Spring Clean Your Finances with these Bots

Just like your home, your finances need regular tidying up too. But unlike your home, you may not see the dust balls collecting in the shadows of your accounts.

What to do when life just gets busy or it’s too much of a tedious task?

Bots to the rescue!

We’re living in an exciting technological age where phones become smarter and Alexa, Google Home, and Nest are changing the way we live.

Bots to assist with finances doesn’t seem too much of a stretch. We’ve picked our favorites:

Trim – Your Personal Financial Assistant

We endearingly call Trim, the money guardian angel bot, as it helps with canceling unused subscriptions, lets you know how much you’ve spent on certain things, and negotiates your cable/internet bills. No more having to flip or scroll through pages of transaction history!

Trim talks to you via SMS Text or Facebook Messenger:

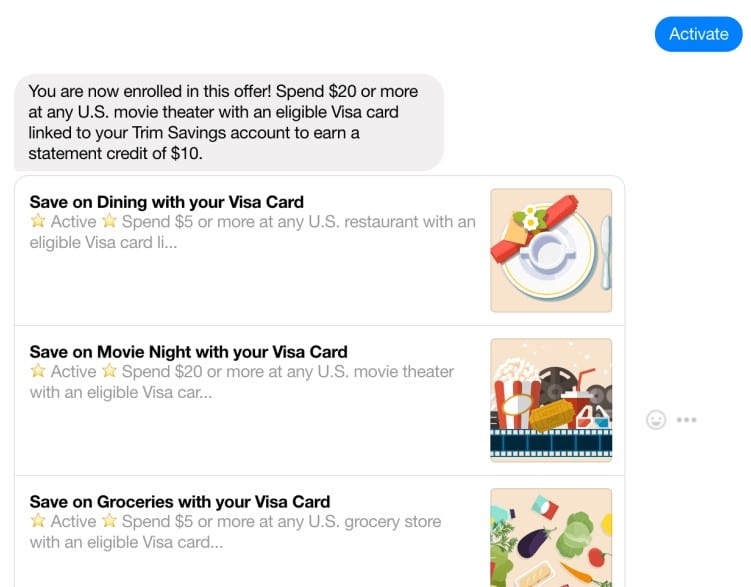

Credit card users will often see Trim offering coupons and savings to your grocery shopping, restaurant dining, and even movies. I’ve gotten almost $30 cash back on these offers alone after I activated them!

Trim is not an app but an AI bot that gets smarter the more you converse with it. It will continuously analyze your accounts and determines where you can save money. Note that it cannot make any changes to your account nor move money around. It’s an assistant that will even save you from having to call your cable/internet provider to negotiate down prices.

How to Sign Up:

1. Head over to Trim to sign up for free via Facebook or Email

2. Choose if you want to communicate via SMS Text or Facebook Messenger

3. Connect a Credit Card or Bank Account by providing login info (256-Bit SSL Encryption ensures your info is safe!)

4. Let the savings begin!

Click here for our full review of Trim!

Blooom – Your 401K Financial Assistant

It’s not a typo, there is an extra O in the name! Blooom will be a game changer in your 401K’s long life.

First of all, congrats on having a 401K! For most, this is the most important retirement planning account you’ll ever have. And also for most, it gets set up, forgotten, and doesn’t get managed to the fullest. In other words, you could be leaving a lot of money on the table that could’ve been yours.

I’m not entirely too savvy with 401K investments but I do have the general knowledge that the right portfolio mix is important based on your age. The younger you are, the more you can take risks to earn more (aka stocks). The older you are, you invest more in the safer, long-term bonds.

But I was pleased to find out that Blooom, analyzes your current account, professionally manages it, and makes sure your 401K always has the right investment mix.

It takes less than 5 minutes to analyze your 401K for free. If you like what you see, then Blooom is only $10 a month after that. It sure beats managing it yourself or paying a traditional advisor $150+/ hour!

All you need to get started on the free analysis is your basic info and your 401K’s login/password credentials. Without the credentials, Blooom won’t know what your account is already invested in to give you the best analysis to grow your money.

We’re completely on board with Blooom because a professionally managed 401K account could grow as much as 2x as an unmanaged one!* You ultimately have control over your account and can change anything. They’ll do a rebalance of your account whenever the stock market shifts as Blooom is constantly monitoring its performance!

So let your 401K wilt further or let Blooom grow it into a field of flowers. Your choice!

*Source: Financial Engines & AonHewitt. (2014). Help in Defined Contribution Plans: 2006 through 2012. https://corp.financialengines.com/employers/FinancialEngines-2014-Help-Report.pdf. Based on 30-year time horizon to retirement.