You Don’t Have to Be Rich to Start Investing and Build That Wealth (+ Get $10 Bonus)

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

It’s never too early or too late to start investing, as long as you start. You don’t have to wait for the “right time” or be rich either to get your share of brand names companies.

At this point, stocks are “king” for both the Millennial and Gen Z generations to build that wealth and you can use Stash to help you get there

What is Stash?

Stash is an investing app that lets you start investing with just $5. This beginner-friendly platform gives access to thousands of single stocks and ETFs (Exchange Traded Funds).

You can search for specific company names for stocks you’re interested in (e.g. Netflix, Apple, Tesla, etc.), as well as choose from ETFs, which Stash conveniently renames into easy-to-understand themes sorted by risk tolerance, goals, interests, and values.

For example, Stash presents “Amplify Transformational Data Sharing ETF” as “BLOK,” which includes companies that are actively involved in blockchain technologies. Much easier to remember and understand, right?

Stash makes it as simple as possible for anyone to get started with investing. Previous Stash members can appreciate the new features as well!

| New Stash Features |

|---|

| Stock-BackⓇ Rewards1: The Stash debit card lets you earn stock while you shop |

| Round-Ups: Utilizes spare change from purchases to invest |

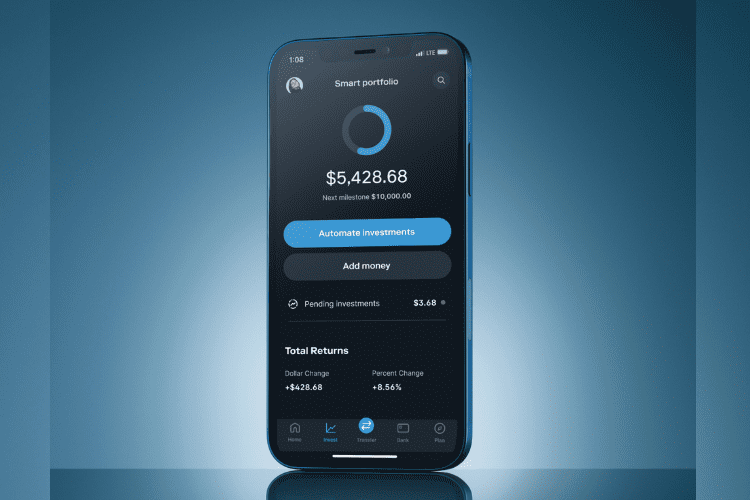

| Smart Portfolio: Growth and Stash+ Members get access to hands-off stress-free investing |

| Stock Parties: Claim bonus stock at regularly scheduled virtual stock parties |

| Crypto: It's now even easier to get exposure to crypto with Smart Portfolio |

How to Get Started On Stash & Get a $10 Bonus

Since Stash is a financial services company, they’ll ask for some personal information when you sign up including your legal name, birth date (must be at least 18+), and Social Security number to verify U.S. citizenship.

- Download Stash

- Answer some questions about yourself, risk tolerance, net worth, and goals

- Choose a monthly plan ($3 for Growth, $9 for Stash+ Plans)

- Deposit at least $5 start investing (Get $10 bonus)

The Smart Wallet readers get a $10 welcome bonus when you deposit $5 or more to your Personal Portfolio!

After account creation and deposit, you can choose where to put your money in and Stash will provide guidance and tools to help you to invest. There’s no need for thousands of dollars to get your share of well-known companies.

💡 DIY or Go Stress-Free with Smart Portfolios

Beginner plan members will have the freedom to cherry-pick their stocks and ETFs with advice from Stash.

If you want a hands-off stress-free approach to investing then consider upgrading to Growth and Stash+ plans to access the new Smart Portfolio feature.

All you need to do is add cash to your Smart Portfolio and Stash will utilize their financial research to pick ideal investments for you based on your risk level as well as rebalance the mix on a quarterly basis.

This type of automation makes investing even easier if you prefer a hands-off approach!

Interested in cryptocurrency? Currently, Smart Portfolio users will get exposure to investing in crypto, to help diversify your portfolio even further.

- No Investing Minimum2

- Fractional investing lets you buy pieces of expensive stocks

- Smart Portfolios option offers hands-off stress-free investing

- Attend virtual Stock Parties to get a piece of offered stock(s) reward

- $10 welcome bonus after the initial deposit of $5 in Invest Account

- The fees can add up, especially for small accounts

- ETF expense ratios eat into returns

- Primarily for ETF and stock investing

🛍️ It’s Easy to Earn Stock While You Shop

If you want additional ways to earn stock, Stash has a unique debit card service that gives “Stock-BackⓇ” rewards1 on purchases at more than 11 million locations. This is offered for every plan!

Earn 0.125% Stock-BackⓇ on all purchases and, at times, as much as 5% at certain merchants with bonuses!

Basically, when you shop at participating merchants with your Stock-BackⓇ card, they’ll reward you with stock in that company. These include big brands like Walmart, Starbucks, Amazon, and more.

If you use your Stock-BackⓇ card at places that don’t have a matching investment, like your local hair salon, they’ll reward you with an investment of your choice from a predetermined list instead.

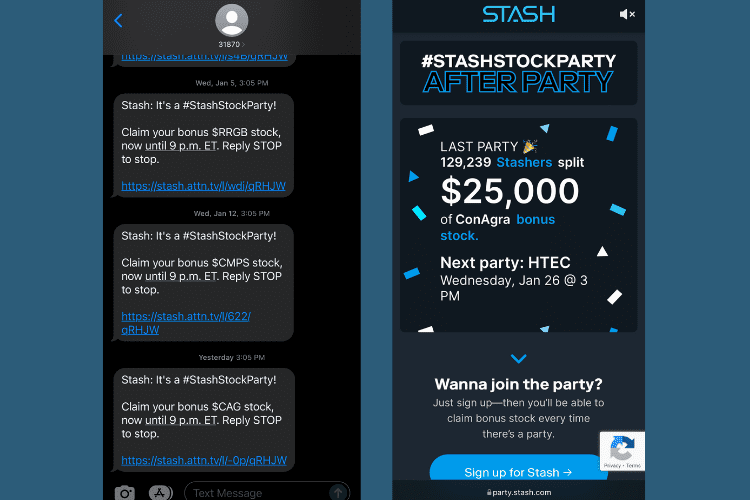

🎉 Attend Stock Parties To Get Bonus Stock

Another way to earn bonus stock is by attending randomly held virtual stock parties. This is also open to every Stash member and we’re subscribed to the stock party text messages so we never miss a bonus stock opportunity.

Typically, you’ll have an hour from the start time to claim the stock, and the more people that attend the party, the bigger your share of the total pot can be!

Some of the recent bonus stock they’ve given out include Nike, Southwest Airlines, Home Depot, and Spotify just to name a few.

How Much Does Stash Cost?

The Stash Growth Plan starts at $3.00 and includes an Investment account, a no hidden fees bank account3, and access to Smart Portfolio, which provides hands-off investing.

You’ll also get a $10 welcome bonus after the initial deposit of $5 in your personal portfolio!

Is Stash Legit & Safe?

Short answer: Yes.

Stash has been around since 2015 with 5 million+ clients, along with being a registered investment adviser with the SEC and offers FDIC-insured bank accounts through Green Dot Bank. They also use the same type of 256-bit encryption that most banks use.

You’ll also set up a pin code (required each time you open the app), or set up thumbprint or facial recognition.

It’s Better With Friends

Refer friends to Stash, and you’ll BOTH get $20 bonus stock when they add cash to their Stash portfolio. Win-win.

Overall, Stash is great for new investors and investors who want a stress-free, non-intimidating approach. Start investing with as little as just $5 and start building your wealth!

^ The Smart Wallet readers get a $10 bonus (an upgrade from the video’s message about a $5 bonus!)

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

The paid partner received cash compensation of up to $150.00 (per cost per action) for providing this endorsement. Compensation creates an incentive for the individual to recommend Stash. Endorsements are not representative of the experience of all clients and are not guarantees of future performance or success. For a representative sample of client testimonials, refer to Apple App Store or Google Play reviews To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account (“Personal Portfolio”).

Promotion offer is subject to Terms and Conditions. *T&Cs.** You must complete within the specific time period included in this offer: (i) successfully complete (or already have completed, or re-apply for and complete) the registration process of opening an individual taxable brokerage account (“Personal Portfolio”), (ii) link a funding source to your account; AND (iii) deposit at least $5 from your funding source into your Personal Portfolio.*T&Cs

Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value. All product and company names are trademarks ™ or registered ® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

1All rewards earned through use of the Stash Visa Debit card (Stock-Back® Card) will be fulfilled by Stash Investments LLC. Rewards will go to your Stash personal investment account, which is not FDIC insured. You will bear the standard fees and expenses reflected in the pricing of the investments that you earn, plus fees for various ancillary services charged by Stash. Stash Stock-Back® Rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates.

2 What doesn’t count: Cash withdrawals, money orders, prepaid cards, and P2P payment. If stock of the merchant is not available for a qualifying purchase, the security will be in shares of a predetermined ETF or from a list of predetermined publicly-traded companies available on the Stash Platform. See full terms and conditions

3The Stash Monthly Wrap Fee starts at $1/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

4Other fees apply to the bank account. Please see the Deposit Account Agreement for details. If applicable, your Stash banking account is a funding account for purposes of the Advisory Agreement. Your Stash subscription fee may be deducted from your Stash banking account balance. Promotion is subject to Terms and Conditions. To be eligible to participate in this Promotion and receive the Bonus, you must complete the following steps: (i) successfully complete the designated registration process of opening an individual taxable brokerage account (“a Personal Portfolio”), (ii) link a funding account (e.g. an external bank account) to your Personal Portfolio, AND (iii) initiate and complete a minimum deposit of at least five dollar ($5.00) into your Personal Portfolio. In the event you only complete the designated registration process to receive the Financial Counseling Service (as defined in your Advisory Agreement), as applicable to you, or do not otherwise complete the account opening process for an individual taxable brokerage account (“Personal Portfolio”), you will not be eligible to receive the Bonus.

5Early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period.

6 Group life insurance coverage provided through Avibra, Inc. Stash is a paid partner of Avibra. Only individuals who opened Stash accounts after 11/6/20, aged 18-54 and who are residents of one of the 50 U.S. states or DC are eligible for group life insurance coverage, subject to availability. Individuals with certain pre-existing medical conditions may not be eligible for the full coverage above, but may instead receive less coverage. All insurance products are subject to state availability, issue limitations and contractual terms and conditions, any of which may change at any time and without notice. Please see Terms and Conditions for full details. Stash may receive compensation from business partners in connection with certain promotions in which Stash refers clients to such partners for the purchase of non-investment consumer products or services. This type of marketing partnership gives Stash an incentive to refer clients to business partners instead of to businesses that are not partners of Stash. This conflict of interest affects the ability of Stash to provide clients with unbiased, objective promotions concerning the products and services of its business partners. This could mean that the products and/or services of other businesses, that do not compensate Stash, may be more appropriate for a client than the products and/or services of Stash’s business partners. Clients are, however, not required to purchase the products and services Stash promotes

Crypto is relatively new and can be volatile. Investments are Delaware Statutory Trusts and offer indirect exposure to Crypto.

Fractional shares start at $0.05 for investments that cost $1,000+ per share.

This Program is subject to terms and conditions. In order to participate, a user must comply with all eligibility requirements and make a qualifying purchase with their Stock-Back® Card. All funds used for this Program will be taken from your Stash Banking account. This Program is not sponsored or endorsed by Green Dot Bank.

Stash Growth Plan starts at $3/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

Stash offers two plans, starting at just $3/month. For more information on each plan, visit our pricing page.

Smart Portfolio is only available in the Growth ($3) and/or Premium ($9) Tier. This is a Discretionary Managed Account whereby Stash has full authority to manage according to a specific investment mandate. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Stash does not guarantee any level of performance or that any client will avoid losses in the client’s account.

A “Personal Portfolio:” You can choose your own investments only in a “Personal Portfolio” which is a Non-Discretionary Managed account.

Bank Account Services provided by Green Dot Bank, Member FDIC.

Please review the Referral T&Cs. To participate and receive cash bonuses or stock rewards, you must: (i) open a taxable brokerage account (“Personal Portfolio”) that’s in good standing. (ii) send a referral invitation to a friend and (iii) your friend must complete the account opening process for a Qualifying New Account. Your referee friend must (i) complete the process of opening an account by using the special designated referral link from your invitation (ii) link a funding account (e.g. an external bank account), and (iii) initiate a minimum deposit of at least one cent ($0.01) into their Account. This Program is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A. Inc., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any funds earned through this program.

Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value. All product and company names are trademarks ™ or registered ® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

While such registration does not imply a certain level of skill, it does require us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client.

To note, SIPC coverage does not insure against the potential loss of market value.