StellarFi Review: Pay Your Bills And Boost Your Credit Score

If you’ve ever applied for any loan, you probably know how crucial it is to keep your credit score in good shape.

Despite this, 16% of Americans report having very poor credit. A bad credit history makes it harder to attain life milestones like owning a home, buying a car, or even getting hired at specific companies.

Knowing how important it is to build and maintain good credit, StellarFi is here to help. Let’s dive into everything this platform has to offer!

What Is StellarFi?

Launched in 2021, StellarFi is a public benefit corporation on a mission to make credit more accessible to those in need.

Most Americans need to take out a loan for major life purchases. But if they haven’t built a reliable credit history or have a poor score, it can bar them from having a chance to own a car or buy their first home.

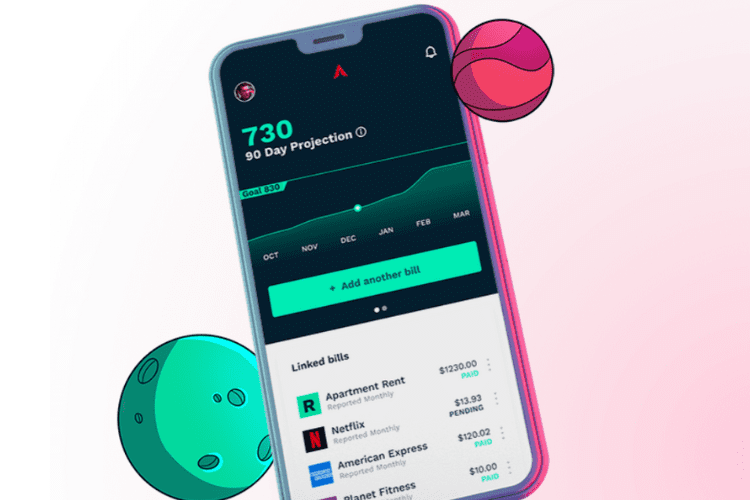

This is why StellarFi was the first and only platform to create a system that uses your everyday bills as a credit-building tool. Using something that most people already have makes it much easier for StellarFi members to build a good credit history as quickly as possible.

This means your streaming services, phone bill, rent, and even your yoga bill can build up your credit. No credit checks, interest, or deposits are required!

How To Build Credit On StellarFi

Since most credit bureaus look for consistent payments and credit usage, StellarFi reports every on-time bill payment you make to major credit reporting agencies like Transunion®, Experian®, and Equifax®. It does this by “paying” your bill using a virtual credit card connected to your bank account.

The site also displays higher credit limits to help you minimize your credit reduction. Lastly, adding StellarFi to your report can help you improve your credit mix.

Using these three basic tactics, people can see their credit scores go up in only a few short months. The site also gives you a free credit report after you sign up as a bonus!

Is StellarFi Safe To Use?

Yes, StellarFi is entirely safe to use. The site uses bank-grade security systems and state-of-the-art encryption tools to ensure your information is secure. The platform also uses random digital tokens to represent a member’s account at their bank and doesn’t store any personal financial details.

StellarFi also has many positive reviews, and its members are more than satisfied with their services.

“StellarFi has helped me increase my credit score by 20 points, and it’s steadily increasing! I would recommend the StellarFi platform to a friend and family member,” says Yvette, a StellarFi user.

Members have seen their credit scores increase by 50 points* in 30 days!

Do You Need To Pay To Become A Member?

StellarFi is a subscription-based membership with three paid tiers. The “prime” option starts at $9.99 per month, and it includes the following:

- Customized credit goals

- Building credit with bills (up to $25,000)

- Monthly reporting to the major credit bureaus

- Cash rewards

- Personalized counseling

For about the price of your Netflix account, StellarFi gives you all the tools you need to build a successful credit history.

StellarFi: Pros And Cons

Pros

- Offers people a chance to build their credit

- Relatively affordable membership

- No minimum income requirement

- Improves factors that makeup 80% of your score

- No credit check

- No interest

- No deposit

Cons

- The 30-day free trial is only for the Prime plan (their most popular)

The Bottom Line

Having a decent credit score is a lifeline for many of us. StellarFi understands this and wants to ensure people who need credit can apply for it easily.

If you don’t have a credit history or have a poor score, StellarFi gives you a chance to create one by doing something you already do.

Ready to start rebuilding your credit rating? Take a second to sign up and start your onboarding process today!

Read More: