Truebill App Review: Automatically Save Money by Lowering Your Bills

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

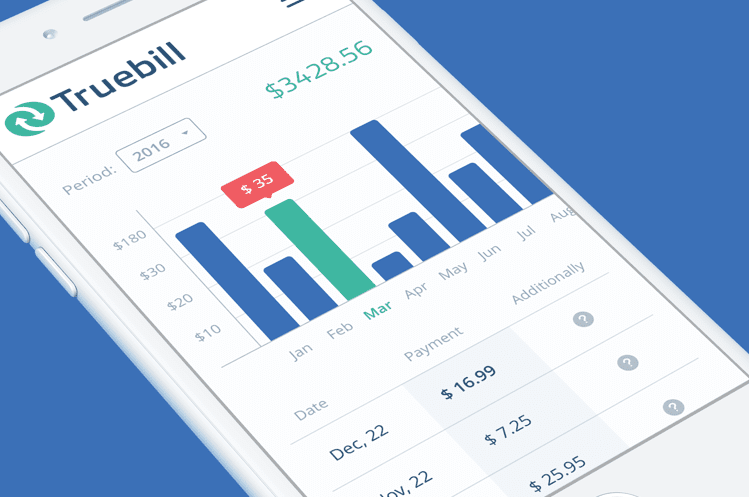

Keeping track of your bills can be like keeping track of your passwords: without an app to help you organize, you’re going to let something slip. That’s what makes Truebill so valuable, as our review will show.

You can download an app store’s worth of budgeting apps, but Truebill stands out. The app some unique services that not only help keep your total spending in view but also works on your behalf to lower your bills.

How Truebill (for iOS or Android) Compares to Competitors

You may already have several bill-pay and budgeting apps on your phone like Mint, Acorns or Prism. Most apps in this category help you budget and send you alerts when you’re going to spend too much. Other apps like Billshark and Trim will also negotiate lower bills for you.

Truebill goes a step further by looking for unique savings opportunities on your recurring bills, whether that is a one-time promotion you may be eligible for, or fees they can dispute for you. Its technology is proactive in bringing down your monthly costs.

Truebill’s Value Prop

According to founder Haroon Mokhtarzada, the idea for Truebill came from an experience he had trying to negotiate for a lower bill. “When you run a subscription business, you realize that there are people who renew because they just don’t get around to canceling,” Mokhtarzada said. “There’s a decent amount of people are doing just that.”

From that initial idea, Truebill added services like bill tracking and alerts. Truebill stands out as a uniquely valuable product, however, for its electric saver and outage rebate services. If you are a subscriber to Arcadia Power, a clean energy marketplace operating across the U.S., Truebill can automatically lower your energy bills to their optimum level.

Truebill has also announced a partnership with Gabi, an online insurance broker that operates in all 50 states, to help you find optimal insurance at the lowest cost.

Truebill (for iOS or Android) also monitors cable TV and internet outages, and if you’re inside one of those blackout areas, Truebill will negotiate with your cable provider for a rebate.

How to Cancel Accounts With Truebill

Truebill premium allows you to cancel subscriptions in the app with one tap. On the front page of the app, Truebill flags accounts it thinks are charging too much. Two taps, and they are negotiating a better rate for you.

Is Truebill Free?

As the old saying goes, if you’re not paying, you’re the product. Some features of Truebill are free, like bill tracking and alerts. Premium features are available for as little as $3 in a “pay what you think is fair” model.

How Truebill Makes Money

Truebill has a teaser rate of $3 per month for premium accounts, and the app offers basic functions, like bill tracking for free. The minimum monthly charge for Truebill premium, which includes its most valuable functions like bill negotiation and electric saver, is $4.99 per month or $35.99 per year. Truebill also charges 40% of any money they save you by negotiating a lower bill.

Can You Trust Truebill?

Digital consumers always want to know, “is this app safe?” The answer to the question, is Truebill safe? is a hard yes. Truebill accesses your bank account using 256-bit SSL encryption, and their API interface is read-only, so they can’t make changes to your account, they only read the bills. What’s more, your login credentials aren’t saved on their servers, so even if they are hacked, your bank info is safe.

Truebill is very upfront about its costs. Pricing transparency (for iOS or Android) is a huge signal that a business is reputable.

How to Cancel Truebill Premium

Truebill comes with a 30 day free trial for new subscribers, and unsubscribing is very easy.

Truebill Review Bottom Line

The Truebill app will save you money on your bills by negotiating for a lower price for phone, cable and other monthly charges. They are up front about how they make money. Premium accounts charge a monthly fee, and Truebill keeps 40% of the savings negotiated on your behalf. If you are putting your trust in their team to negotiate your new bill and the new services it will bring, you have to be prepared to accept changes in your service.

(If you’re interested in other apps that can help you manage your money, here are some of our favorites.)