Public.com Review: Invest in Some of the Hottest Stocks in America

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Public.com believes that everyone should be able to own a piece of any public company that they want. Investing is no longer just for financial experts, advisors, or people with a lot of money. Because with Public.com, you can do it starting with just $1.

- No account minimums

- Ability to buy fractional shares

- Commission-free trading

- Active and transparent investment community to learn from

- Mobile phone account access only

- Only stocks and ETFs from major exchanges available

- No retirement or joint accounts

How Public.com Works

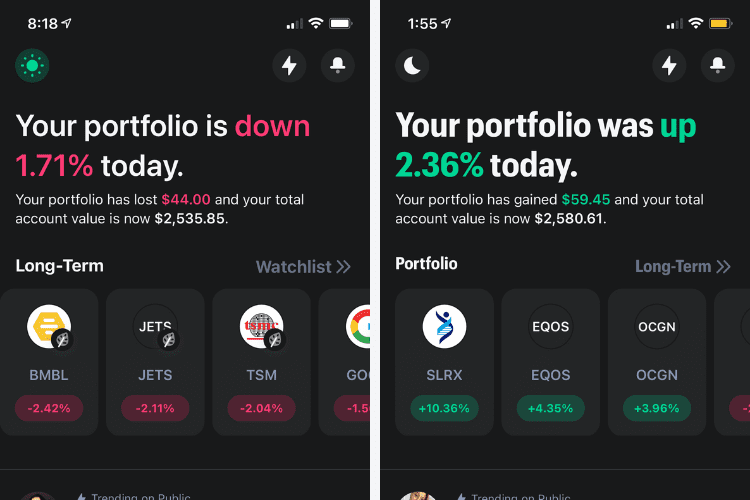

Public.com members (it’s free to sign up) can invest in many public companies with fractional shares of stocks and ETFs (Exchange-Traded Funds). No matter the full share price, you could own slices of stock.

For example, Tesla is currently at $742 a share (at the time of this writing), and if you don’t want to purchase the full share, you can put in whatever amount you’re comfortable with, even if it’s $1.

Trading is also commission-free.* Whenever you want to sell or trade any stock you own, you can do it without any fees.* There are also no account minimums, no account maintenance fees, or monthly service fees.

Why Public.com Might Be Worth Your Time

While there are similar investment apps on the market, Public.com combines the best of both worlds because members can real-time trade/sell stocks commission-free* and buy fractional shares/slices into any public company.

Members can buy fractional shares of popular companies without spending thousands of dollars.

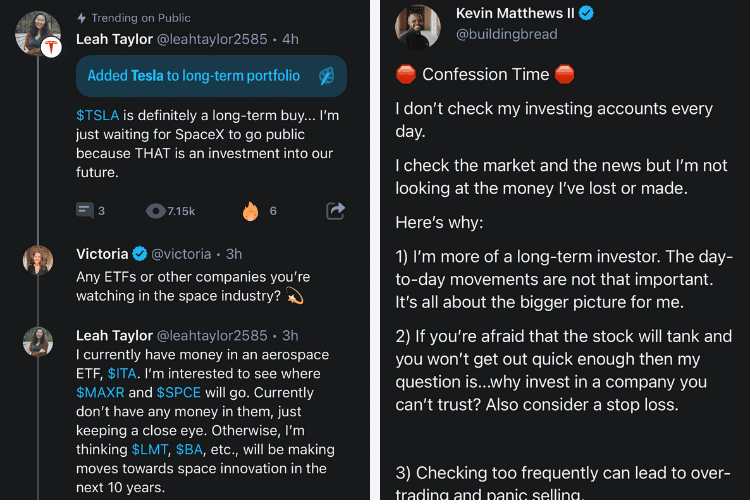

Members that join Public.com are also embraced into the highly active community as well. The strong social aspect lets you follow industry experts, friends, celebrities, etc. to see what they’re buying/selling in the social feed. This type of transparency opens up discussion and the sharing of knowledge/opinions helps each other grow rather than “going at it alone.”

This is great for those new to investing and an opportunity for veterans to share their thoughts.

While you shouldn’t view it as concrete investment advice, it’s a starting point for you to learn more and a step to take fear and confusion out of investing.

How to Get Started on Public.com

Creating an account on Public.com is free and straightforward.

- Download the Public.com app

- Follow the on-screen instructions (it’ll aim to get a sense of what your interests are, how comfortable you are with investing, etc)

- Link a bank account (This is where your money will be transferred or deposited from)

- Start exploring!

You can easily see what industry experts’ portfolios look like, read up on the news in-app, and start investing on the same day.

How Does Public.com Make Money?

To differentiate itself from other well-known apps and to provide transparency for its members, Public.com announced on February 16, 2021, that they were officially PFOF-free. Short for “payment for order flow,” it’s a common revenue generator for fee-free broker apps to receive small payments (or rebates) for directing their clients’ orders to specific market makers.

PFOF can be controversial, as it can create conflicts of interest, but it is legal as long as it’s properly disclosed and updated quarterly. However, Public.com did away with PFOF to align with their customer’s best interests and switched to an optional tipping feature.

When members make any trade, they have the option to “tip” Public.com. The amount can vary by the dollar value of your order and is pre-set by the app.

Public.com also makes money from securities lending (which doesn’t affect members’ experience), and interest from uninvested cash balances at 0.2%.

Is Public.com Legit & Safe?

Short answer: Yes.

Public.com is insured by the SIPC (Securities Investor Protection Corporation) up to $500,000 per account. They also use Bank-Grade security with AES 128-bit encryption and TLS 1.2 to secure data in transit.

How to Get Free Stock

The bigger the community, the more active it’ll be to learn from each other’s successes and mistakes, so Public.com offers referral bonuses.

Invite friends and both of you will receive a free fractional share of stock from a company of your choice (options will vary) up to $20 upon approval. It’s potentially a good way to diversify your portfolio without using your own money.

Final Thoughts

If you want to invest in the companies that matter to you the most, commission-free*, and get access to a helpful community, Public.com is absolutely worth a download to check it out. When you can purchase slices, you can invest in well-known companies without a lot of money upfront!

The Smart Wallet is a paid marketing affiliate of Public.com.

*Offer valid for U.S. residents 18+ and subject to account approval. There may be other fees associated with trading. See Public.com/disclosures/

*Photo credit: Cait Brice | The Smart Wallet