13 Ways to Rack Up $1,500 Before Halloween

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

An extra $1,500 would really help out a lot right? After bills and rent, it just doesn’t seem like our accounts are left with much each month.

So before your numbers get even more in the red, check out some options below to help make it easier on yourself. Save and make enough to get the essentials taken care of so that you might have some leftover for the fun stuff, just in time for Halloween!

1. A Legit Way to Earn $750 This Week

You can get $750 direct deposited into your bank account and all you have to do is try out some deals. The catch? You can only do this once a year!

Seriously, anyone 18+ can participate in Flash Rewards, a rewards program that’s been around since 2016 and has rewarded $11 million to members over time.

So how do you get the money? Answer: You just have to follow the instructions carefully!

Flash Rewards work by showing you “deals” they think you would like. This includes mobile apps and games, subscriptions, financial services, etc. Each type of deal you choose has its own mini task to complete.

- Head over to Flash Rewards and fill out basic info (Email, Name, etc.)

- Take a quick Survey (it helps figure out the optional offers & required deals to recommend)

- Complete deals by shopping Flash Rewards’ great brand name partners.

- Important: Follow the instructions on completing the specific number of deals for each level and get to Level 5 to get the maximum reward! (there are plenty of deals to try – some are free trials or app downloads, others require a purchase!)

- Claim the reward and get it in about a week!

You won’t get your reward if you don’t complete the required amount of deals. Sure, it takes a little more effort but it’s legit. Get your $750!

2. Earn Up to $200 Every Time You Win This Viral Bingo Game

Bingo Clash is the free modern version of bingo that you can play on your Samsung to win cash and real-life prizes. There are daily cash prizes as well as weeklong tournaments with prize pools that can go up to $25,000!

You play against other people of similar skill in 1v1, tournaments, or multiplayer. It’s fair play as everyone gets the same card and the same numbers called out, but it’s how fast and accurate you are that will declare the winner!

Pro-tip: Don’t hit the Bingo button until almost the end of the game to rack up bonus points!

Bingo Clash is free to play and fun, plus you could win cash/prizes, so check it out!

3. Get Free Money Back on All Your Shopping Hauls

Check your pockets; check your purse. And keep receipts for your iPhone.

Just grab all your recent receipts from your coffee runs, grocery trips, restaurants, and gas station fill-ups, scan them into Fetch Rewards on iOS, and earn points for free money! Connect your email account, as well, to count DIGITAL receipts from Amazon, Instacart, and more.

Basically, snap a pic of your receipt from anywhere, and that’s it; you’ve got points for money. There’s no minimum spend, no need to select items manually, scan in any receipt from any store or gas station, and it’ll automatically reward you.

It’s free and easy to use and is a must-have iOS app for anyone who buys stuff!

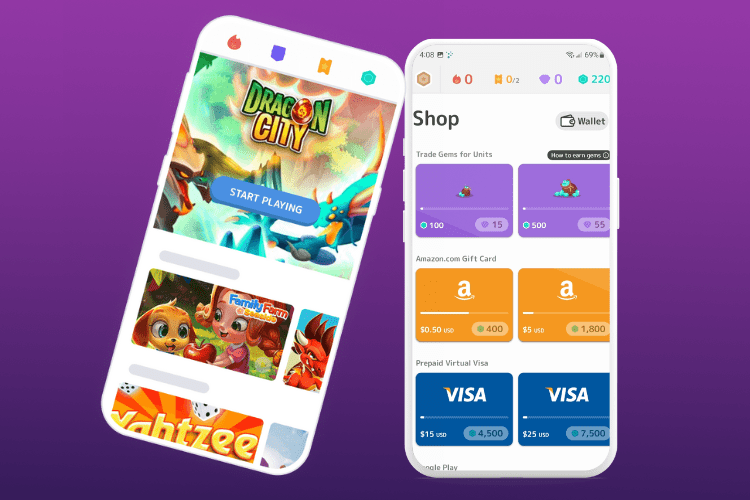

4. Play New Games and Earn Branded Gift Cards

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!

5. Ask This Company To Pay Off Your Outstanding Credit Card Debt

It’s 2024, and you want to body slam that debt down and keep it down. You just need a little help doing it.

MyLendingWallet can help if you have under $35,000 in debt. They’ll offer a personal loan that pays off all your balances and consolidate them into one balance to make it easier on yourself.

Regardless of credit status, you can quickly determine if you qualify for a loan with APRs ranging from 5.99% to 36% max. Since their network has over 100 vetted lenders, you’ll be able to compare with no obligation either.

You can get funds as fast as 24 hours, and they have flexible repayment periods (61 days to 72 months!). Even better? There’s no credit score impact to check, so see how LoansUnder36 can help now! It only takes 2 minutes.

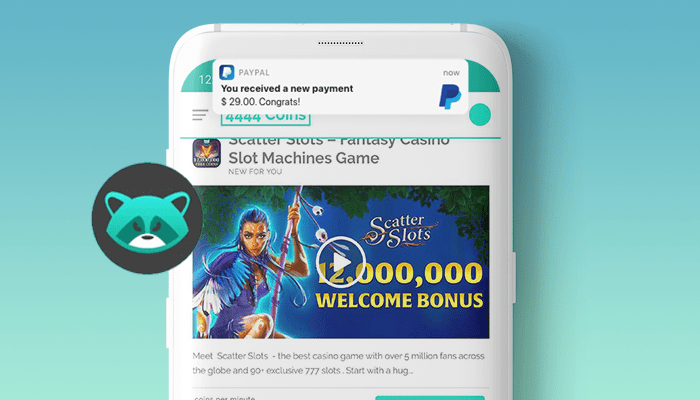

6. Make Easy Money Just Trying and Playing Games

There are so many new games coming out on the daily that it’s hard to choose which to play.

My strategy? Only focus on the games that pay for my time.

You can do it with AppStation, an app that pays you to try out new games.

When you earn coins from trying new games, you can redeem for:

- PayPal Cash

- Amazon gift card

- GameStop gift card

- PlayStation Store gift card

- Xbox Live gift card

- And too much more to list

Nab a 4,444 coin welcome bonus too, which is basically around 50 cents in value. And if you don’t like to wait, you can choose to payout as low as $1.

If your friends want to get it on the money action from afar, introduce them to AppStation, where you’ll get bonus coins and 25% of all their earnings. To make it a supportive group, your friends will also earn 25% of your earnings too!

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.