13 Simple (and Legal) Ways that Help Millennials Pay Rent

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

No matter your level of adulting, there’s an invisible line that should be avoided. And that’s the “move-back-in-with-your-parents-cause-you’re-outta-money” line.

For real though, you don’t want to resort to that.

Even if you have the best relationship in the world with them, it’s not your own space.

They probably also have a knack for saying stuff that really riles you up, or is that just my own immigrant parents? (“Don’t eat so late, you’re gonna get fat,” “You’re throwing this away? Why? I’ll save it for later.”)

So to avoid that situation altogether, let’s make rent. Regularly.

Of course, you’ll still need a full-time job on your own. But to give you some extra cushion though, you can check out these simple ways to make rent.

1. A Legit Way to Earn $750 This Week

You can get $750 direct deposited into your bank account and all you have to do is try out some deals. The catch? You can only do this once a year!

Seriously, anyone 18+ can participate in Flash Rewards, a rewards program that’s been around since 2016 and has rewarded $12 million to participants over time.

So how do you get the money? Answer: You just have to follow the instructions carefully!

Flash Rewards work by showing you “deals” they think you would like. This includes mobile apps and games, subscriptions, financial services, etc. Each type of deal you choose has its own mini task to complete.

- Head over to Flash Rewards and fill out basic info (Email, Name, etc.)

- Take a quick Survey (it helps figure out the optional offers & required deals to recommend)

- Complete deals by shopping Flash Rewards’ great brand name partners.

- Important: Follow the instructions on completing the specific number of deals for each level and get to Level 5 to get the maximum reward! (there are plenty of deals to try – some are free trials or app downloads, others require a purchase!)

- Claim the reward and get it in about a week!

You won’t get your reward if you don’t complete the required amount of deals. Sure, it takes a little more effort but it’s legit. Get your $750!

2. Get Up to $55 Per Win Popping Bubbles

Make consistent extra money playing Bubble Cash, where you match 3 bubbles of the same color until you clear the board. It’s popular, too, since the game is frequently ranked within the Top 10 in the App Store with a 4.6/5 star rating with over 120K+ reviews!

Win free cash when you collect enough gems to enter practice tournaments, and then win MORE when you enter the higher stakes tournaments (there’s a small entry fee for the bigger tournaments).

“Finally, a game that isn’t a scam! I won $71 yesterday on Sunday, and today on Monday, it was already in my Paypal” – Mzmari

Play for free now, and then switch to cash games to increase your winnings whenever you want. Obviously, this won’t make you rich, but 100% worth it compared to other games that don’t pay.

3. Earn Up to $750 Trying Out Offers

Try out offers and get rewarded. That’s the gist of Earn Big Rewards, a fun program where you can earn up to $750 (or even $1,000 if you’re ambitious) just by checking out sponsored offers from their partners.

Over 1 million members have gone through and got their rewards, and you can too! It’s simple.

Offers and deals vary, but the most important thing to know is that different levels have different rewards. Lower levels yield smaller rewards, while Level 5 will get you $500, $750, or $1,000.

You’ll be able to choose from mobile games, free trials, subscriptions, streaming services, and more after answering some quick questions.

Once you complete the levels you want, you can cash out and get the reward in a week!

4. Get Paid Up to $225/Month While Watching Viral Videos and Taking Fun Surveys

Founded in 2000, Inbox Dollars has been paying customers for their opinions for over 24 years and counting! They are one of the most trusted survey sites with fun, multiple ways to earn extra cash that set them apart.

“Fast and easy. Love that I can cash out to my PayPal and easily transfer money to my bank account.” – Tefanie P

Take surveys, watch videos, play games, and even read emails for extra cash. Who wouldn’t want to watch viral videos for money and get paid up to $225/month?

Inbox Dollars is a great platform to make a little side money. It’s free to sign up, so give it a try today!

5. Get $35,000 Worth of Debt Paid Regardless of Your Credit

Owe $35,000 or less on credit cards? Find a personal loan using MyLendingWallet to pay off all your balances and consolidate them into one balance to make it easier on yourself.

It takes 2 minutes to find loans regardless of your credit status, with APRs from 5.99% up to 36% max. Their network has over 100 vetted lenders, and you’ll be able to compare side-by-side with no obligation quickly.

There’s no credit score impact by checking and the repayment periods are flexible, ranging from 61 days to 72 months (6 years). Plus, you can get the funds as fast as 24 hours!

6. How to Earn Up To $120 or More Without Stress!

Earn extra cash by playing popular mobile games, taking surveys, watching videos, referring friends and family, and more! KashKick is free to use, and sign-up is super easy.

KashKick also pays you to refer friends and family, and you can earn a 25% Bonus off any offers your friends and family complete! (If your referral earns $100, you earn $25!)

“Kashkick saved my life! I lost my job, and thanks to KashKick, I get a little side income to pay a couple of bills.” – Shanice, New Orleans.

Find a new side hustle through this app and check daily to make that money wherever you are.

7. Get Free Money Back on All Your Shopping Hauls

Check your pockets; check your purse. And keep receipts for your iPhone.

Just grab all your recent receipts from your coffee runs, grocery trips, restaurants, and gas station fill-ups, scan them into Fetch Rewards on iOS, and earn points for free money! Connect your email account, as well, to count DIGITAL receipts from Amazon, Instacart, and more.

Basically, snap a pic of your receipt from anywhere, and that’s it; you’ve got points for money. There’s no minimum spend, no need to select items manually, scan in any receipt from any store or gas station, and it’ll automatically reward you.

It’s free and easy to use and is a must-have iOS app for anyone who buys stuff!

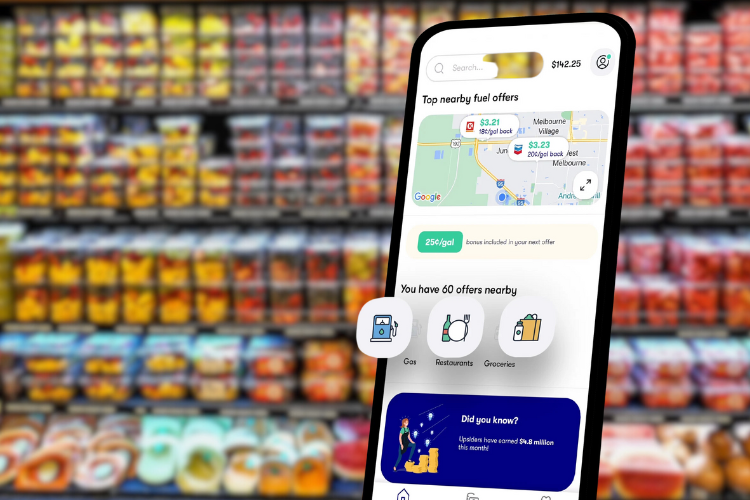

8. Get Free Cash Back Every Time You Get Groceries, Gas, or Meals

Why not get free money back any chance you can get? That’s why we like Upside, a free cash back app that partners with 100,000+ businesses to bring you great offers you can’t get anywhere else.

On average, frequent users earn an extra $340 a year for just getting things they already buy!

“Easy money back without a catch. I’m getting cash back on stuff I would’ve had to buy anyway. Upside gives you easy savings that you actually see!” – alicejpark90

Wherever you are, just use the app to see where you can get cash back! You can get up to 25¢ per gallon, up to 30% back on groceries, and up to 45% back at restaurants.

Easily cash out via bank transfer, Paypal, or gift card; there’s no limit to how much you can earn. Download Upside for free to earn cash back, and new members can use a welcome code: TSW25 to get an additional 25¢ a gallon on their first gas purchase!

Gas offers are not currently available in NJ, WI, or UT.

9. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

10. This Company Pays Up to $5 for Every Survey You Complete

Getting paid for your opinions isn’t new and won’t make you rich, but it’s extra money that you otherwise wouldn’t have.

Sign up for Opinion Outpost (it’s free to join!), where they typically pay out $390K a month to their members just for completing surveys, including product tests (before items hit the shelf!), ad reviews (feedback on ads before launch), focus groups, and more. Earn up to $5 for every survey you complete and there’s no limit to how many you can take!

Important: Be sure to verify your email address so you can start earning!

Cash out starting at 50 points ($5) via PayPal or choose gift cards to Amazon, Target, Apple, and more. These are easy surveys with quick payouts, available 24/7, and you’ll help brands improve their products. Join the 25 million members worldwide already earning extra cash for free since 1998!

11. When It’s 2024, and You Still Have Credit Card Debt Under $100,000

Stop the anxiety attacks by getting rid of your debt. If you owe $100,000 or less, AmONE can help by matching you with a low-interest loan to pay off all your balances. Problem solved.

Their interest rates start at just 6.40% compared to credit cards, which can go as high as 36%! Plus, it’s only one monthly bill, making it way easier to manage.

There’s also no credit score impact to check, and repayment periods are flexible. Take 2 minutes to check, and you can get funds as quickly as 48 hours to wipe that credit card debt!

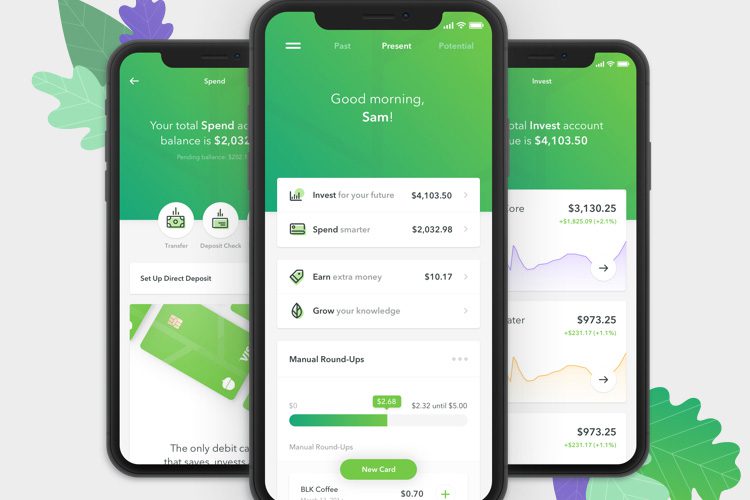

12. The Money App Backed by Celebrities That Saves AND Invests for You

Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

That’s because Acorns automatically saves and invests your spare change from every purchase with the Round-Ups® feature. You’ll get a diversified portfolio picked by experts based on your investment profile.

You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

Get started in under 5 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more based on your subscription plan.

With no hidden fees, Acorns makes it easy to invest in your future with your spare change!

BONUS: Earn $20 Per Hour to Start Teaching English To Kids Online Working From Home

If you’ve been considering a side gig to supplement your primary income or love the idea of working from home, consider teaching English online to kids ages 6-10!

EF Online (Education First) is a teaching platform helping to connect students in China and native English speakers for over 20 years now. It’s a flexible schedule where you can work from home, earn up to $20/hr to start, and all lesson materials are provided.

Here are the requirements:

- Must be a native English speaker living in the U.S.A or UK

- Bachelor’s degree in any field

- By the start of your teacher’s contract term, you must earn and submit documentation of a 40 Hour TEFL (Teaching English as a Foreign Language) certification (or higher)

- Agree to an online background check (no cost to you)

- Be available to work during set hours

- Have a solid wifi connection and headset

- And lastly, be passionate!

Classes are 25 minutes each and they encourage repeat classes, so you might be teaching the same students regularly. In addition, their parents can book you up to 6 months in advance leading to a more stable income.

If you enjoy interacting with kids, this is definitely a rewarding and flexible gig from home!

BONUS 2: Pay Less on Student Loans. Get More Out of Life.

If you feel bogged down by student loans, you’re not alone. 44.7 million Americans have student loan debt, making the total student loan debt in the United States above $1.47 trillion dollars(*). However, there are options to ease that financial burden.

One way is to refinance your student loans (whether they’re federal, private, or ParentPLUS), consolidating that debt at a lower interest rate.

Credible’s made that part easy. Their loan marketplace helps you find prequalified rates from multiple lenders in just 2 minutes.

They can help you find options to lower your interest rate, reduce your monthly payment, or both! To see your options, just fill out a quick information sheet and compare your prequalified rates – without impacting your credit score. You can even get your finalized offer in as little as one business day.

There are no prepayment penalties, loan application fees, or origination fees through Credible’s lending partners, and the marketplace is free to use!