Chime Review: No Monthly Fees, Early Payday^ Feature, and A Better Way to Build Credit

Banking is necessary, but fees like maintenance, overdraft fees, and fine print can complicate it.

Traditional banks charged $6.1 billion in overdraft fees alone in the first three-quarters of 2023.#

Skip all the monthly fees, get an early payday,^ and consider Chime® instead.

What is Chime® and How Does it Work?

Chime is an award-winning mobile financial app and debit card. It has an FDIC-insured online account with:

- No monthly fees or minimum balance

- Early payday – Get paid up to 2 days early with direct deposit1

- Earn 2.00% Annual Percentage Yield (APY)2 with the high-yield Chime Savings Account3

- 60,000+ fee-free ATMs~ at stores you love, like Walgreens®, CVS®, and 7-Eleven®

- A Chime Visa® Debit Card with instant transaction notifications & ability to block the card when needed via the app

- Access to apply for the Secured Chime Credit Builder Visa® Credit Card4 for a better way to build credit history

Bonus for Tax season: Get your federal tax refund up to 5 days1 earlier when you file directly with the IRS and direct deposit through Chime!

Its mission revolves around protecting customers by giving them peace of mind and never profiting from their misfortune or mistakes (hence, no monthly fees).

They also have an award-winning financial app with over 300,000+ five-star reviews, which allows you to easily track your daily transactions and balance.

Chime also offers P2P, so if you need to divvy up the money for food, etc., you can send money for free to your family and friends through Chime, even if they don’t have the app yet!

With no monthly fees, minimum balance requirements, or foreign transaction fees, Chime makes it easy to switch.

- Get your paycheck via direct deposit up to 2 days earlier^

- No monthly fees or minimum balance

- Earn 2.00% APY1 with high-yield Chime Savings Account3

- 60,000 fee-free~ ATMs nationwide

- Chime’s SpotMe® feature will spot eligible members up to $200*

- Automatic savings tools

- No personal checks, but Chime can send them on your behalf

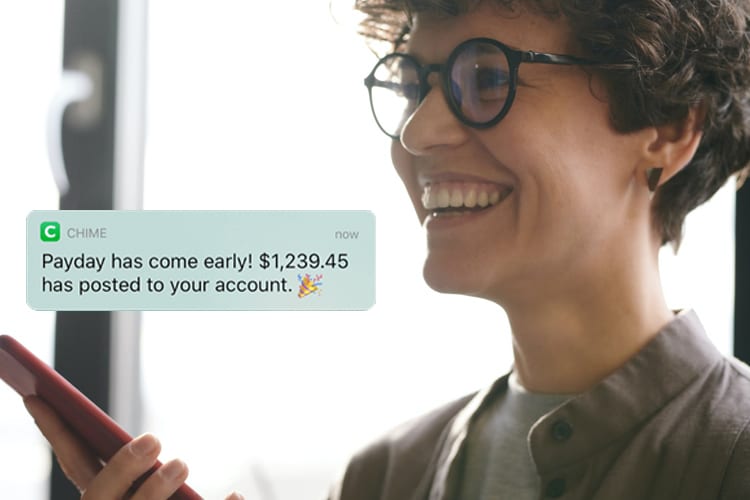

Get Your Paycheck Up to 2 Days Early with Direct Deposit^

One of Chime’s most loved features is that you can get your paycheck up to 2 days early^ when you set up direct deposit through Chime. That’s up to two more days to think about how you want to spend, save, or pay off the bills!

“Chime is amazing! The SpotMe* feature has helped me with paying my insurance bill that could not be postponed. Without this feature my insurance would have been cancelled. In addition using this I was not charged excessive overdraft fees that most banks charge. Thank you Chime for this feature! 💚💚” – Real member, sponsored content

So, for instance, if your payday usually falls on a Friday, you could get paid on Wednesday instead. Direct deposit is just faster, and you don’t have to worry about paychecks getting lost in the mail.

Start Building Credit for Free with the Chime Secured Credit Builder Visa® Credit Card

Your Chime Checking Account works with Credit Builder, a valuable free option for members that want to build their credit easily and safely.4 There’s also no credit check to apply.

It works like this:

- Move: Move money from your Chime Checking Account to your Credit Builder secured account. This is the money you can spend on your Chime Secured Credit Builder Visa® Credit Card.

- Spend: Use your Credit Builder card anywhere Visa® is accepted. Your everyday purchases and regular on-time payments4 will work towards building your credit with no annual fees and no interest.

- Build: The money that lives in your Credit Builder account will automatically be used to pay your monthly balance on time when you turn on the optional Safer Credit Building feature4. Chime reports your payments to the three major bureaus. Positive payment history can help build up your credit!

Moving money is instant; you’ll always know how much is in your secured Credit Builder account. Using this method to build up your credit history is extremely valuable!

Tired of Overdraft Fees?

Avoid the hassle of being at the checkout and realizing you don’t have enough money to swipe on your debit card. Instead of returning your item, Chime’s SpotMe® feature will spot eligible members up to $200* so you can continue your purchase.

At Chime, they do things differently. Instead of charging you an overdraft fee, they allow you to overdraft up to $200 with no fees.*

With SpotMe®, when your next deposit arrives in your Chime Checking Account, they will apply it to your negative balance, making this a simple and hands-off process.

Grow Your Savings with 2.00% APY1 and Built-In Features

If you aren’t great at saving money but know you need to get your act together, Chime makes that easy, too, with their optional Savings Account.6 They have automatic savings tools that allow you to be smart with your money with minimal effort.

- Competitive Savings: Their newest feature gives other banks a run for their money as they now offer a competitive 2.00% APY1 for your savings. This will let you earn more money on your money as that’s more than 9X2 the national average!

- Save when you spend: This optional feature rounds up each debit card transaction to the nearest dollar and automatically deposits into your savings account. The spare change adds up!

- Automatic Transfer: Save your paycheck on autopilot. You can automatically save 10% of your paycheck in your optional Chime Savings Account with a single setting.

How Chime Makes Money

Traditional banks make money by charging their customers overdraft, monthly maintenance, transfer, and account maintenance fees.

Chime doesn’t profit from your account(s) in the way of fees. Rather, Visa collects an interchange fee from the merchant every time you swipe or run your Chime Visa Debit Card. Visa then pays Chime a portion of this fee. That money adds up over time, enabling Chime to run smoothly without charging fees to customers like you. Chime also receives monetary compensation from out-of-network ATM charges.

Can You Trust Chime?

Chime is FDIC insured up to $250,000 via their banking partners, The Bancorp Bank or Stride Bank, N.A.

Chime also has 128-bit AES encryption, access control, and security processes to ensure your money is always safe. They will text whenever your debit card is used to ensure there is no fraudulent spending when you turn on alerts. Debit cards are also protected by Visa’s Zero Liability Policy◆, which states that you won’t be held responsible for unauthorized charges made to your account.

You’ll also be able to block your card and order a replacement debit card from within the Chime app.

Is Chime for You?

If you’re sick of fees and complicated processes to open and close accounts, you should consider signing up through Chime for free. Utilizing their free Credit Builder credit card is also an easy way to start building up credit by using everyday purchases to generate positive on-time payments5. This leads to a positive credit history!

Chime’s 2.00% APY1 puts your money in an optional high-yield savings account. You won’t be charged a fee for overdrafts with their SpotMe* feature. And getting paid up to 2 days earlier^ puts you ahead too!

Signing up for an account takes only a few minutes and has zero impact on your credit score.

Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank N.A. or Stride Bank, N.A.; Members FDIC. The secured Credit Builder card issued by Stride Bank, N.A.

Chime received the highest 2022 Qualtrics® NPS score.

*Chime SpotMe is an optional service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member’s Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime’s discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won’t cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Conditions.

1 Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

2 The Annual Percentage Yield (“APY”) is variable and may change at any time. The disclosed APY is accurate as of May 22, 2023. No minimum balance required. Must have $0.01 in savings to earn interest.

3Chime Checking Account is required to be eligible for a Savings Account

4To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

Banking services and debit card provided by The Bancorp Bank N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

The secured Chime Credit Builder Visa® Credit Card is issued by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. Please see the back of your card for its issuing bank.

* Eligibility requirements and overdraft limits apply.

˜ Get fee-free transactions at any Moneypass ATM in a 7-Eleven location and at any Allpoint or Visa Plus Alliance ATM. Otherwise, out-of-network ATM withdrawal fees may apply