15 Dead Simple Ways to Save $5,294 or More This Year

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance because talking about money should always be an honest discussion.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance because talking about money should always be an honest discussion.

It’s time to turn your saving money goals into reality. This means it’s time to stop thinking it’ll happen and just start doing it. We’ll show you how to stop overthinking and implement these dead simple ways to save into your life now, starting with a little over $5K.

And just for fun, do you know what $5,294 can get you if you were to spend it all on one thing? (on average)

- 1,050 cups of coffee

- A year’s worth of gas (practical)

- 70.5 pairs of Nike shoes

- 105.8 pairs of Vans shoes

- 1,058 delicious Costco Rotisserie Chickens

- 3,529 Costo Hot Dogs (the ones that come with a drink)

- 1,764 packs of Oreos

- 44.4 years of Amazon Prime

- 407 months of Netflix (or 33.9 years!)

Or you can go on a vacation, and invest the rest. Up to you!

1. You Gotta Eat! Get Up to $240 Cash Back in Grocery Savings

If you’re following nutrition gurus or meal planners on Instagram, you know that your shopping list gets a little longer with each inspiration. I know mine does.

But I don’t feel too guilty though because my shiny things syndrome and basically everything I buy normally, give me a chance of getting cash back.

It’s simple. All you have to do is take a picture of your grocery receipt and Ibotta will pay you cash.

Here’s how it works:

Before you go to the store, search for your shopping list items in the Ibotta app. After your store visit, take a photo of your receipt to get cash back.

Ibotta is free to download and you’ll also get up to $20 in Welcome Bonuses when you sign up!

Some offers we found:

- 25 cents back on any item

- $3 – $5 back on various wine

- $2 back on KIND Protein Bars

- 25 cents – $4 back on ice cream

- $2 back on Herbal Essence Haircare

Popular stores are Walmart and Target, but Ibotta also works at restaurants, online shopping sites, and at the bar! On average, active Ibotta users save up to $240 a year or more. What would you do with that extra money?

Welcome Bonus: Up to $20

Average savings a month: $20

What it could add up to in a year: $240

Additional Referral Earnings: $5 per referral

2. Most People Forget They Have a Recurring Subscription. Are You Losing Money Too? (Save up to $720/Yr)

They say that 84% of people forget they have a recurring subscription still charging them. In this case, auto-pay isn’t so great. When you download Truebill, the money management app will display all your current subscriptions (in 2 minutes or less) so you can see it all in one place. Then you can decide which to cancel, and the app will do it for you! Even that pesky gym membership that’s typically so hard to get out of.

With the app, I realized I still had a very niche streaming service that I haven’t touched in about 7 months. (Thanks, free trial subscription…) I immediately canceled it through Truebill and saved $70 from that sub.

Other things that Truebill can help out on? Their team of experts can help lower your monthly bills by negotiating down rates and even getting you back credit on internet or cable outages.

Average savings a month: $60

What it could add up to in a year: $720

3. Don’t Toss That Receipt! Do This First for Free Money

Before you crumple up that receipt in your pocket or forever lose it in the abyss of your purse, scan it into the Fetch Rewards app, and earn points towards free money. I repeat, free money.

It’s ridiculously simple and actually fun to use.

Shop at any grocery store, convenience store, club store, neighborhood store, or big box store, take a picture with the app, and that’s it. (Favorites include Target, Kroger, and Walmart!)

Unlike other apps, you don’t have to go to specific stores, there’s nothing to pre-select prior to shopping, and there’s no minimum spend. Just scan in any receipt from a store that sells groceries (even when you didn’t actually buy any groceries) and boom, points for money.

You can start cashing out as soon as $3 (3,000 points) and you can grab a $2 welcome bonus on us (2,000 points) when you use promo code REWARD before scanning your first receipt!

Welcome bonus: $2

Average savings a month (depends on purchases): $25

What it could add up to in a year: $302

Additional referral earnings: $2 per referral

4. Automate Your Current Savings and Save an Average $1,720 a Year

If you’re part of the 80% of Americans that have some sort of savings but could use a little more help, you’re definitely not alone. The key to saving is automation.

You won’t even notice it but Digit will make it happen.

Just link a checking account and their smart algorithm will determine small but safe amounts to withdraw into your separate FDIC-Insured Digit savings account.

Regular savers will get a 1% bonus every three months, netting you some free money!

It’s the perfect set-it-and-forget-it app where the AI will watch your savings back.

You can withdraw your money at any time you need and it’s free to use for the first 30 days. After, it’s just $5 a month.

Average savings in a month (varies): $144 or more

What it could add up to in a year: $1,728 or more

Quarterly bonus: 1% on your total savings amount

Additional Referral Earnings: $5 per referral

5. Binge on Food, Entertainment, Health & Tech News TV for Money (Up to $200 a Month)

I can barely cook but I love watching food videos. The new season of Chef’s Table? I’m there.

If you’re a video junkie too, become an Inbox Dollars member where you can watch their TV and Videos section that ranges from Trending News, Entertainment, Food, Health, Tech, and even the latest World News to earn some cash. You’ll also get $5 as a sign-up bonus too!

They set it up in playlists though and they’ll tell you how long it takes as it can range from a few minutes to half an hour. Tip: You can set it to Play, open up another browser tab and let the videos run while you continue doing something else if you’re multi-tasking!

Playlists and earning potential can change, but it’s possible to earn up to $200 a month, watching videos!

Welcome Bonus: $5

Potential earnings a month: Up to $200

What it could add up to in a year: $2,400

Additional Referral Earnings: 10% of your referral’s earnings

6. Get Paid for Playing Free Digital Scratch-Offs Anywhere

Don’t bother going to the liquor store to buy physical scratchers (they get expensive too).

Instead, play digital scratchers for free on Lucktastic.

There are a ton of different scratchers you can play, and you can earn both cash and tokens.

Scratched all of them for the day? Don’t worry, there are specific night-time scratchers that are available every night too!

When you want to redeem your earnings, you can choose from:

- Amazon gift cards

- CVS gift cards

- Dunkin’ Donuts gift cards

- Check mailed to you

- Visa gift cards

Lucktastic keeps things free by showing a few ads here and there. It’s so easy, just turn it on the next time you’re binge-watching on Netflix and multi-task!

Average savings a year from not spending on lotto tickets/scratchers: $206.69*

7. Up To 40% Cash Back Automatically? Sign Us Up!

Saving money and getting cash back on purchases always sounds like a great idea – until you completely forget to take the steps to get the savings. There are SO many ways to save money while shopping, who can remember if it’s not automatic?

Ebates can help you get cash back on everyday shopping as well as apparel, beauty, and more, automatically. With Ebates, you don’t even have to upload your receipts after your purchases. They’ll send you simple push notifications when your favorite stores increase their cash back deals or have a good sale.

Offering simple one-tap savings with no points or fees helps ensure that you get the most out of your purchases. So, before buying anything, hop into the app to see if you can get up to 40% cash back at over 2,500 stores.

They also have an amazing referral program where you can earn $25 for each eligible friend. New members get a $10 bonus too!

Welcome bonus: $10

Average savings a month (depends on purchases): $33

What it could add up to in a year: $396

Additional referral earnings: $25 per referral

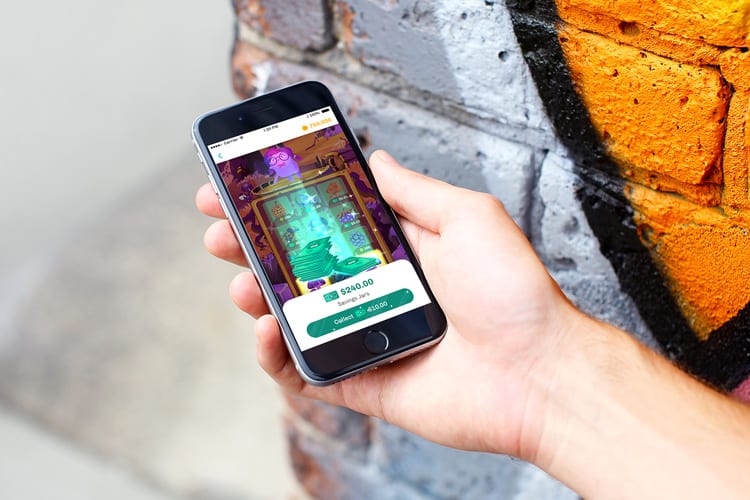

8. Turn Gaming On Your Phone into Saving for Your Wallet (Average Savings of $720 a Year)

Look, we know saving money is boring, but it’s just one of those non-negotiables in life. 63% of Americans don’t even have enough to cover a $500 emergency. Yikes.

That’s why Long Game Savings is actually making saving fun by just playing free games on their app. Games are light and easy-to-play (think lotteries, scratchers, slots, and more) and you can win daily cash prizes up to $1M (yes, million) and crypto!

When you set up a savings account, you access the games. The more money you save, the more you can play and now, their new debit card lets you earn more rewards just by spending normally. It has a RoundUp feature that lets your purchases be rounded up to the nearest dollar with the change going towards your savings. So every time you’re buying a meal, getting stuff at Target, etc, you’re contributing to your savings and earning interest!

Long Game Savings is completely free-to-use as banks pay them, not you. There’s no way to lose money, but plenty of ways to earn and win! Plus you can withdraw your money at any time.

9. Find Reliable Car Insurance That Won’t Break the Bank (And Save $368/Year)

Let’s talk about car insurance.

It’s not a sexy topic, but it’s one of those things you need and is required by your state’s laws.

Plus you’re sharing the same roads with a lot of different people. Distracted people, oblivious people, road-rage people, etc. It’s best to cover yourself when everyone is operating a giant motor vehicle.

And chances are, you’re probably overpaying on your current insurance premium. I know it’s convenient to stick with the same provider because it’s a hassle to deal with finding another. I definitely get it.

However, you can try getting a real-time comparison quote from The Zebra.

They help match you among 200+ insurance carriers to find the best coverage for your needs.

You’ll also get an Insurability Score in 2 minutes. It’s a neat personalized score between 400-950 that represents your ability to be insured. (Kind of like a credit score but for car insurance and they’ll give tips on how to improve it.)

The higher the score, the more likely you’ll get some pretty awesome rates. (Find out how)

Typically The Zebra can save drivers up to 15% or more off their current premiums (or $368 a year). Once you see your quote, an Agent will get in touch with you to answer further questions you might have and to finalize it (if you want!).

It’s a pretty simple process, so get a quote to see how much you could be saving on the road.

Average savings a month: $30.66

What it could add up to in a year: $368

10. Grow Your Money in a High Yield Savings Account that’s 20x Higher than National Average

Over the past year, plain savings accounts have outperformed both the S&P 500 yield and the 10-year US Treasury Bond yield.*

While the average interest rate for savings accounts in the US is fairly low at 0.09%, there are high yield savings accounts that offer more than 20x higher than the national average!

Just enter your zip code below to see some of the highest yielding saving accounts in the nation right now. Since you’ve figured out how to save money, put it somewhere safe to grow!

11. Cash Out on The Everyday Things You Do Online

How much time do you think you spend online? Most likely more than you think.

The average American spends 24 hours online a week(*), but for me, I know I definitely surpass this since I have to be online for work. Along with post-office hours shopping, browsing, reading, it’s rare that I’m not online.

If it’s the same for you, capitalize on all that online time by earning points you can redeem towards gift cards, and even better, cash.

You can do it with Swagbucks, a free rewards program for the everyday things you do online.

Earn points by

- Watching entertaining videos

- Shopping at your favorite retailers

- Searching the web

- Participating in surveys

- Playing fun trivia games

Then you can redeem for a large variety of gift cards (Amazon, Target, Walmart, Starbucks are popular) or my favorite, Paypal Cash and Visa Gift Cards. Cash out in as little as $3!

You’ll even get a $5 bonus when you earn 2,500 SB points within your first 60 days.

The best way to earn SB? Surveys. You can get up to 300 SB for each qualified one you participate in. While you obviously won’t get rich doing this, you can nab an extra $10-$20 a month on them.

Keeping your profile updated and doing the Daily To-Do List will also earn you extra SB. There are a lot of opportunities so you can cash out early and often!

12. Always on the Go Means More Gift Cards for Your Wallet

You’re rarely at home, and that’s ok. Do your thing at work, school, hanging out with friends or exploring new areas. Wherever you are, you’ll easily get compensated for just being you.

Panel App is a loyalty incentive app that will give you points just by leaving the app running in the background.

Because it gives you points on location, go ahead and enable location services. Then just turn the app on before you go about your day and head to your normal spots.

After testing it we think it’s a great (lazy) app that rewards you for doing almost nothing. If you’re still skeptical, know this:

- You don’t have to complete offers

- You don’t have to watch ads

- You don’t have to buy anything

- You don’t have to do anything but leave the app running

We snagged a $5 Amazon gift card via email after a few weeks of just leaving the app on and forgetting about it. You can also choose VISA gift cards, MasterCard gift cards or sweepstakes entries.

Overall, a solid choice for earning a bit of spending money for literally just leaving the app running on your phone!

13. Make 1.92% Interest On Your Money with Fee-Free Banking

Traditional banks may2 seem to take every opportunity they can to squeeze more money out of you. With everything from a monthly service fee to various hidden fees nibbling away at your account balance. Enter Varo which was founded to provide banking services without the hidden fees.

Yep, Varo has no monthly service fees, no foreign transaction fees, and no ATM withdrawal fees. On top of having no fees, Varo lets you make more money on your money. Varo provides a high-yield savings account that starts at 1.92% Annual Percentage Yield (APY)1 that can move up to 2.80% APY1 based on qualifying activity. To put this into perspective, the average APY of the 5 biggest national banks is 0.09%.*

Varo has a few sweet extra features too:

- Get your paycheck up to 2 days earlier^

- No minimum balance requirement

- Over 55,000+ AllPoint® ATMs worldwide to use your Varo Visa® debit card

- Offers personal loans to pre-qualified customers who want to consolidate debt

- Varo will send any paper check to anyone in the U.S. on your behalf

- “Save the Change” rounds up your purchases to the nearest dollar and saves the difference to your Varo savings account

If you’re sick of being charged banking fees and want to make more out of your money, check out Varo. It takes less than 5 minutes to learn more and apply for free.

14. Shop for a Better Home Policy in 2 Minutes & Save an Average $720 a Year

Home and car insurance policies are the types of payments you just can’t get around. You just need it.

But it doesn’t mean that you have to go broke or overpay for your premiums. And you don’t need to drive yourself crazy comparing lengthy policies either.

You can use Gabi, a service that compares home & auto insurance policies for you.

The best part? They can save an average of $720 a year for their customers and there’s no extra cost to use Gabi. You can focus on choosing which policy is right for you.

They start by taking a look at your current policy, so you can upload a PDF or connect an insurance account. There are no annoying forms to fill out and under 2 minutes, you’ll get your options and recommendations based on your current plan and usage.

Gabi is also a licensed insurance broker (not some fancy search engine), so they maintain their own database of policies from the best insurers. And since your policy is on file with them, they’ll keep monitoring for better insurance deals on your behalf as life goes on.

If that sounds good, you can create a free account with no commitments where you can potentially save in under 2 minutes.

Average savings in a month: $60

What it could add up to in a year: $720

Additional Referral Earnings: $100 each referral

15. Just Save Your Emails to Get Money Back (Average Savings $240 a Year)

If you never delete emails like me (unless it’s spam) and shop online, then you’ll always have a chance at getting some money back.

A free tool called Paribus gets you money back on select online purchases even after you’ve bought them.

Price changes happen all the time after checkout. And now you can get a refund of the price difference back at online stores that Paribus monitors! (For example, Target, Kohl’s, GAP, Best Buy, Walmart and more.)

They do this by checking your inbox for email receipts. (Don’t worry, they don’t open any other email and their tech logic only identifies emails that are receipts.) Once they’ve found a receipt that has at least a $3 price drop, they’ll alert you then contact the retailer on your behalf to get the money or tell you how to get the refund back.

Also? If your guaranteed shipment is late from Amazon Prime or Walmart, they’ll help you get compensated! Perfect for the upcoming holiday season when gifts in hand are important.

Your savings mileage will vary but Paribus is 100% free to use and all the savings are yours to keep. Your pair of shoes dropped $7? You get $7 back.

Average savings in a month: $20

What it could add up to in a year: $240

*Average lotto savings statistic source: LendEdu.com

*Paribus compensates us when you sign up for Paribus using the links we provided.

*Savings Account performance source: TheHustle.co