How To Reach Your Financial Goals Faster with the Wally App

In a consumer society, being conscious of one’s finances and future budgeting is essential knowledge everyone should learn. Securing financial stability is important, especially in this unstable economy. Analyzing your spending budget will give you an advantage in life where you’re in control of your finances. For the financially-conscious consumer, staying on top of one’s finances while preventing debt from creeping up is an important lifestyle issue in an age where platforms like TikTok, Facebook, and YouTube make financial content more accessible.

Being on top of your budgeting and spending habits will significantly influence your financial lifestyle. There’s a vast market for financing and budgeting apps. However, how can you possibly know which app is the best one to use? What makes certain finance apps better than others?

Well, whether you’re a novice or a budgeting expert, the Wally app is perfect for organizing all of your finances in one spot. Let’s jump right into the details!

What is Wally?

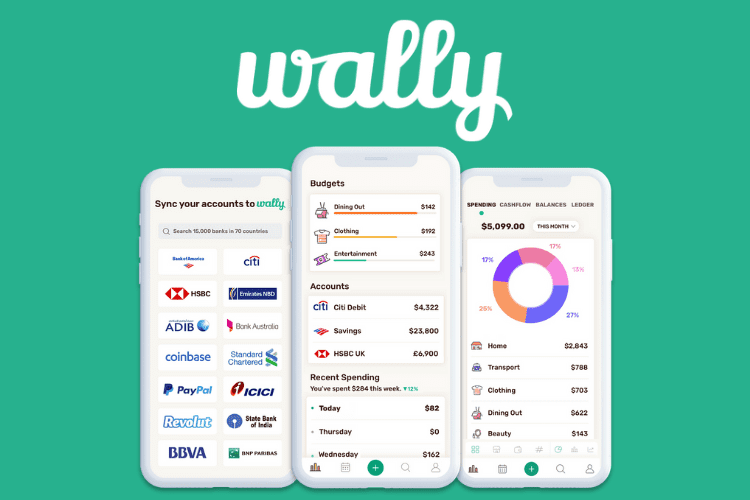

Wally is a smart personal finance and budgeting app available on the App Store, designed to curate as much insight into your finances as possible. Unlike other financing apps, Wally has a fairly simple and user-friendly design that makes tracking your finances easy. With all your important documents and financial reports securely stored in one space, Wally promotes itself as the app that stays on top of your finances wherever you are.

The app was launched in 2013 by Saeid Hejazi. It’s been featured in Forbes, The Guardian, BBC, and other notable publications as highly rated in the finance and budgeting app category.

When using Wally, the app allows several options for setting up your accounts such as credit cards, checking accounts, savings accounts, etc.

What Do Users Have to Say About the Wally App?

“My husband and I use Wally to track our daily expenses and remain on budget. I love the new insights as they help me see my spending trends, and the updated interface is clean and very easy to use. There are many options to provide a lot of details in each transaction.”— JessInAtlanta

“This app is really helpful to have the details in one space. It’s the perfect tool to track all of my expenses.”— Arulanjali

“This app has been surprisingly nice. I wanted a nice budgeting/tracking app that I could easily enter all of my transactions, and the little things it does have been awesome. Great visualization of spending and solid customizability.”— ys-422

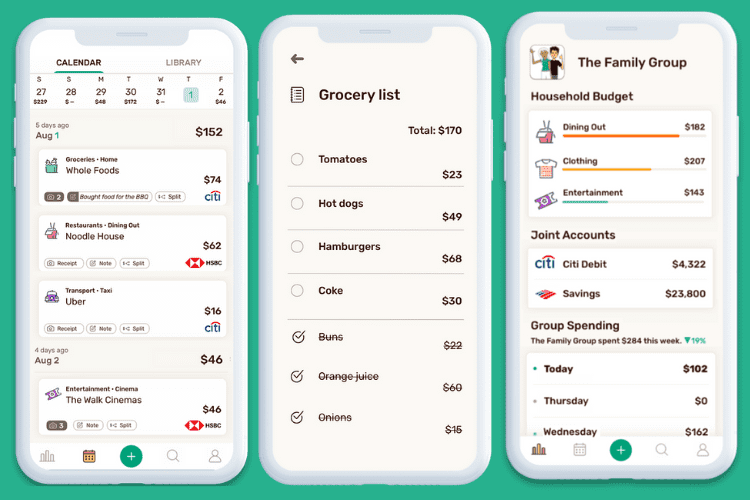

Check out some Wally app dashboards below:

What Services Does The Wally App Offer?

Group-Sync of Joint Accounts and Household Budgets

Think of a Google Docs file for finance where everyone can review, plan, and input their day-to-day spending habits- that’s exactly what this functionality does. This feature is perfect for group budgeting like lease agreements where every party has secure access to key documents and can discuss group finances. The app provides important insights into a group’s shared spending, allowing the user to create an accurate outline of the group’s budgeting plan. It also allows users to split bills between parties. Not only does this encourage accountability in group spending, but it also promotes financial transparency for group decisions.

Track Foreign Transactions

With 15,000 banks available in 70 countries including the U.S., Wally can sync and manage all your foreign accounts in one place. Wally’s 200+ currencies allow you to track and convert foreign transactions while providing insights that can give you an overall view of your spending in each currency.

Sync Your Checking, Banking, Credit Cards, and Loans

Wally connects to your banks, meaning all credit and debit cards can seamlessly be added giving insights into your bank accounts as well as providing an organized analysis of your savings. Think of it as a financial advisor in your back pocket!

Get Spending Insights

One nifty feature of the app is the ability to organize your spending or budgeting under tags, places, or categories while providing a visual outline of your spending habits each month through its graphs and tables.

Add Cash Receipts

Although done manually with a digital upload, having your receipts together in one place creates a more organized and accurate view of your finances for the app to analyze. Keeping track of receipts will help factor into your spending budget for each month.

Review Account Balances While Factoring in Liability and Growth

This feature is a big selling point for most users to stay on top of their finances. The app allows you to create a budget that factors in potential emergencies (I.e. emergency bills outside your monthly spending plan, etc.) and creates financial security. Especially for those who have financial assets, Wally factors that into your budgeting and financial plan for an accurate assessment of your financial habits.

Setting Daily Budgets and Saving Targets

Planning a vacation somewhere in a few months or buying a new TV? As you set financial goals, Wally will automatically notify you of the amount of money left in your budget and how much you need to put aside for future endeavors.

How To Set Up A Wally Account

1. Download the Wally app from the App Store.

2. Create an account with your email address.

3. Verify your account.

4. Read the terms & conditions before continuing with the platform.

What is Wally Gold?

While the basic version of Wally is free for download and use, signing up for a Wally Gold subscription will grant you access to various advanced features. These include:

- Budgeting by category

- Budgeting by period

- Rollover budgets

- Family and Household Features

a. Start a group

b. Shared accounts

c. Household/Group Budgets

d. Household Rollover Budgets

Check out the table below which indicates the different subscription tiers available:

| Wally Gold Subscription Tiers | |

|---|---|

| Monthly | $8.99/mo |

| Annually | $39.99/yr |

| Lifetime | $99.99 once |

While the annual subscription seems like the best bang for your buck, you might just want to consider the one-and-done $99.99 lifetime membership tier. If you already love using the Wally app anyway, it makes sense to pay for a lifetime membership upgrade and never pay again.

The Bottom Line

Although the Wally Gold subscription gives you access to other advanced features that help plan your finances, the basic version is substantial for the average user. This app is well suited for beginners and budgeting experts alike.

Not only does the app prioritize your spending and create a detailed profile of your financial lifestyle, but it also goes above and beyond in assisting with your budget and spending plans. From currency conversions for an upcoming vacation to planning and accounting for potential purchases outside of your designated budget, the Wally app has you covered.

This is an awesome app that acts as your finance organizer, allowing you to stay on top of the finance game! So, what are you waiting for? Download the Wally app on iOS now.

Read More: