All the Types of Insurance You Definitely Need

Being an adult is defined by responsible behavior and reasonable decision-making. You need to get a job, save money, pay your bills, not spend above your means, exercise your right to vote, have an emergency fund, and the list goes on.

However, no matter your age, there will still be moments when we feel like we don’t know what we’re doing. For instance, understanding vocabulary terms and concepts still makes us scratch our heads no matter how often we’ve read or used them.

So when you add another confusing layer like insurance to the above hallmarks of maturity, it can be tempting to shrug it off or “let someone else handle it.”

But this article will go over all the types of insurance you DEFINITELY need.

Think of insurance as a life jacket. It’s frustrating to wear (or pay for) when you don’t need it, right? But if you hit an emergency – even if it’s just once – you’ll be extremely grateful for that life jacket for saving you.

Navigating your life without insurance means you are only one car accident, illness, or natural disaster away from financial ruin. Sure, you’re paying for something regularly that may or may not happen. But once it does, you’ll be glad you have it.

1. Health Insurance

According to the Kaiser Family Foundation (KFF), medical debt is consistently responsible for nearly half of American bankruptcies. An estimated 530,000 families each year cannot pay their medical bills, so they turn to bankruptcy to stay afloat.*

“Unless you’re Bill Gates, you’re just one serious illness away from bankruptcy,” says Dr. David U. Himmelstein, M.D. in a Physicians for a National Health Program (PNHP) press release*.

So by having health insurance, it can protect you by covering many of your medical costs.

If you’re young, healthy, and single, you probably don’t need as much coverage as someone with chronic health issues or children. There are ways to select high or low-deductible plans to make health insurance more affordable for your budget while still meeting your medical needs.

You wouldn’t want to pay for an $18,000 C-section or $50,000 surgery all on your own, right? Your health insurance policy protects you from debt and makes it easier to stay healthy by enabling regular care and maintenance.

Which Health Insurance is Right For You?

Let’s go over the types of plans you’ll typically see offered. When “premium” is referred to, it means the amount that you pay for the policy.

HMO = Budget-friendly

Health Maintenance Organization (HMO) is the cheapest option for health insurance. Because of the lower premiums, deductibles (the amount you pay before insurance kicks in), as well as fixed copays (set prices for medical services), an HMO requires you to pick doctors from their network.

When you enroll, you’ll choose a PCP (Primary Care Physician) or GP (General Practitioner) from their in-network coverage, who will be your main doctor and referrer should you need to see a different specialist, like an allergist, cardiologist, psychiatrist, etc. Your PCP will be the first point of contact to give approval (aka referral).

This plan can be good for people who don’t have major health problems, want to keep premiums down, and don’t mind taking an extra step to get to the doctor they need.

PPO = Flexible but Higher Premiums

Preferred Provider Organization (PPO) is the complete opposite of HMO. It’s the most expensive option for health insurance but gives the most flexibility regarding out-of-network coverage and no referrals needed to see specialists. In other words, you can see whomever you want and don’t need to wait for a referral.

This plan can be good for people who can handle the higher premiums, and if they expect they’ll need more healthcare in the year, they’ll enroll in.

EPO = Larger Network

Exclusive Provider Organization (EPO) is like the middle ground to HMO and PPO. It has lower premiums than a PPO but higher than an HMO. However, it provides larger in-network care, typically on a national level. If you’re traveling in a different state, you’re likely to find a local doctor within your network to be covered.

Some EPOs require PCP referrals, and some don’t.

This plan can be good for people who want the flexibility of a larger in-network and are willing to pay more than an HMO but lower than a PPO for the potential convenience of no referrals.

POS = Like an HMO but with Out-Of-Network Coverage

Point of Service (POS) is like an HMO in that you need a PCP referral for a specialist but costs more with higher premiums because it offers out-of-network coverage instead of confining you to in-network.

This plan can be good for people with specific medical conditions who may need to see different specialists and want the flexibility to see who they want (with a referral).

HDHP = Low Premiums but Higher Out-of-Pocket Cost

High Deductible Health Plan (HDHP) offers low premiums but higher deductibles, which means more out-of-pocket costs before insurance kicks in. Depending on your employer, it could be tied to an HMO, PPO, EPO, or POS and paired with a Health Savings Account (HSA) to help pay for some of the deductible costs.

An HSA is a pre-tax account for healthcare expenses (e.g., copays, medical bills), and any unused amount can be rolled over into the next year (and can keep rolling).

For instance, my employer funds and adds $600 annually into HSA accounts. To take advantage of the pre-tax dollars, I contribute to an HSA directly from my paycheck to offset the high deductible.

This plan can be good for healthy people who don’t have expensive medical conditions, higher-income individuals who can contribute to the pre-tax HSA account, and/or those who like having a “triple-tax-free” investing account. An HSA can be invested in mutual funds, like a 401(k) or Roth IRA.

How is an HSA “triple-tax-free?”

- Money is deposited into the account pre-tax

- As the money grows in the HSA, it’s sheltered from taxation

- And when you withdraw for medical-related expenses, it’s tax-free

And since any unused money can roll over onto the next year, and so forth, you should have no fear of contributing too much and not using it “in time” for medical expenses. Because after age 65, you can withdraw the money for any purpose with no penalties.

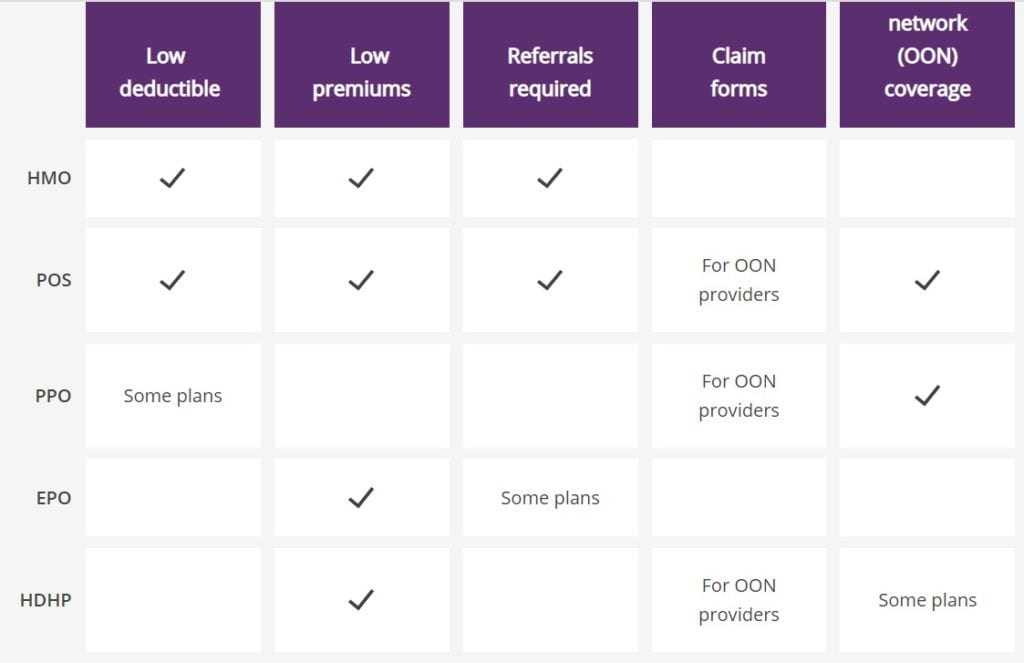

Here’s an at-a-glance look at the different health plans:

It’s important to note that once you’re enrolled in a health plan for the year, you won’t be able to change it until the following year or if when a qualifying life event (QLE) happens such as:

- Marriage or divorce

- Having/adopting a baby

- Death

- Losing health coverage

- Change in residence (zipcode)

What About Flexible Spending Accounts?

A flexible spending account (FSA) is similar to an HSA. However, the funds don’t roll over into the next year and are a supplement to any health insurance plan that is not an HDHP. (HSAs are only available to high deductible health plans)

This means that FSAs are “use it or lose it” pre-tax accounts, so any funds not used within the year will be lost unless your plan has a rollover period, which in the year of COVID, can be offered.

You set the amount you want to contribute for the year at the beginning of enrollment (e.g., $1,000), and over time, it will be deducted from your paycheck into the FSA. To use your FSA, you get a debit card connected to your FSA account so you can easily pay for qualifying purchases or services.

Age 65+ Health Insurance

After employer-provided health insurance, what’s next?

When you hit 65, you could apply for the government’s Medicare health program. You’re automatically enrolled if you’re already receiving Social Security Benefits.

Otherwise, you’re eligible when:

- You’ve worked at least 10 years in the United States (thus contributing to payroll tax, which is also called Social Security Tax)

- You’re age 65 or older

- You’re a citizen or permanent resident of the United States

If you’re younger than age 65, you can be eligible for Medicare through disability or those that have End-Stage Renal Disease or ALS.

To see if you qualify for Medicare, use the government’s eligibility tool.

And what do all the different parts of Medicare mean? It wouldn’t be insurance if it didn’t confuse you, so here’s Stephanie to explain further:

2. Life Insurance

You don’t want to think about your death, but since it’s guaranteed to occur eventually, it’s silly not to purchase life insurance. Of all the types of insurance, this particular one doesn’t help you directly, but it does protect your family by replacing the income you contribute to the household. You’d want your loved ones to be financially covered in case the worst happens, right?

Essentially life insurance is valuable to anyone and is a contract with a life insurance company. You pay the premiums, and the life insurance will pay out to your designated beneficiaries after your death.

Even if you’re single with no children, you can get a smaller, less expensive policy. If you have any debts, if your debts have co-signers, if you have aging parents or a sibling with medical conditions, or if you own a business, that payout will be helpful to ease some burden on them.

If your family has any history of major health issues, and if you’re likely to be diagnosed with it, later on, it’s best to buy life insurance now as premiums cost less the younger and healthier you are.

No debts and don’t want children? Do you still need life insurance?

And even if you have zero debt and don’t want any children, someone will have to take care of your end-of-life expenses like hospital care, legal expenses, funerals, and other hidden costs of dying.

A smaller life insurance policy can prevent your family and friends from going into debt if they have to cover those expenses.

What will life insurance cost?

The cost of policies varies greatly, depending on the insurer and type of insurance (term or whole life) you buy. But in general, life insurance gets more expensive as you age, so it’s best to purchase your policy earlier in your life, while you’re still young and healthy!

Read More: When Is the Right Age to Buy Life Insurance? Spoiler Alert: Now

3. Homeowner’s/Renter’s Insurance

Property insurance covers your home, whether you own or rent, and your possessions. This is an absolutely essential form of insurance because it protects your largest investment and most valuable assets from damage, theft, and other threats.

Like all insurances, you’ll have to shop around for a quote or an estimate of what you’ll be paying based on your answers to the following:

- The size of your home

- The neighborhood

- If a fire station is nearby

Each company has its own way of calculating, so it’s best to get quotes from multiple sources.

Here are some additional tips from Allstate:

I don’t own a home. Do I need renter’s insurance?

Short answer: Yes.

Long answer: It’s critical to have renter’s insurance as it protects your belongings in case of a disaster or emergency. While your landlord may have insurance on the property, it doesn’t cover the renter’s property, like your laptop, phone, jewelry, etc.

Having a renter’s insurance policy covers your assets, and you’ll either get the cost to replace items covered, or it’ll reimburse you for the value of what was lost.

Auto insurance sometimes bundles a renter’s insurance to give a package deal, which is another avenue to consider.

Just be sure to read the fine print of your insurance policy. Some insurance companies don’t automatically cover natural disasters like floods, earthquakes, or fires. You don’t want to learn that for the first time after a disaster occurs. You may need to purchase extended dwelling coverage with your policy to get the extra protection you need.

Read More: Toggle Renters Insurance Review

4. Auto Insurance

Unlike health insurance, auto insurance is not voluntary coverage: Most states require car owners to have it. However, you’d probably want to keep auto insurance even without mandatory laws. The average loss per claim on cars is nearly $5,000, and without insurance, you’d have to pay every cent of that loss out-of-pocket.

Auto insurance is a relatively affordable investment that delivers significant benefits after any type of auto incident:

- Collision coverage pays to repair or replace your car if it’s damaged or destroyed in a wreck

- Comprehensive coverage covers all of your auto losses not caused by a wreck, such as from theft, fire, or hail

- Liability coverage covers the costs of any injuries or damage to another party that you caused in a collision

Keep in mind that the exact cost of your monthly or quarterly auto insurance premium varies based on your driving history, credit score, age, type of vehicle, and many other factors.

Common Auto Insurance Terms

Liability insurance: This is for injuries and property damage that you cause to others. So if your liability insurance is too low, you could be sued for damages your insurance doesn’t cover. So generally, the more assets you have, like a house and savings, the more liability insurance you should have.

Uninsured Motorist Coverage: If you’re hit by another driver without liability insurance, this covers you and your passengers. This is needed because there are 32 million uninsured drivers on the road in the U.S.*

Comprehensive: This covers damages to your car caused by some nature (hail, flood, fire), falling objects, explosions, vandalism, or hitting an animal.

Collision: This covers damages to your car when you hit another car or an object (e.g. a tree)

If your car is an older model, Comprehensive and Collision coverage may not be as important or worth it since the maximum claim payout, the car’s value if it’s totaled, would be low.

Personal Injury Protection (PIP) or MedPay: This covers medical bills for anyone in your car, regardless of their fault. If you have good health insurance, though, you may not need this.

Most auto insurances are priced around the same factors, so if you’re familiar with them, you can save some money.

- Clean Driving Record: If you cause a car accident, this generates high rates. Drive safe and keep a clean record!

- Good Credit: Insurance companies take into account what your credit score is when deciding your premiums. Low credit scores tend to claim more insurance.

- Discounts for Paying in Full: A lot of insurers will give discounts if you pay in full rather than in installments.

- Maintain Continuous Coverage: If you let a policy expire without canceling it, your rates will go higher when you buy your next policy. So don’t let a policy end without renewing it or switching to a different one.

Read More: EverQuote Review: Save An Average $610 a Year on Car Insurance

A Few Insurance Tips to Keep In Mind

As you shop around for the best insurance policies and begin to purchase your layers of protection, keep these tips in mind:

- Ask your insurance provider about cost-cutting methods like auto-pay or accident forgiveness. Most providers offer multiple discounts but won’t give you the information until you ask.

- Steer clear of gimmick policies like accidental death, mortgage life, and flight insurance. These policies just want your money; the emergencies they cover often fall under the umbrella of other insurance policies you already have.

- Re-evaluate your insurance policies as you get older. You might be able to find more affordable auto insurance or homeowner’s policy after you demonstrate a history of responsible behavior.

Or you may need to adjust the dollar amount of coverage to keep up with inflation or increasingly valuable possessions. However you do it, make sure you’re covered since only 40% of Americans have enough saved to cover a $1,000 emergency expense!*

Don’t wait to get out of debt! Read this: A Complete, Step-By-Step Guide to Get Out of Debt.