23 Money-Making Tips for Your Financially Challenged SO

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

If your significant other’s five-year plan is just to make it through 2020, there’s some validity to that line of thinking. But obviously there are other factors that should come into play. Especially finances, since that’s always going to be in the picture.

Having a stable primary job is first and foremost a priority. However, with COVID-19, that’s tough since that affects everyone quite differently. Maybe hours are reduced, or even worse, no longer available. So if your SO needs a little help in finding some creative money-making tips, share this list with them, especially if they’re not that hot in the financial department, to begin with.

To be clear, most of the suggestions below are meant for making side cash. This wouldn’t take the place of a full-time job. During this time, every little bit helps though, and having some fun, can release the everyday stress we’re all going through.

1. Earn a $10 Amazon Gift Card by Trying New Games

When you’re ready to add even more games to your lineup, then download Cash Giraffe, an Android app that pays you to try out new games for, yes, you guessed it, cash. All are free to download!

Just earn coins from trying new games, and then you can redeem them for:

- PayPal Cash

- Amazon gift card

- GameStop gift card

- PlayStation Store gift card

- Xbox Live gift card

- And more good stuff

“Payouts are faster than most apps. PayPal rewards are small, but hey, it’s free money 💰 🤑“- Cassandra McGuire

A 3,599 coin welcome bonus is yours immediately too, when you sign in! Plus, get 200 coins for every friend you refer and 25% of their earnings.

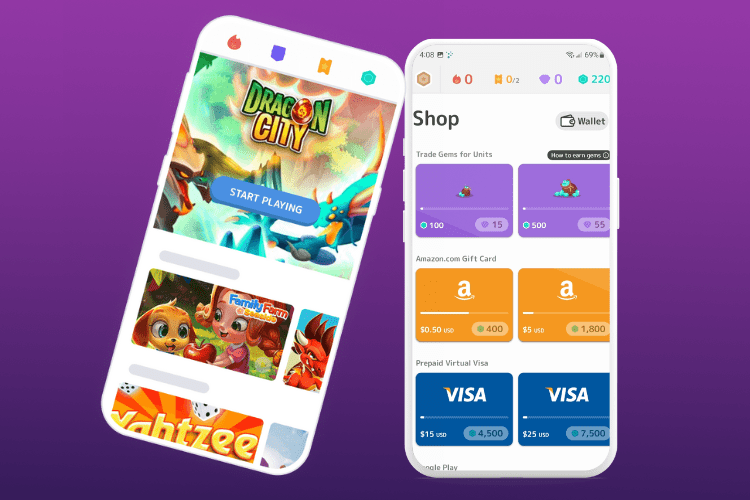

2. Play New Games and Earn Branded Gift Cards

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!

3. Spin to Win - Earn Coins to Build Adventurous Villages (And Raid Others)

Note: You can’t make any money off this game but we’re adding it in just because it’s fun and a good way to distract yourself when you want to.

Coin Master is a free casual game that’s amassed over 81 million downloads and has earned the rep of being one of the most interactive games on the market.

Spin to earn coins, chances to raid other villages, and build up your own village to move to the next level. There are over 200 uniquely themed villages to build including Steampunk Land, LA Dreams, Magical Forest, Hell’s Village, and more. Pets can also be raised to help you get more coins.

When you need a little break from the real world, head into Coin Master to play for free!

4.

5.

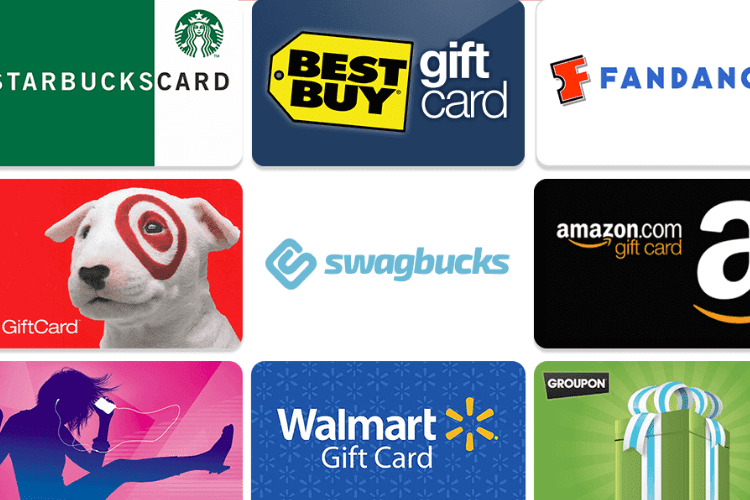

6. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

7. Empower Yourself Financially, Especially for Women

Whether you think about it or not, there are important realities in a women’s life.

Gender pay gaps where women make less than men, career breaks where women’s earnings drop significantly after having a child,(*) and longer than average lifespan meaning women need more money to live.

That’s why it’s vital to save for retirement and invest, especially if you’re female and why

Ellevest exists, an investment service and money membership created by and designed for women.

Men and those that identify as non-binary are welcome to join as well but it’s the first company to take on women’s unique set of obstacles when constructing an investment portfolio.

With affordable flat monthly fees starting at $1 and maxing at $9, you can be sure that your financial health is taken care of with personalized retirement planning (Plus and Executive memberships), investments with no asset management fees outside of your membership fee, and discounted sessions with career coaches and financial planners. Membership also includes an Ellevest debit card,* which gives you the option to round up spare change to help you save further** as well as unlimited ATM fee refunds.***

With the current world events, it’s even more important to make sure that your “future you” will be comfortable, so take advantage of the first free month and see how it can help you.

8. Save Time (And Money) By Unsubbing From Marketing Email

When the “unread” number in your email inbox is growing by the day, it’s time to wrangle it in.

There’s no doubt that our inboxes get slammed with a lot of marketing emails. And now, every corporation that we’ve ever given our emails to is expressing how they’re handling COVID-19.

Instead of wasting time unsubscribing one by one, just use Unroll.me, a free service designed to help clean your inbox by displaying all the email subscriptions you have in less than a minute.

You then have the following options to: Keep in Inbox, Unsubscribe, or Add to Rollup.

“Add to Rollup” is like a summary of the emails you might want to look at but don’t immediately have time for. Think of it as a daily, weekly, or monthly digest (you choose) of all the subscriptions you picked to be contained in one convenient, scrollable email (like a newsfeed).

It ignores all your personal emails and only looks at the commercial emails so

save time and money by getting rid of marketing emails.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.