using this app to find extra income, and on average members make $5,500 a year more!

You can find thousands of new part-time opportunities daily. Once you link your bank account (it’s secure!), the app’s Income Tools feature will give you personal insights into the extra money you’re making too.

It only takes a few minutes to sign up for free so answer some work history questions & what type of job you’re looking for to see opportunities immediately!

Opinion Outpost: This survey company is free to join and they typically pay out $390,000 a month to their members just for completing surveys. Earn up to $5 for every survey you complete and there’s no limit!

This includes product tests (before items hit the shelf!), ad reviews (feedback on ads before launch), focus groups, and more.

Cash out starting at 50 points ($5) via PayPal or choose gift cards to Amazon, Target, Apple, and more. These are easy surveys with quick payouts, available 24/7, and you’ll help brands improve their products.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.

Not investment advice. Securities trading offered by Open to the Public Investing, Inc., member FINRA & SIPC. Cryptocurrency trading offered by Apex Crypto LLC. Mark up on crypto applies. Free stock offer for new customers only. Full terms and conditions at www.public.com/disclosures. Investing involves risk.

Investment advisory services offered by Stash Investments LLC, an SEC registered investment adviser. Investing involves risk and investments may lose value.

Promotion offer is subject to Terms and Conditions. *T&Cs.** You must complete within the specific time period included in this offer: (i) successfully complete (or already have completed, or re-apply for and complete) the registration process of opening an individual taxable brokerage account (“Personal Portfolio”), (ii) link a funding source to your account; AND (iii) deposit at least $5 from your funding source into your Personal Portfolio. *T&Cs

Stash Growth Plan starts at $3/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

A “Smart Portfolio” is a Discretionary Managed account whereby Stash has full authority to manage. “Smart” is only available in Growth ($3) and/or premium ($9). Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Stash does not guarantee any level of performance or that any client will avoid losses in the client’s account.

A “Personal Portfolio:” You can choose your own investments only in a “Personal Portfolio” which is a Non-Discretionary Managed account.

1Stash does not endorse the illegal use of narcotics.

*The Smart Wallet is a paid affiliate partner of Robinhood