22 Stupid Simple Ways to Make Extra Cash in 2020

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance because talking about money should always be an honest discussion.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance because talking about money should always be an honest discussion.

Let’s face it, everyone can use a little help on their finances. Regardless of what gets shared on your friend’s and family’s social media, no one knows the whole picture but themselves. Some may even be afraid to admit it.

It doesn’t have to get overwhelming though! When you’re ready to buckle down and tackle your finances, we can help.

Especially if you’re currently making less than $60,000 a year.

After taxes, that salary goes down quick but just start small with the money moves below to get back in control.

1. Get Free Money Back on All Your Shopping Hauls

Check your pockets; check your purse. And keep receipts for your iPhone.

Just grab all your recent receipts from your coffee runs, grocery trips, restaurants, and gas station fill-ups, scan them into Fetch Rewards on iOS, and earn points for free money! Connect your email account, as well, to count DIGITAL receipts from Amazon, Instacart, and more.

Basically, snap a pic of your receipt from anywhere, and that’s it; you’ve got points for money. There’s no minimum spend, no need to select items manually, scan in any receipt from any store or gas station, and it’ll automatically reward you.

It’s free and easy to use and is a must-have iOS app for anyone who buys stuff!

2. Get Paid Up to $225/Month While Watching Viral Videos and Taking Fun Surveys

Founded in 2000, Inbox Dollars has been paying customers for their opinions for over 24 years and counting! They are one of the most trusted survey sites with fun, multiple ways to earn extra cash that set them apart.

“Fast and easy. Love that I can cash out to my PayPal and easily transfer money to my bank account.” – Tefanie P

Take surveys, watch videos, play games, and even read emails for extra cash. Who wouldn’t want to watch viral videos for money and get paid up to $225/month?

Inbox Dollars is a great platform to make a little side money. It’s free to sign up, so give it a try today!

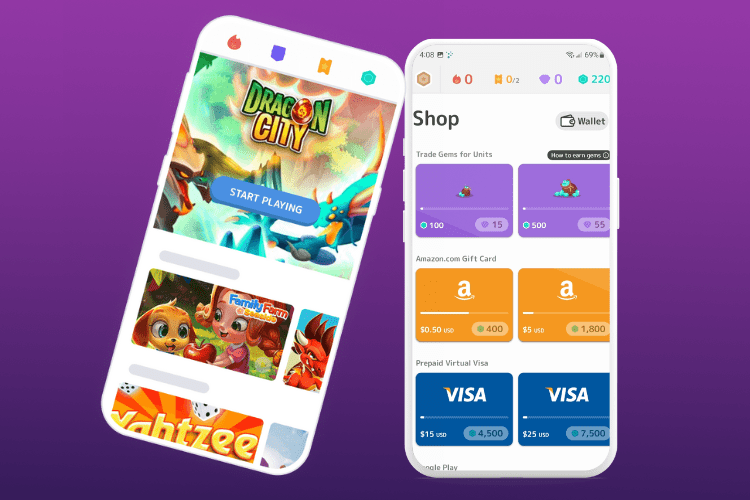

3. Play New Games and Earn Branded Gift Cards

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!

4. Empower Yourself Financially, Especially for Women

Whether you think about it or not, there are important realities in a women’s life.

Gender pay gaps where women make less than men, career breaks where women’s earnings drop significantly after having a child,(*) and longer than average lifespan meaning women need more money to live.

That’s why it’s vital to save for retirement and invest, especially if you’re female and why

Ellevest exists, an investment service and money membership created by and designed for women.

Men and those that identify as non-binary are welcome to join as well but it’s the first company to take on women’s unique set of obstacles when constructing an investment portfolio.

With affordable flat monthly fees starting at $1 and maxing at $9, you can be sure that your financial health is taken care of with personalized retirement planning (Plus and Executive memberships), investments with no asset management fees outside of your membership fee, and discounted sessions with career coaches and financial planners. Membership also includes an Ellevest debit card,* which gives you the option to round up spare change to help you save further** as well as unlimited ATM fee refunds.***

With the current world events, it’s even more important to make sure that your “future you” will be comfortable, so take advantage of the first free month and see how it can help you.

5.

6. Work From Home: Earn $20 Per Hour to Start Teaching English To Kids Online

The past few months have been rough on Americans and their livelihoods. If you’ve been considering a side gig to supplement your primary income or need a job working from home, teach English online to kids ages 5-13!

EF Online (Education First) is a teaching platform helping to connect students in China and native English speakers for 20+ years with their global network of 600+ schools. You’ll experience a flexible schedule where you can work from home, earn up to $20/hr to start, with all lesson materials are provided. While teaching experience is preferred, it’s not required. Earn extra rewards the more you teach!

Here are the requirements:

- Must be a native English speaker living in the U.S.A with a Bachelor’s degree in any field

- By the start of your teacher’s contract term, you must earn and submit documentation of a 40 Hour TEFL (Teaching English as a Foreign Language) certification (or higher)

- Agree to an online background check (no cost to you)

- Be available to work during a set range of hours

- Have a solid wifi connection and headset

- And lastly, be passionate!

Classes are 25 minutes each and since EF Online encourages repeat classes, you might be teaching the same students regularly. In addition, parents can book you up to 6 months in advance leading to a more stable income.

If you enjoy interacting with kids, this is definitely a rewarding and flexible gig from home!

Note: The following U.S. states are excluded from this gig – CA, IN, MA, NH, NJ, NY, and IL.

7. How to Get Paid $22/Hr Being a Grocery Shopper

When you’re looking for a legit side gig, consider grocery shopping for others, instead.

Shipt is an app where members can request same-day deliveries on grocery, household, and more. After browsing through millions of products from stores like CVS, Target, ALDI, Costco, and a lot more popular retailers, members create a shopping list.

This shopping list is then sent to a professional Shipt Shopper (potentially you!) who’ll head to the store, grab the items, and deliver. Shoppers are independent contractors and are paid up to $22/hr and more. Plus 100% of all tips are yours to keep!

So if you’re interested in a flexible side gig that helps out the community, have a valid driver’s license and auto insurance, a reliable car, know the difference between romaine and iceberg lettuce, apply here. Work whenever you want and get paid weekly!

8. Federal Student Loans are Paused But the Best Time to Pay is Now

Student debt in the U.S. totals more than $1.5 trillion and is one of the biggest consumer debt categories since it affects more than 44 million Americans.*

And even though Federal student loan payments are paused and most interest rates are set to 0% via the CARES Act through September 30, 2020, the best time to pay is during this temporary relief period if you can. That’s because however much you send will basically double the payment impact as 100% goes straight towards the principal balance.

You can use FutureFuel to make it easier. It’s a personalized Financial Health platform that’ll help save time and money off your student debt and on average, members save $15,000 off their debt plus shave off 4 years of payment!

Utilize their valuable Round Up feature, which sweeps your spare change directly to your student loans as extra payments. As well as the Giveback feature, where you can earn up to 30% cash back on everyday purchases from 450+ popular brands to use towards your loans!

Give yourself peace of mind and you could shave an average of $15,000 off your loans. We think that’s worth it and it takes less than a minute to connect your loan(s).

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.