10 Money Moves to Make in 2021

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Your priorities may feel like they’ve shifted, especially after the “year that shall not be named,” but one thing always stays constant.

Money.

Even if you feel like you’ve saved a lot of money by not going out as much, having that cushion will make any unforeseen future less scary. And if you spent too much last year, well, let’s get things back on track.

We’ve rounded up the following money moves that will help give your finances some diversity. The best part is how easy it is to get started!

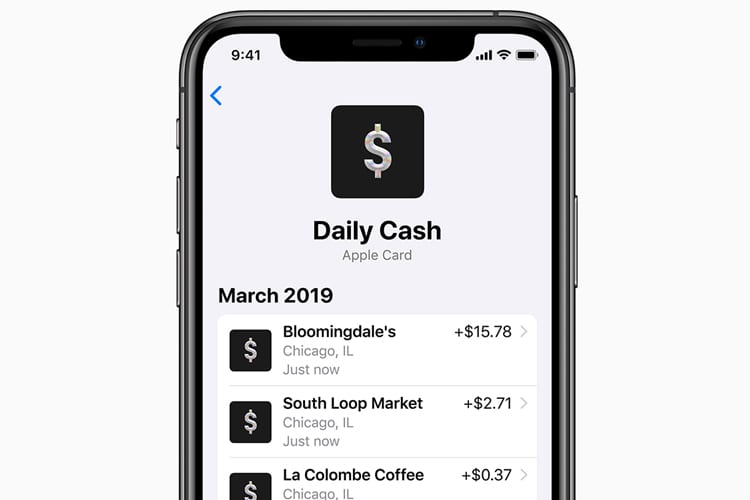

1. iPhone Users Get Unlimited Daily Cash - Here’s How

If your credit card roster needs a boost, consider the Apple Card.

Upon approval, you’ll get a sleek titanium white Apple Card issued by Goldman Sachs that has NO fees (not even late fees!) as you’ll only be responsible for the interest charged to your balance. Plus, perks like unlimited daily cash and extra security features that only the iPhone can provide.

Earn from these cash back categories:

- 3% on all types of Apple purchases (includes in-app purchases, games, services, etc.)

- 3% on a growing list of merchants that include T-Mobile, Uber Eats, Duane Reade, Panera Bread, and more

- 2% on basically everything else you use Apple Pay for in-store or online

- 1% when you use the physical card if the retailer doesn’t accept Apple Pay

You’ll earn the Daily Cash immediately which can be used right away or saved. Unlike other credit card rewards, Apple Cash doesn’t expire!

And since the Apple Card lives in your Apple Pay wallet, it’s extra security built-in as a potential phone thief would have to go through Face ID or Touch ID in order to purchase anything.